Payoff Letter For Judgement In Wake

Description

Form popularity

FAQ

The period has expired: Most judgments remain on credit reports for seven years and six months. If this period has passed, you should contact the credit agencies and make sure they remove the judgment. The seven-year and six-month period is not absolute. People have been able to get a judgment removed sooner.

When focusing on the main objectives, Lost Judgment is about 24½ Hours in length.

Lien and Judgment Negotiation Locate your creditor and find out how much you owe: This can often be the most challenging part of lien negotiation. Evaluate and explain whether it is worth it to try and negotiate the lien or judgment: Some liens are negotiable and some aren't. Negotiate: Negotiation is an art.

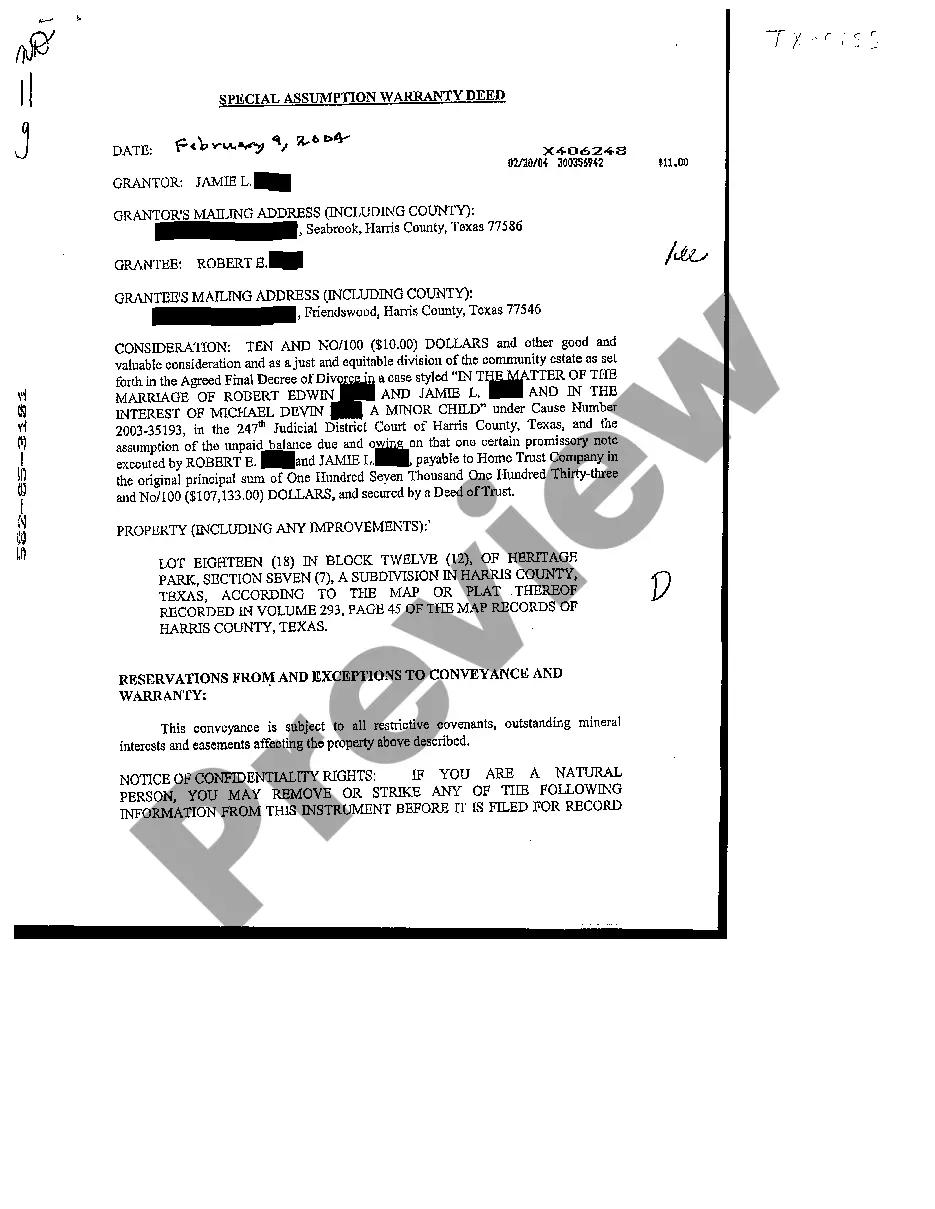

A judgment lien expires after 5 years from the date it is recorded but may be rerecorded once for another period of 5 years not less than 120 days before the expiration of the initial judgment.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

It means that the court is entering a judgment in favor of the defendant; this often happens in cases where there are counter-claims against the plaintiff for which the court finds in favor of the defendant.

It means that the court is entering a judgment in favor of the defendant; this often happens in cases where there are counter-claims against the plaintiff for which the court finds in favor of the defendant.

How to Obtain a Prayer for Judgement in North Carolina Understand Eligibility Criteria. Consult with an Attorney. File a Request with the Court. Appear in Court. Provide Relevant Documentation. Negotiate with the Prosecution. Understand the Implications. Comply with Court Requirements.

Enter a judgment means to make a final recording of the decision and the opinion, if the court made one. When the entry is complete depends on the jurisdiction, but entering a judgment usually either occurs after the decision is inserted into the docket or sent to a specified official.