Judgment Against Property For Nri In Harris

Description

Form popularity

FAQ

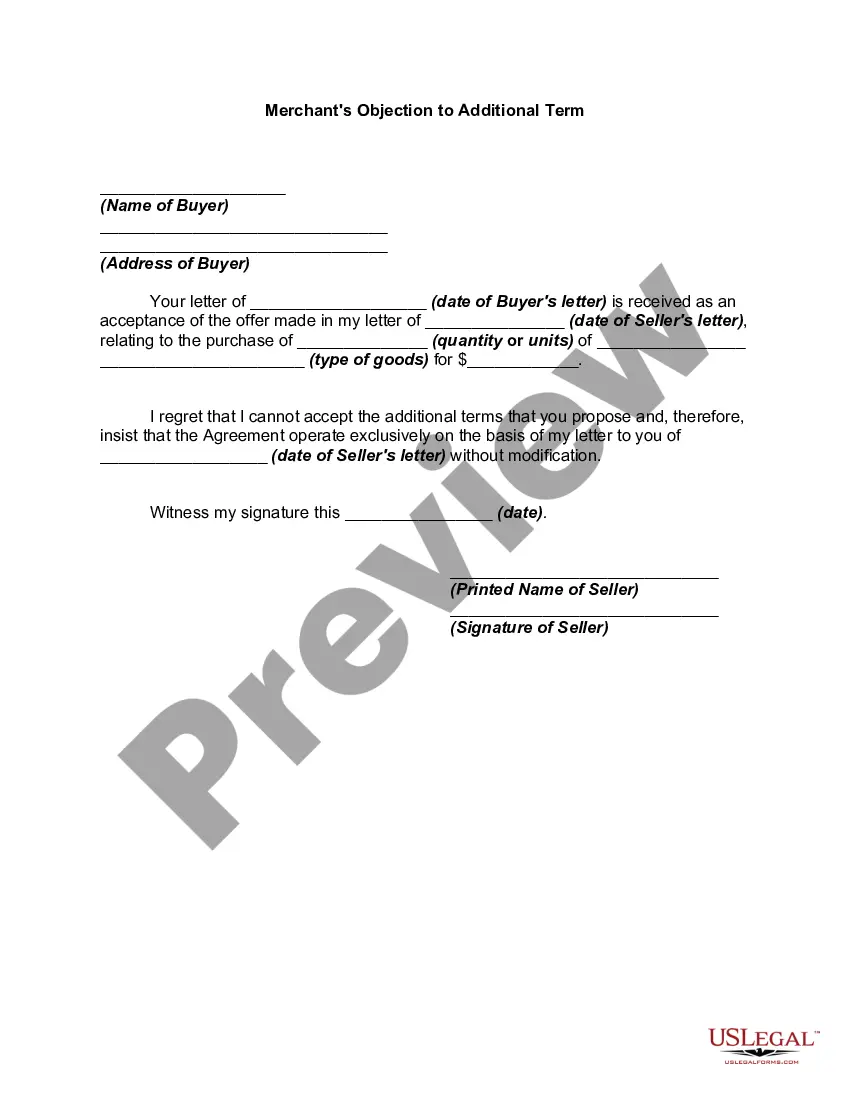

NRIs use Power of Attorney ('POA') as an instrument to appoint an agent/attorney to help them sell their properties in India.

