Judgment Against Property With Notice To Garnishee In Georgia

Description

Form popularity

FAQ

In a Nutshell This court order allows them to collect on the debt by seizing your real or personal property (or putting a lien on it), garnishing your wages, or levying your bank account. Personal property includes everything from household goods to vehicles. Real property includes things like your home or land.

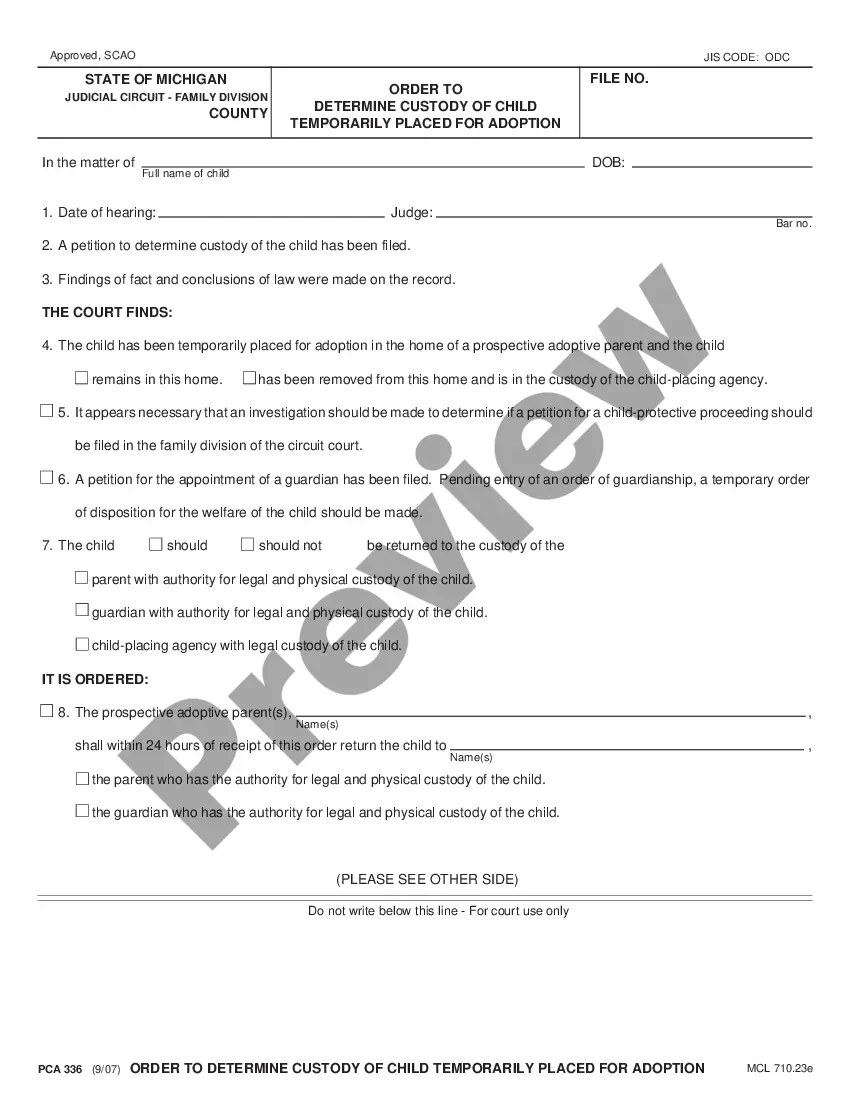

A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.

Creditors cannot take your home in Georgia, but they can place a judgment lien on it.

In Georgia, you can attach judgment liens to both real estate—land, buildings, and other improvements—and personal property like cars, artwork, antiques, electronics, and more.

