Lien Payoff Request Form (rev-1038) In Tarrant

Description

Form popularity

FAQ

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are a number of options to satisfy the tax lien.

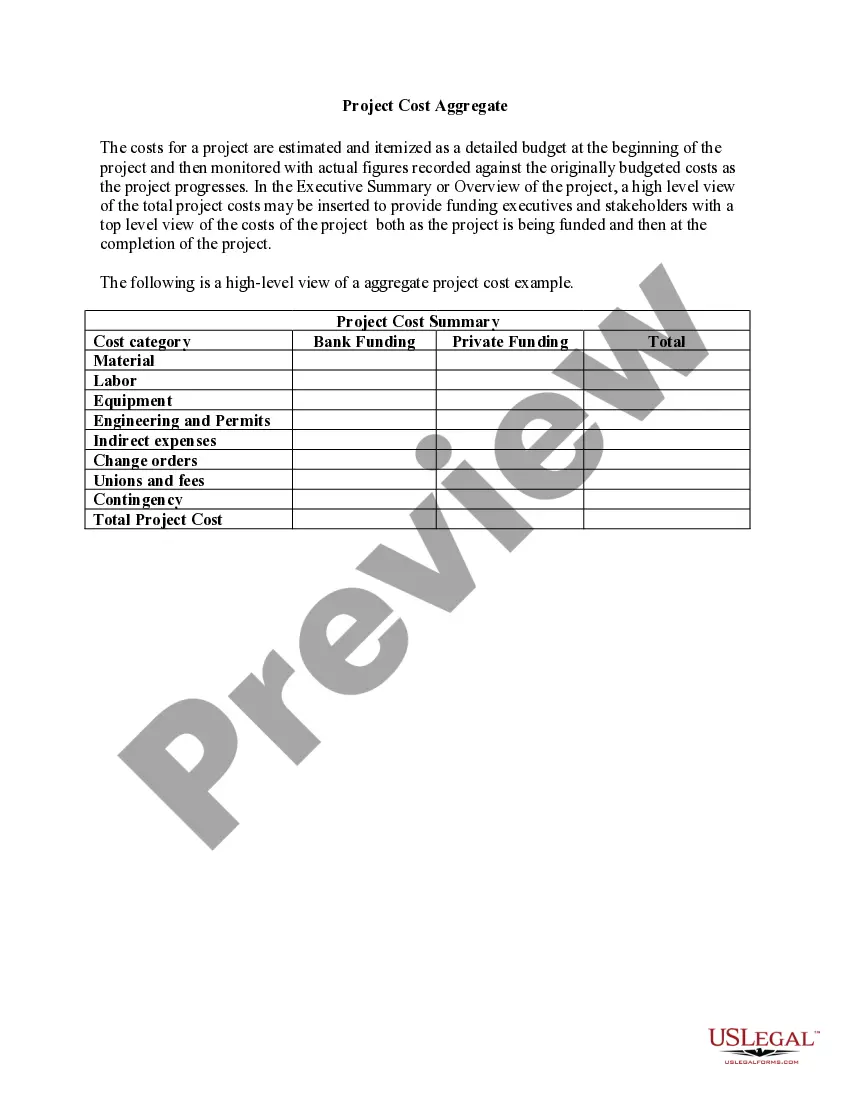

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

State tax department phone numbers StatePhone number California 800-852-5711 Colorado 303-238-7378 Connecticut 860-297-5962 Delaware 302-577-820015 more rows •

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

Requesting a Copy of the Certificate For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed.