Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Act For Property Taxes In Sacramento

Description

Form popularity

FAQ

The homestead exemption provides an exemption from property taxes on a primary residence and protects the value from creditors, and circumstances that arise from the death of the homeowner's spouse. The exemption can't be claimed for another property elsewhere.

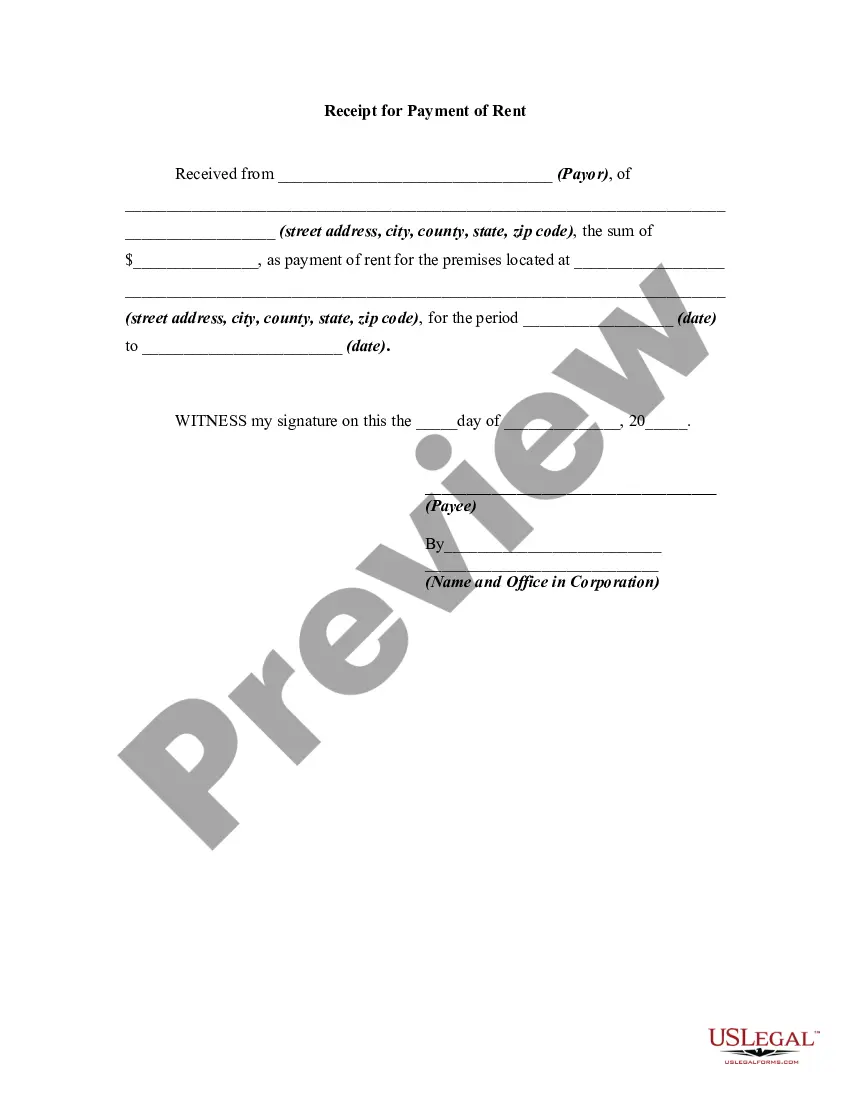

Filing a homestead declaration typically requires three steps. Complete a homestead declaration form. Sign your declaration in front of a notary. Record the homestead declaration form with your county recorder's office.

Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office. Once the exemption has been granted, it remains effective until a change in eligibility occurs, such as selling or moving out of the home. Annual filing is not required.

