Installment Agreement Fee In Fulton

Category:

State:

Multi-State

County:

Fulton

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

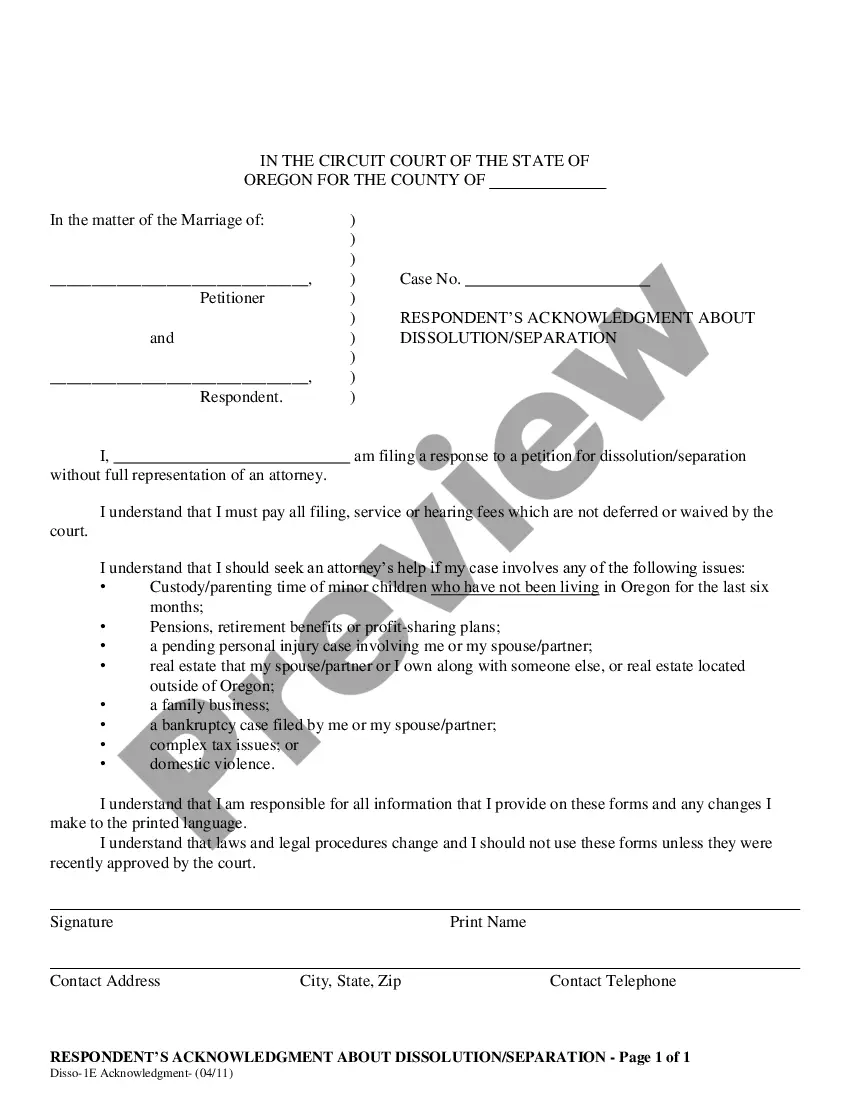

The Retail Installment Agreement outlines the terms under which purchases can be financed through installment payments with a focus on the installment agreement fee in Fulton. It specifies the purchase price, interest rate, payment terms, and late fee provisions, ensuring clarity on financial obligations between the seller and purchaser. The agreement also establishes a purchase money security interest in the collateral, providing protection for the seller in case of default. In addition to payment details, it defines events of default and remedies available to the seller, including the rights to reclaim collateral. Key features include the ability for purchasers to prepay amounts without penalties and the disclaimer of warranties by the seller. This form is notably useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in transactions requiring structured payment options, as it provides a clear framework to protect their interests and ensure compliance with legal standards.

Free preview

Form popularity

FAQ

If you are unable to revise an existing installment agreement online, call us at 800-829-1040 (individual) or 800-829-4933 (business).

The counties in Georgia with the highest effective property tax rates are Taliaferro County (1.51%), Dooly County (1.43%), and Dougherty and Seminole Counties (1.40%). The Georgia counties with the lowest effective property tax rates are Gilmer County (0.43%), Fannin County (0.40%), and Towns County (0.36%).

The Fulton County effective property tax rate is 1.16%.