Florida Homestead Exemption Rules In Nevada

Description

Form popularity

FAQ

While the specifics can vary by state, generally, homestead exemptions are only available for an individual or family's primary residence. This means you cannot claim homestead exemptions in multiple states.

10 Best States For Homesteading 2023 Tennessee. Rural Tennessee is already a popular location for sustainable living enthusiasts, with a fantastic harvesting season of around 9 months of the year, there are low property taxes and costs. Idaho. Oregon. Maine. Michigan. Connecticut. Montana. Alaska.

You must reside on your homestead property as your primary residence. However, there is no particular amount of time you have to be physically present on the property to qualify for homestead exemption. To qualify for homestead exemption, you have to declare Florida as your permanent residence.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Between Florida and Texas, Florida has the stronger homestead exemption. While both states protect an unlimited value of homestead property, Florida law allows a debtor to transfer non-exempt assets into a Florida homestead.

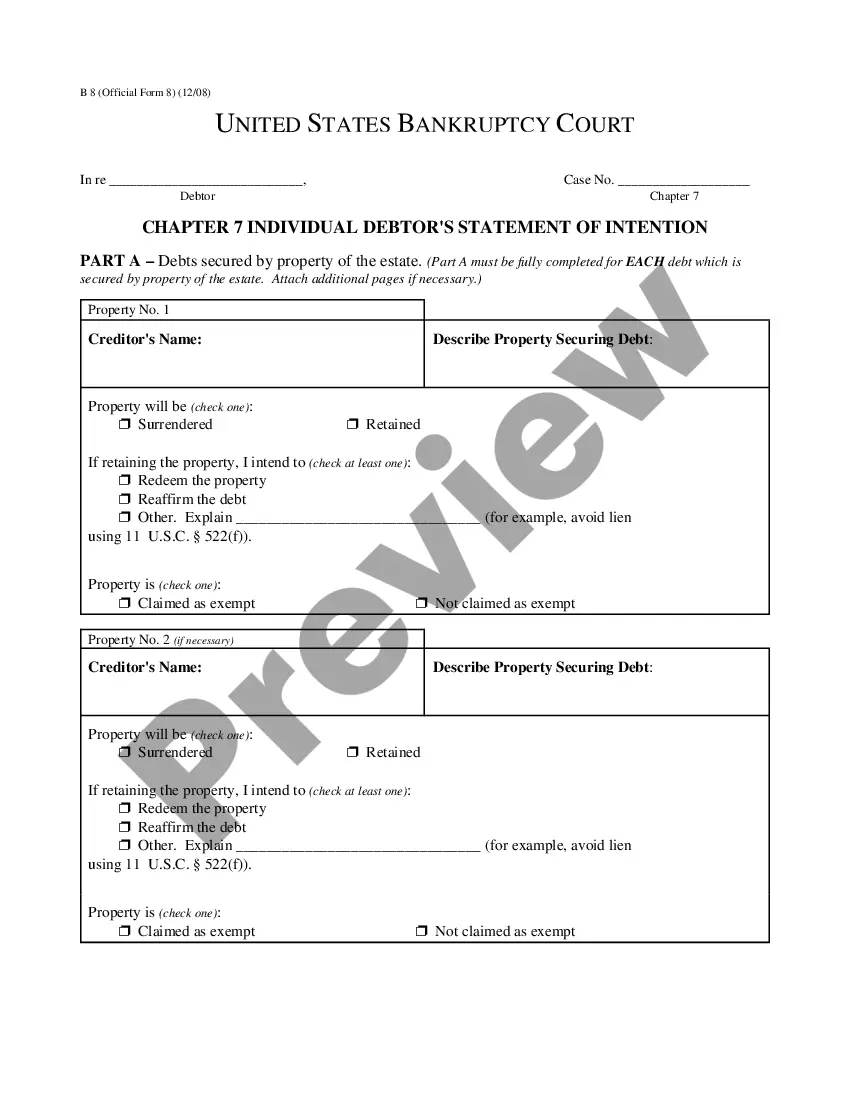

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000.

If the house you own is no longer your primary residence then you are not entitled to the Homestead Exemption. That's pretty much the long and short of it. Renting in another state and living there full time is obviously not using the Florida Home as your primary residence.

Filing for a homestead exemption in Florida can lead to substantial property tax savings. The exemption is designed to reduce the taxable value of a homeowner's primary residence, ultimately lowering the overall property tax bill. Florida law provides a generous exemption of up to $50,000 for eligible homesteads.

Which State Has the Best Homestead Exemption? 1. California. California has two systems for the homestead exemption. Under one system, homeowners can exempt up to $600,000 of equity in a house. Florida. Iowa. Kansas. Minnesota. Oklahoma. Rhode Island. South Dakota.

Homestead Exemption Lawyers in Las Vegas An individual may only claim one residence as his or her Homestead, and the Homestead Declaration may be filed at any time before a sheriff's sale.