Judgement Lien Example In Maryland

Description

Form popularity

FAQ

It shows up on your credit report as well as on any background checks. The judgment is considered a lien against your property, including any real estate that you have, in the state in which the judgment is filed.

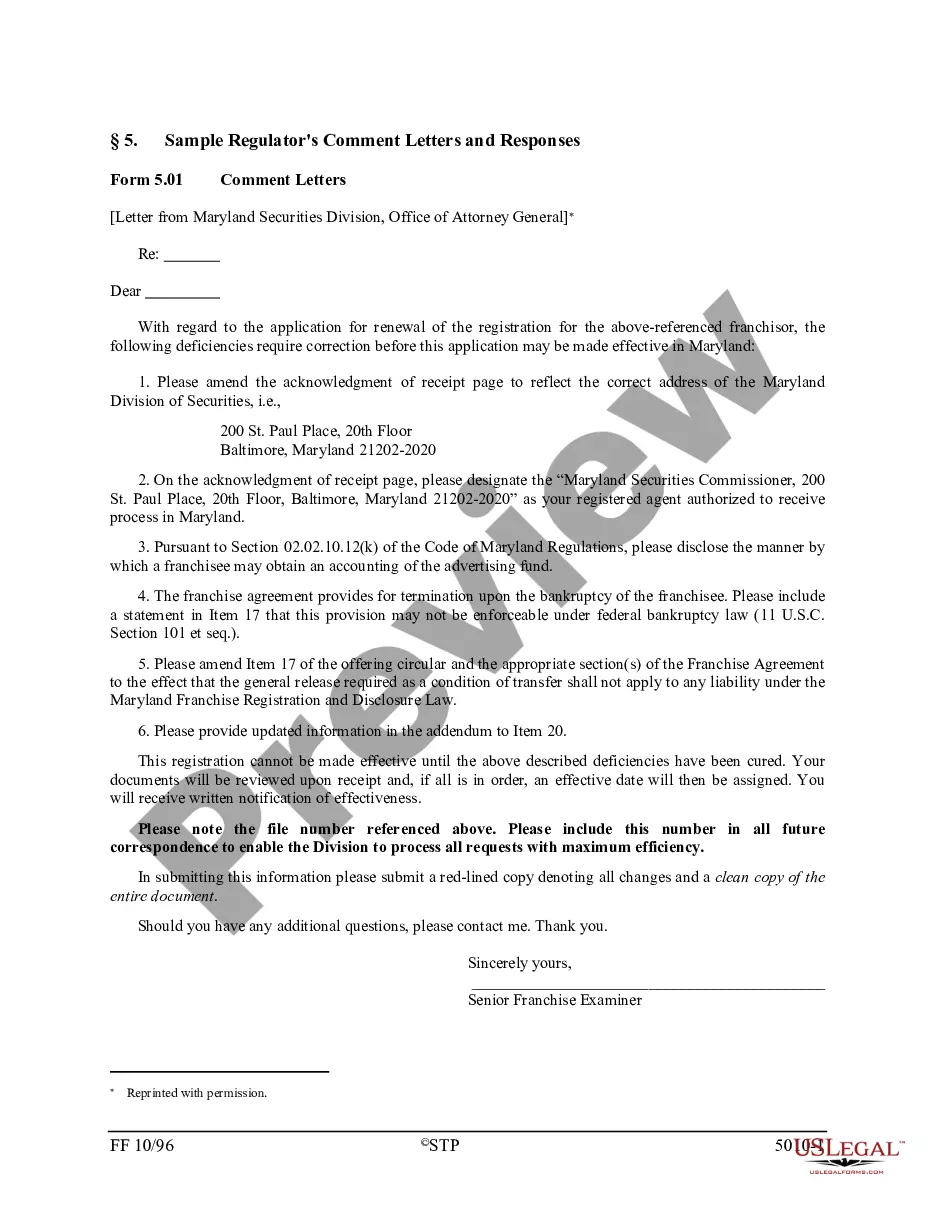

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials.

