This form is a sample letter in Word format covering the subject matter of the title of the form.

Judgment Against Property For Sale In Maricopa

Description

Form popularity

FAQ

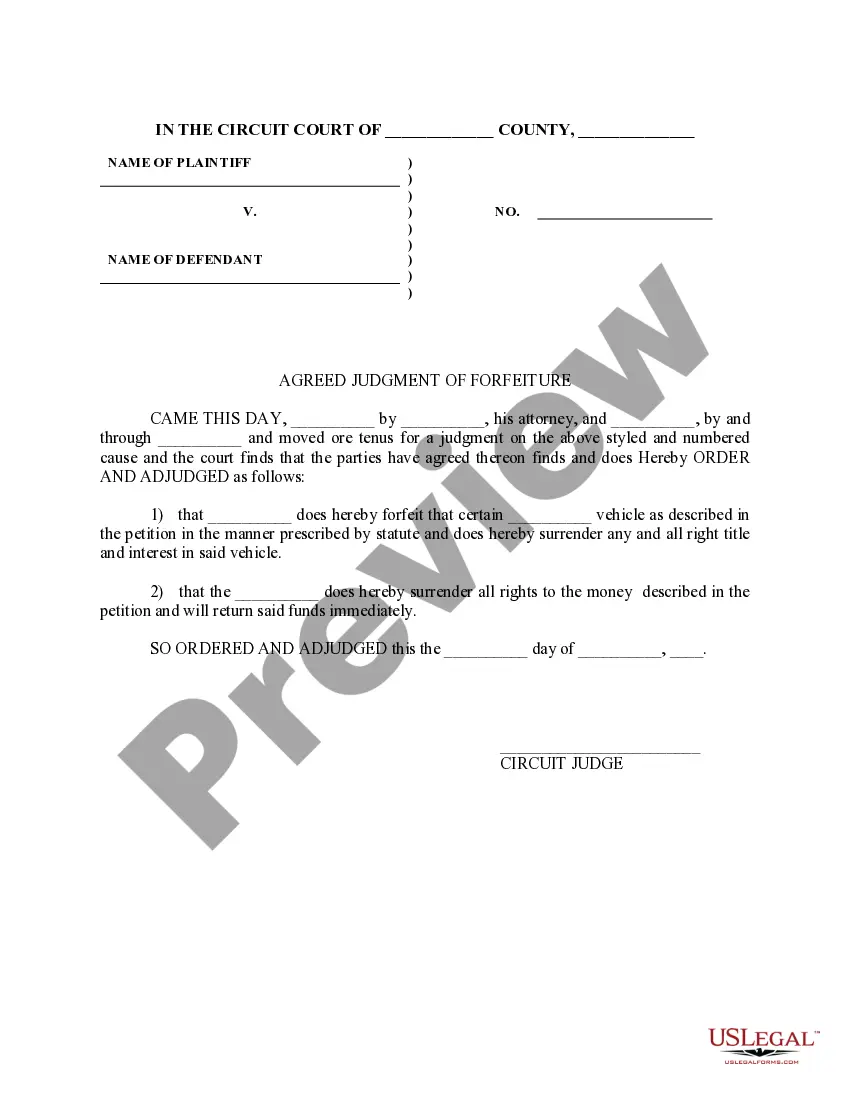

Except as provided in sections 33-729 and 33-730, from and after the time of recording as provided in section 33-961, a judgment shall become a lien for a period of ten years after the date it is given on all real property of the judgment debtor in the county in which the judgment is recorded, whether the property is ...

Arizona's homestead exemption exempts up to $150,000 of a person's equity in their dwelling from attachment, execution or forced sale. The exemption applies to a person's house and land, condominium or cooperative, mobile home or mobile home and land.

Criminal History information must be requested from the Arizona Department of Public Safety. Recorded documents such as oaths of office, judgements, liens and deeds are available at the Maricopa County Recorder's Office.

All judgments must be in writing, and the court must mail copies to all parties. The judgment must clearly state the determination of the rights of the parties. The judgment is due and payable immediately after the judgment is rendered by the justice of the peace or a hearing officer in small claims court.

Collection Methods There are 2 primary methods to collect a debt: Writ of Garnishment or Writ of Execution. Writ of Garnishment is often referred to as garnishing a debtor's wages. A written notice is served to both the debtor and the debtor's employer or financial institution.

Take the certified copy to the county Recorder's Office where the Judgment Debtor has real estate property. If the Judgment Debtor has property in different counties, you can record your judgment with each county. NOTE: Fees apply.