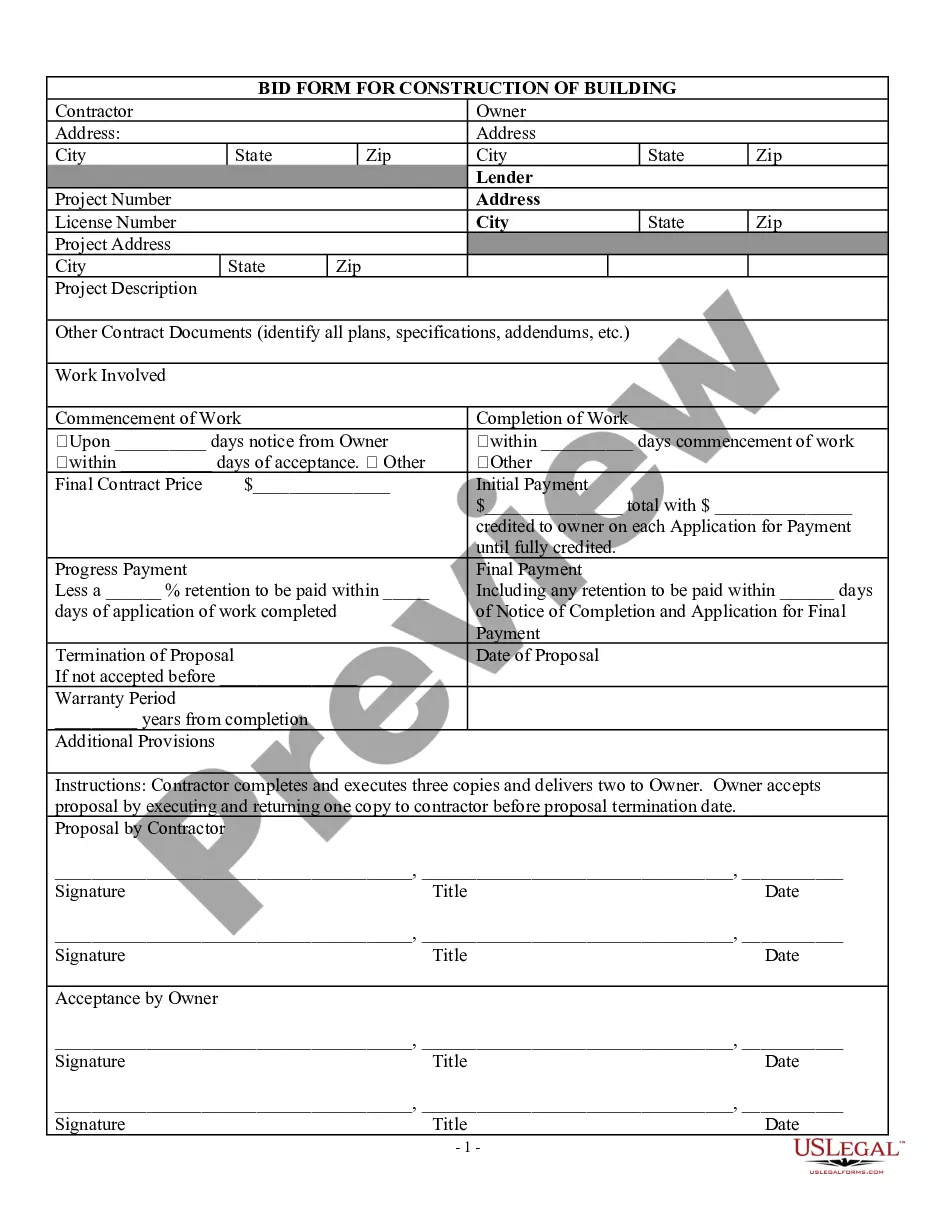

Steps to Obtain Power of Attorney for NRI Property Sale Draft a non-judicial POA on a Rs. Visit the sub-registrar's office and have witnesses present. Both the grantor and attorney must sign the document in front of the sub-registrar. Collect the registered copy within 4-5 days from the designated office.

Yes, US citizens can grant Power of Attorney for use in India. However, the document must be notarized in the US, attested by the Indian consulate, and comply with Indian laws to be legally valid.

An NRI or OCI who has acquired immovable property in India in ance with the foreign exchange laws in force at that time can sell such property to an Indian resident, provided: The transaction takes place through banking channels in India; and. Indian resident is not otherwise prohibited from such acquisition.