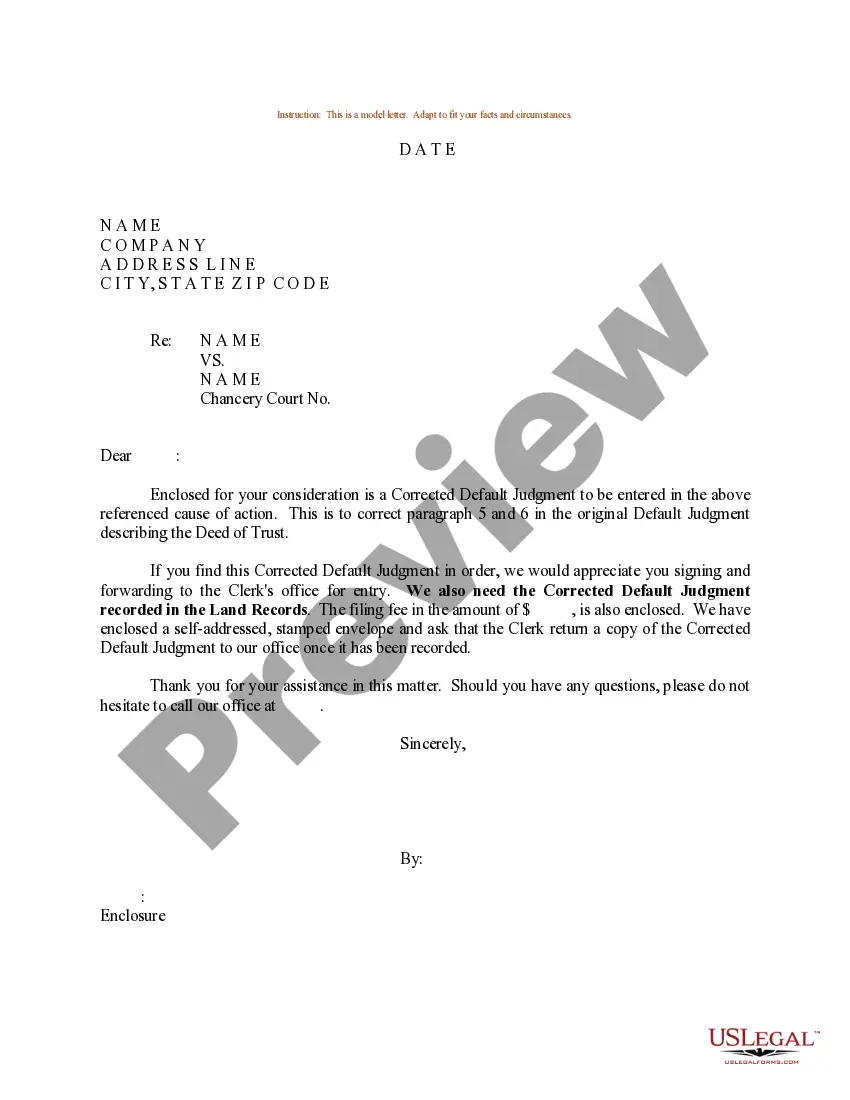

After a default judgment is issued in Maryland, creditors have various options to enforce it. They may attempt to seize non-exempt property owned by the debtor. This can include bank levies, vehicle sales, or, in some cases, placing a lien on real property.

A creditor who obtains a judgment against you is the "judgment creditor." You are the "judgment debtor" in the case. A judgment lasts for 12 years and the plaintiff can renew the judgment for another 12 years.

How do I find a lien? Liens against property can be recorded at the Department of Land Records alongside deeds. Search for liens online using Maryland Land Records (mdlandrec). Some liens come from court judgments. Unpaid taxes on the property may result in a lien.

Yes, but somebody had to go to court to get the judgement. If you were legally served with a Summons & Complaint and didn't show up in Court a ``Default Judgement'' would be entered based on the Plaintiff's case. Being ``legally'' served doesn't always mean it was personally handed to you.

The most common ways you may find out that there are outstanding judgements against you in one of the following ways: letter in the mail or phone call from the collection attorneys; garnishee notice from your payroll department; freeze on your bank account; or. routine check of your credit report.