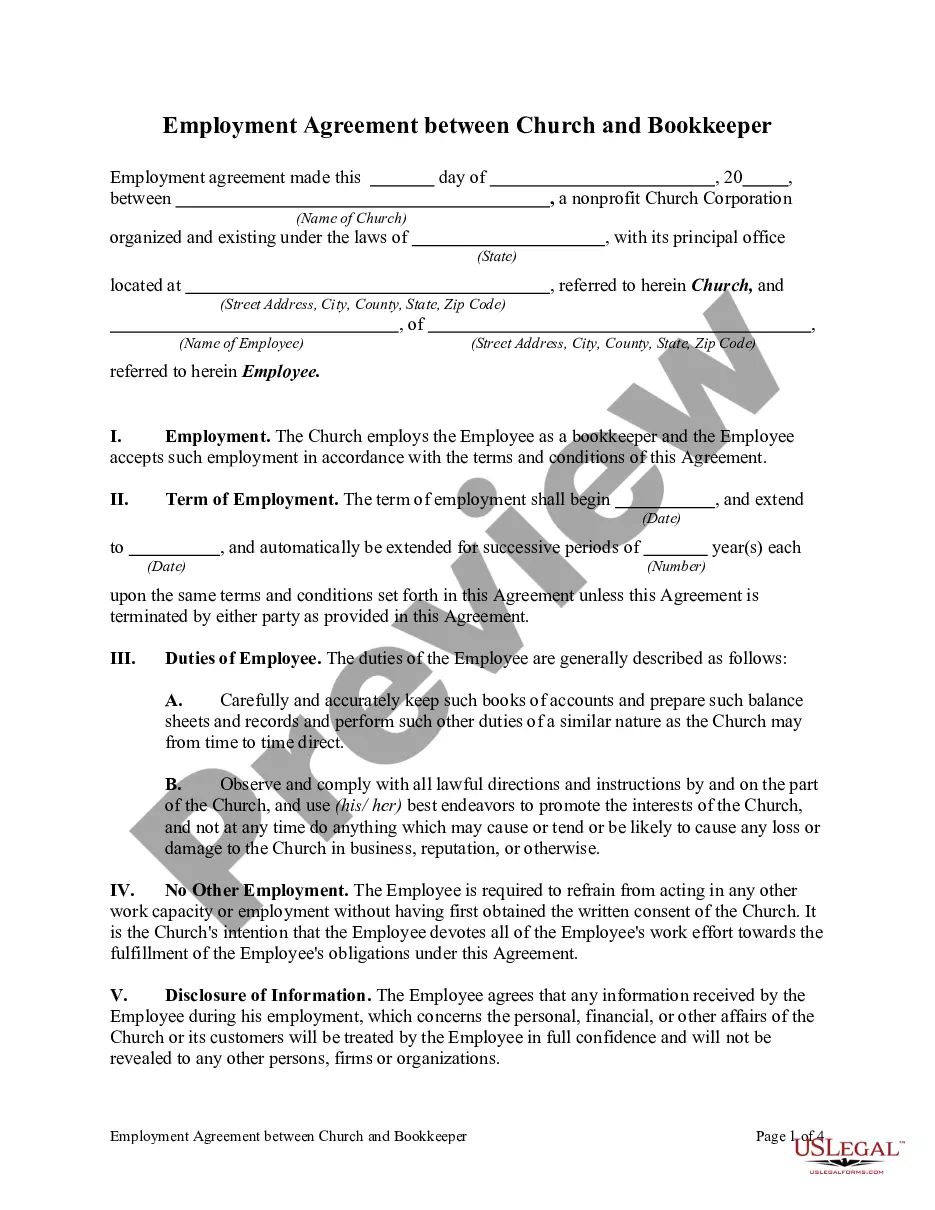

1. Senior Citizen Homeowners' Property Tax Exemption. The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

Homestead tax exemptions shelter a certain dollar amount or percentage of home value from property taxes. They're called “homestead” exemptions because they apply to primary residences, not rental properties or investment properties. You must live in the home to qualify for the tax break.

The home must have been the principal place of residence of the owner on the lien date, January 1st. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located.