Installment Agreement Form In Urdu In Allegheny

Category:

State:

Multi-State

County:

Allegheny

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

Installment Agreement Form in Urdu in Allegheny is a legal document that facilitates the payment of a purchase price over time. This form includes essential details such as the total purchase price, interest rate, and monthly installment terms that are payable to the seller. It also outlines the consequences of late payments and defaults, allowing the seller to declare the entire debt due if the purchaser fails to comply. Users can edit key sections like interest rates and payment schedules according to their agreement. The form is useful for attorneys, partners, and owners who need structured payment plans, while paralegals and legal assistants may utilize it for drafting and processing agreements. The clear format ensures users with little legal experience can understand and fill out the necessary information accurately. Successful completion and adherence to the form's terms protect the interests of both sellers and purchasers, making it a vital tool in financing transactions.

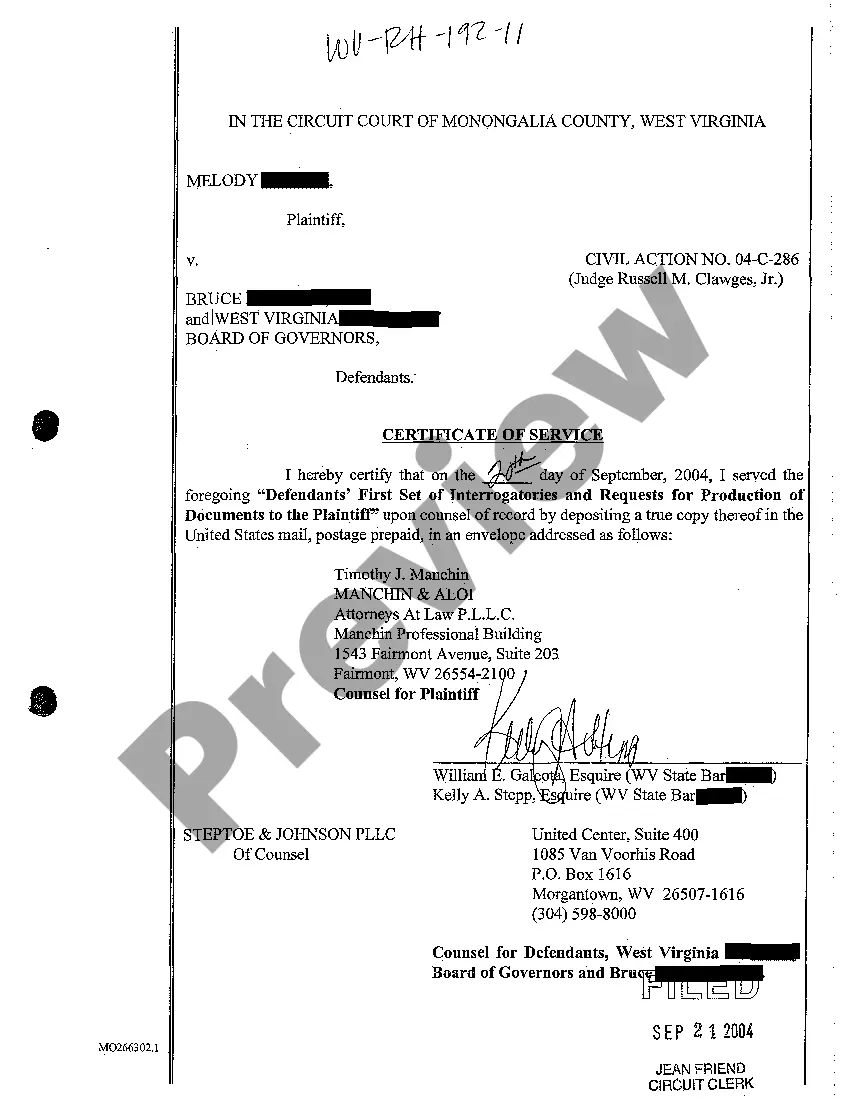

Free preview

Form popularity

FAQ

About Form 9465, Installment Agreement Request. Internal Revenue Service.

IRS Form 2159, Payroll Deduction Agreement, is a tax document to set up an installment agreement, a form of tax debt relief that allows taxpayers to make monthly payments on their federal tax debt by having funds withheld from their paychecks and sent directly to the IRS.

An instalment sale agreement between you and a credit provider allows you to buy a vehicle or asset using the principal debt, which you repay by means of regular instalments over an agreed period, with fees and interest.

If you are unable to revise an existing installment agreement online, call us at 800-829-1040 (individual) or 800-829-4933 (business).