Judgment Lien On Jointly Owned Property In Arizona

Description

Form popularity

FAQ

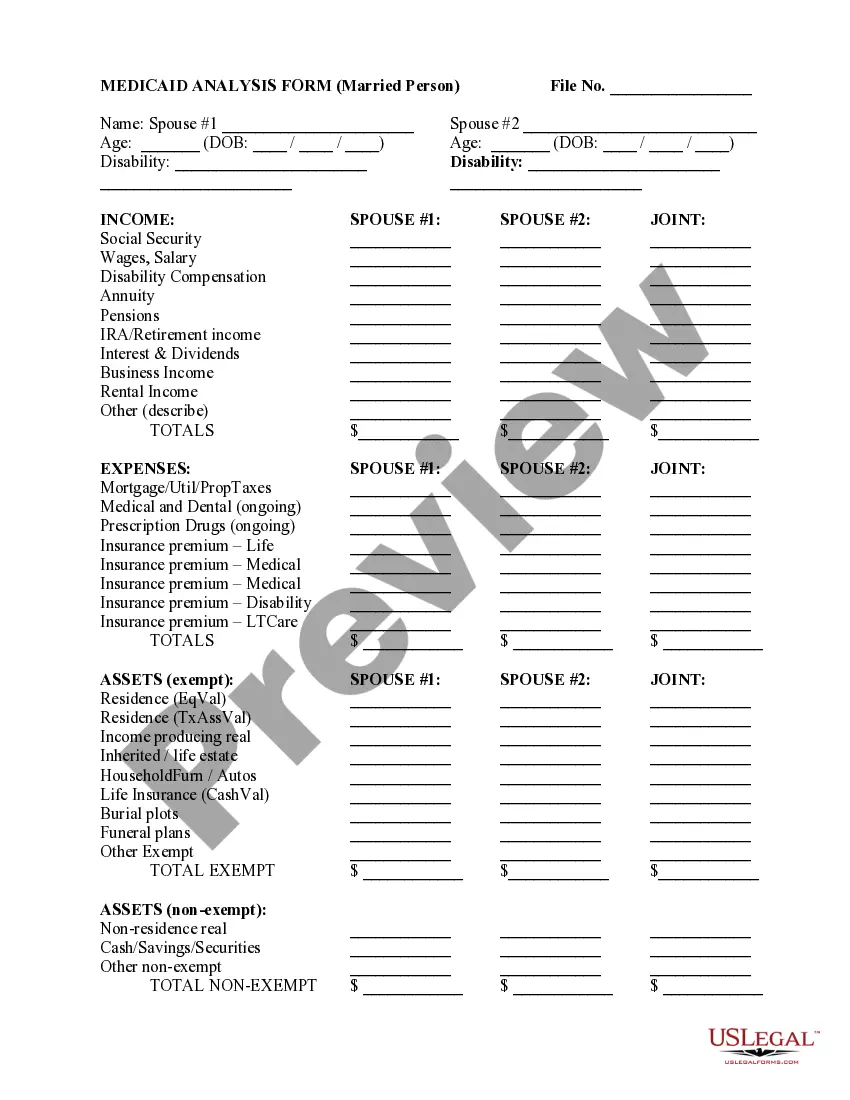

Arizona's homestead exemption exempts up to $150,000 of a person's equity in their dwelling from attachment, execution or forced sale. The exemption applies to a person's house and land, condominium or cooperative, mobile home or mobile home and land.

Arizona has protections in place for those declaring bankruptcy in the state. The Arizona homestead exemption, for example, protects your primary residence during bankruptcy if you have no more than $150,000 in equity. Likewise, retirement and pension accounts like 401(k)s and IRAs are exempt during bankruptcy.

Except as provided in sections 33-729 and 33-730, from and after the time of recording as provided in section 33-961, a judgment shall become a lien for a period of ten years after the date it is given on all real property of the judgment debtor in the county in which the judgment is recorded, whether the property is ...

Regarding your question about jointly owned property, it is possible for a lien to be placed on it unless it is held "by the entirety," which is a special way that a deed can be held by a married couple. However, if it is not held in this specific manner, there is a potential for a lien to be placed.

The short and legal answer is YES, the creditor can force the sale of that half interest, but normally they won't. Part of the reason is that half of a property is not worth half of what the property is worth.

The exempt property may include community, joint or separate property of the judgment debtor. B. If the judgment debtor dies or absconds and leaves a spouse or dependent any property that is exempt under this section, the property remains exempt to the spouse or dependent.

One way to collect on a judgment is to place a lien on property owned by the judgment debtor. In Arizona, the person in whose favor a judgment has been entered can record a copy of the judgment to create a lien against property owned by the judgment debtor.

How does a creditor go about getting a judgment lien in Arizona? To attach the lien, the creditor files and records a judgment with the county recorder in any Arizona county where the debtor owns property now or where they may own property in the future.

Key Requirements for Arizona Pre-liens Recipients: Send the notice to the property owner, general contractor, the party you are in contract with, and any construction lenders. Mailing Method: Use first-class mail with a certificate of mailing to ensure proof of mailing.