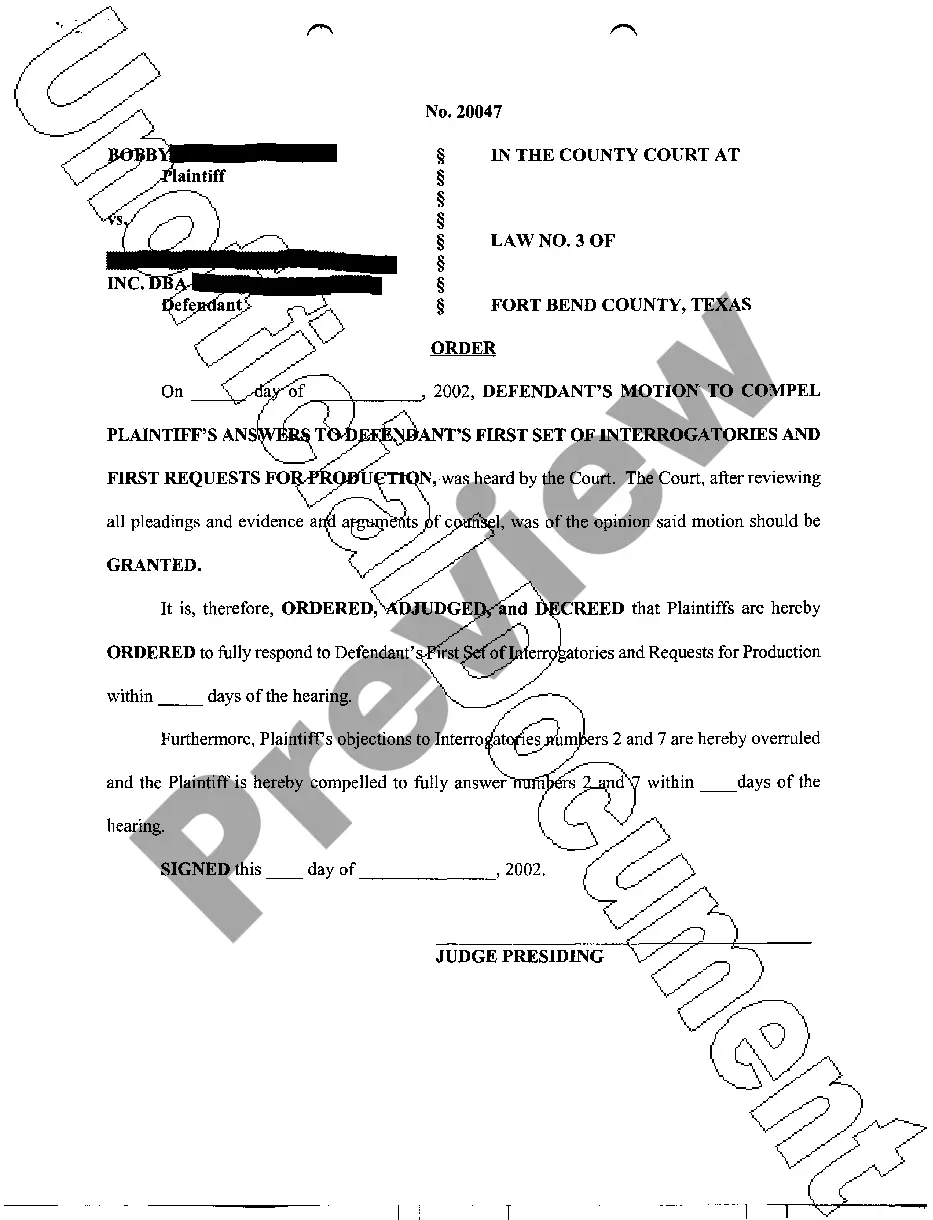

In cases where the judgment is entered by default, action can be taken immediately to satisfy the judgment, either by garnishment or levy upon the property of the defendant in fi fa. Other judgments may not be enforced for a period of ten days after entry of the judgment.

In Georgia, a creditor can garnish the lesser of 25% of your disposable income or the amount by which your disposable earnings exceed 30% of federal minimum wage. If your disposable income is less than 30 times minimum wage, it cannot be garnished at all.

Once a judgment is issued, the creditor has the right to take further actions to collect the debt, such as wage garnishment, bank account levies, or placing liens on your property.

Regardless of how the judgment is obtained, there are three main options to consider in attempting to collect on the judgment. Filing a Garnishment. First, a party may pursue a garnishment. Recording a Writ of Fieri Facias. Conducting Post-Judgment Discovery.

To file an exemption for wage garnishment, you must file the Claim of Exemption (WG-006). By doing this, you will explain to the Sheriff why some or all of the wages the creditor wants your employer to garnish should be exempt. Wage garnishment and bankruptcy are not for everyone to handle.