Loan Payoff Letter Example Formula In Salt Lake

Description

Form popularity

FAQ

Page 1 Forms and. Instructions. Forms and. Instructions. TC-65. UTAH. Utah State Tax Commission • 210 North 1950 West • Salt Lake City, Utah 84134 • tax.utah. E-Filing is Easier! E-filing is the easiest and most accurate way to file. Utah is Online.

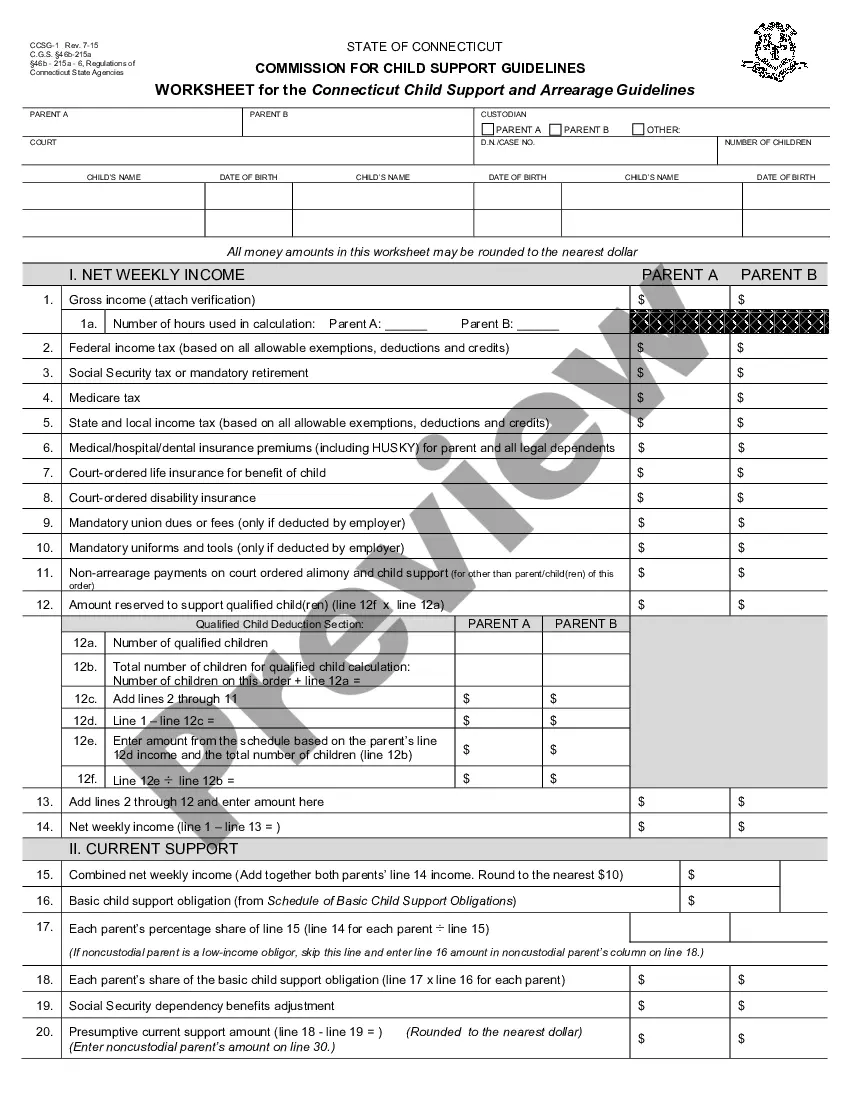

If your federal adjusted gross income is less than or equal to your federal standard deduction, you are exempt from Utah income tax. For this purpose, the federal standard deduction does not include the extra deductions for age or blindness.

You must file a TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or.

Types of partnerships: Liability & tax considerations In Utah, partnerships are generally taxed as pass-through entities, meaning the profit and losses from the businesses pass directly into the partners' personal incomes. Utah does require a yearly partnership return from each partnership within the state.

If you were under 65 at the end of 2024 If your filing status is:File a tax return if your gross income is: Single $14,600 or more Head of household $21,900 or more Married filing jointly $29,200 or more (both spouses under 65) $30,750 or more (one spouse under 65) Married filing separately $5 or more1 more row

Ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return. You were a nonresident or part-year resident with Utah source income and are required to file a federal return.

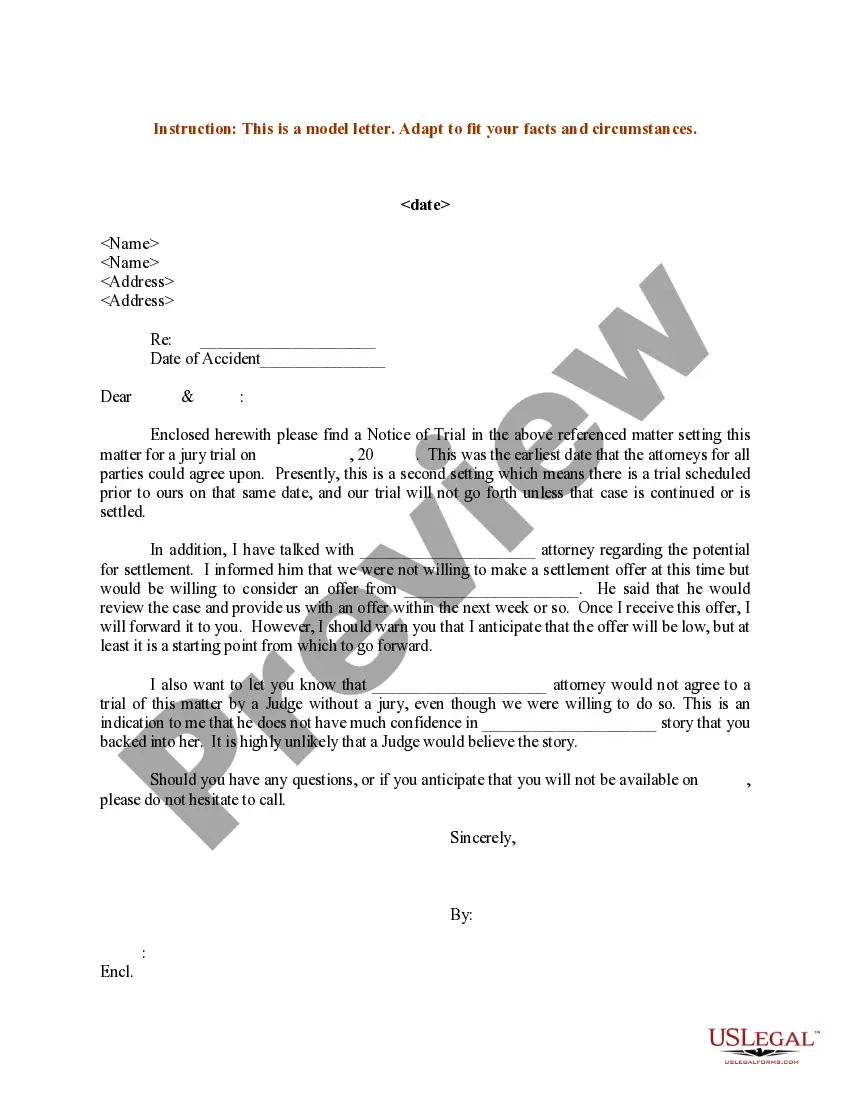

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.