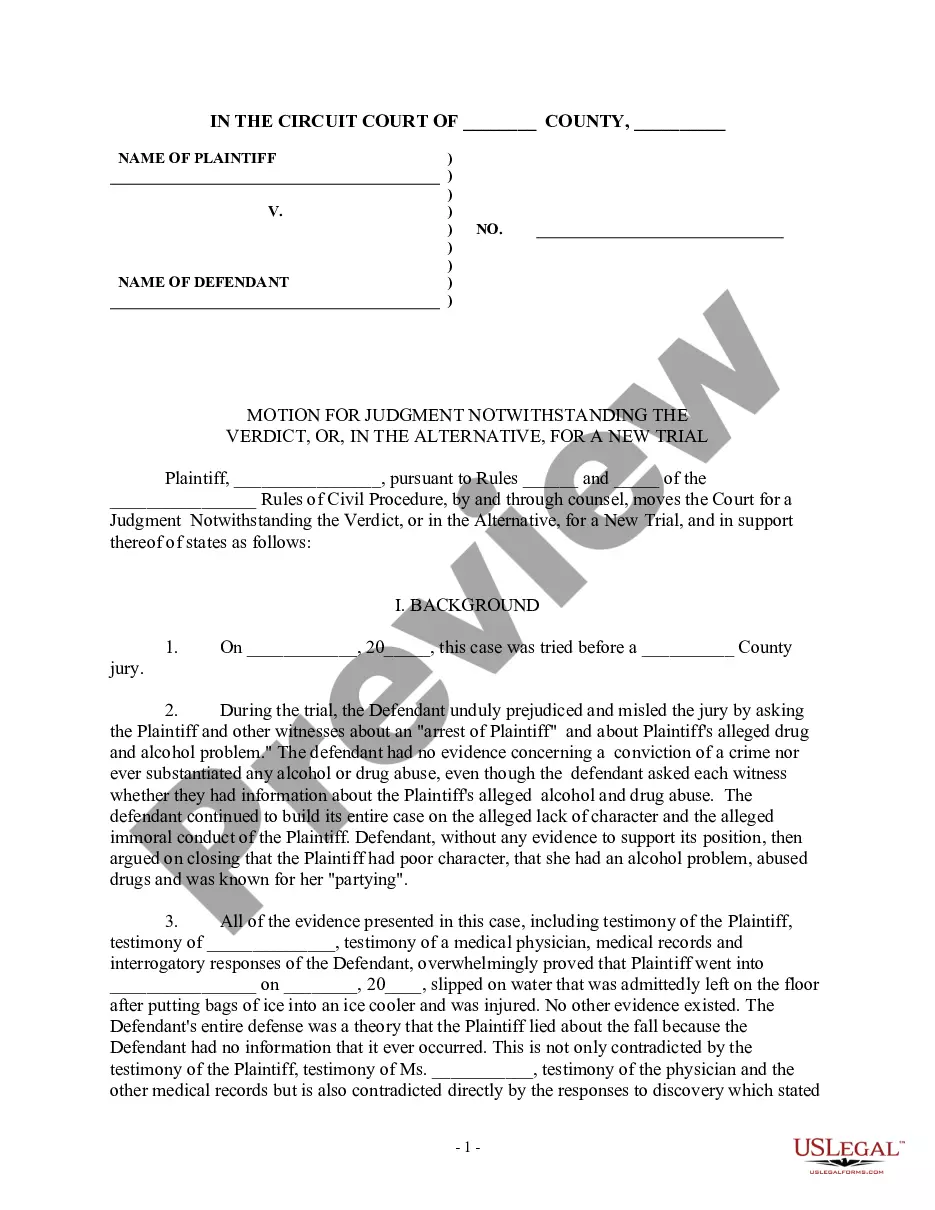

Non-Resident Indians (NRIs) can file civil suits in India. The jurisdiction for such suits is generally determined by the Code of Civil Procedure, 1908 (CPC) and specific statutes relevant to the subject matter of the suit.

Q. How long does a property case take in court India? A. Officially, property disputes may extend up to three years.

Yes, you can file a case in India for your rights in a property without physically being present in the country.

Executing a POA in India Step 1: Notarization. First up, get the POA notarized. A notary public will verify the document and the identities of the parties involved. Step 2: Witnesses in Place. You'll need two witnesses present during the execution. Step 3: Activation. The final step is the activation.

It shows up on your credit report as well as on any background checks. The judgment is considered a lien against your property, including any real estate that you have, in the state in which the judgment is filed.

Most judgment liens last for 10 years and can be renewed for another 10 years. For example, the creditor could place a judgment lien on your home which would inhibit you from selling the property without first paying the creditor what you owe.