Notice Judgment Lien Form With Two Points In Utah

Description

Form popularity

FAQ

Essentially, consensual liens don't adversely affect your credit as long as repayment terms are satisfied. Judgment and most statutory liens have a negative impact on your credit score and report, which affect your ability to obtain financing in the future.

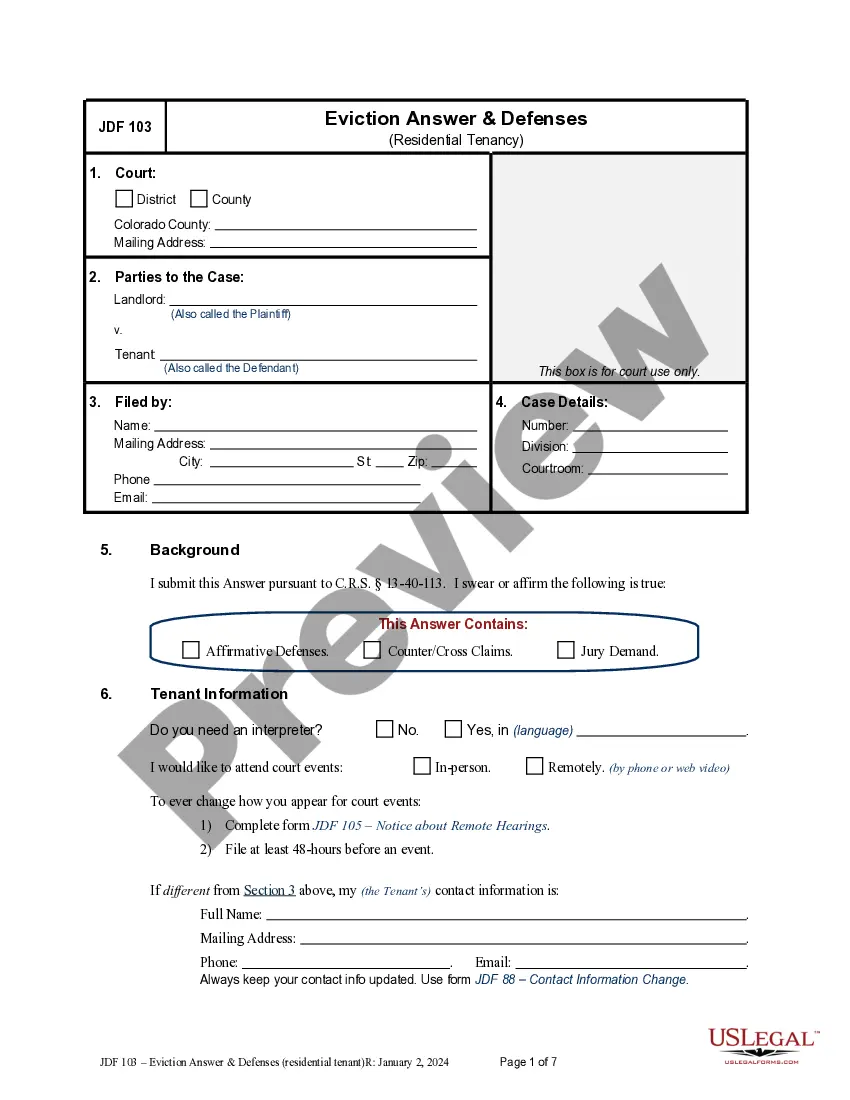

Do I Have A Judgment Against Me? As noted above, you're not supposed to wake up one day to find a judgment against you. You're supposed to receive notice of a lawsuit, followed by a period of time during which you can choose to respond to the Complaint.

File the judgment or Abstract of Judgment in the office of the County Recorder in the county in which the debtor's real property is located. If the debtor has real property in more than one county, file in each county. Also file with the County Recorder a Judgment Information Statement.

Types of Liens in Utah Mechanics lien. Lessors lien. Tax lien. Personal injury lien. Mold lien. Attorneys lien. Judgment liens. Real estate lien.

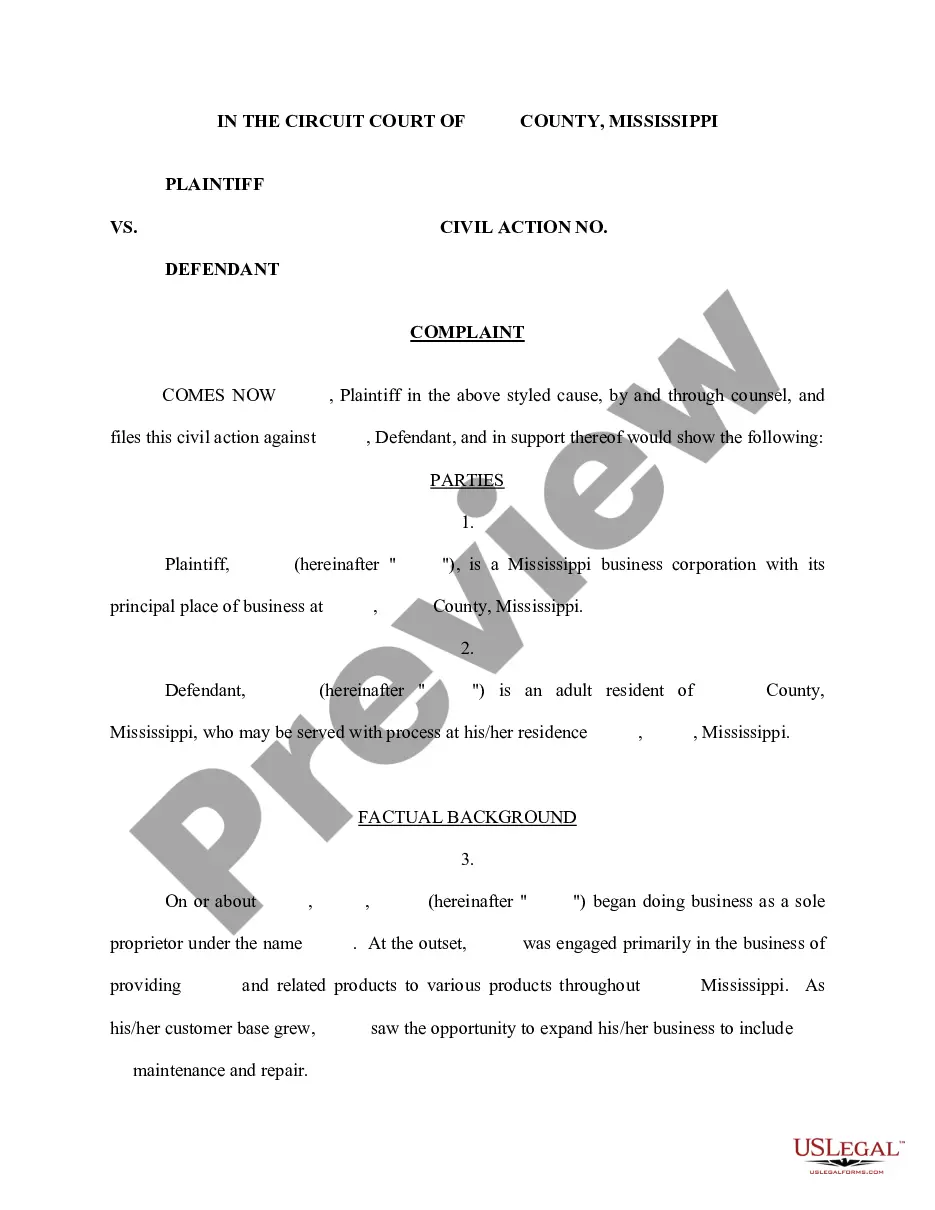

You take or mail something called an 'Abstract of Judgment' to the county recorder's office. This is a document that summarizes the court's decision. Once the Abstract of Judgment is recorded, it creates a 'general' lien. Think of it as a giant sticky note that attaches to all the debtor's real property in that county.

If payment is not made after recording a lien, the next step is to file a lawsuit to enforce the lien. In Utah, this must be done within 180 days after recording the lien.

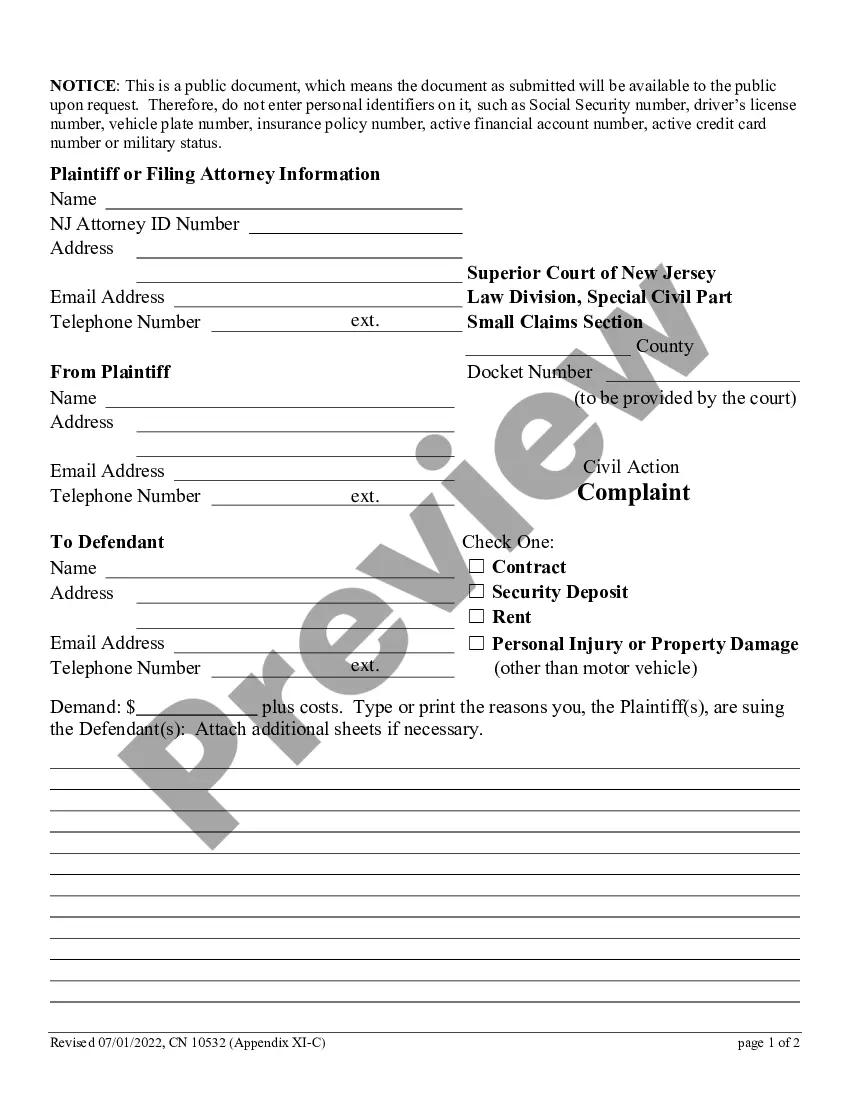

The easy definition is that a judgment is an official decision rendered by the court with regard to a civil matter. A judgment lien, sometimes referred to as an “abstract of judgment,” is an involuntary lien that is filed to give constructive notice and is to attach to the Judgment Debtor's property and/or assets.

The duration of a judgment lien in the state of Utah resulting from the docketing of a judgment, abstract of judgment, transcript of judgment or warrant for delinquent taxes, runs as follows: 8 years for all judgments (U.C.A. 78B-5-202) and ten years for tax warrants (U.C.A. 59-1-1414(6)).