E-commerce Rules In Utah

Description

Form popularity

FAQ

Question 11: Which of the following is NOT provided by e-commerce? E-commerce provides a variety of services, but not all options listed are typically considered services provided by e-commerce platforms. Here's the correct answer: Customer pickup services.

The Federal Trade Commission Act (FTCA) prohibits certain unfair or deceptive acts or practices in or affecting commerce. Other state and federal regulations govern the shipment of goods and the issuance of, or notices concerning, refunds.

The correct answer is Preservation. Preservation is not considered to be one of the three phases of e-commerce. E-commerce or electronic commerce is the trading of goods and services on the internet.

commerce does not include interactions among the various departments within the business as in ecommerce, transactions take place through the internet and it usually does not have any specific geographical location for conducting their business.

Explanation: C2B is not one of the major types of e-commerce. The C2B, or consumer-to-business model, is when customers offer products or services to businesses.

The Commerce Clause refers to Article 1, Section 8, Clause 3 of the U.S. Constitution, which gives Congress the power “to regulate commerce with foreign nations, among states, and with the Indian tribes.”

commerce does not include interactions among the various departments within the business as in ecommerce, transactions take place through the internet and it usually does not have any specific geographical location for conducting their business.

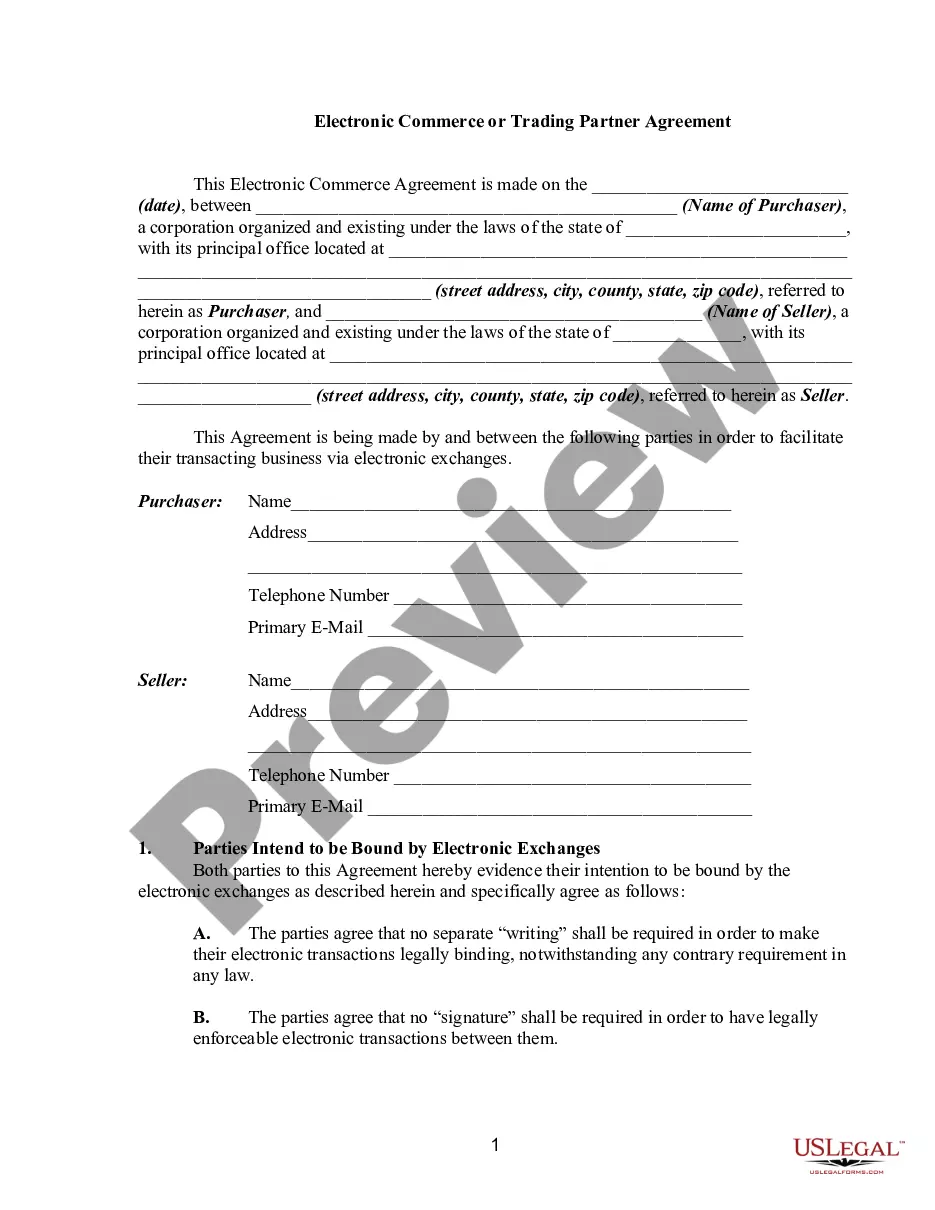

The UETA explains the types of circumstances that need to exist to legally permit electronic signatures within the context of “transactions” (i.e., actions between two or more people relating to business, commercial, or governmental affairs), and to permit electronic transactions.

You can register for a Utah seller's permit online through the Utah State Tax Commission. To apply, you'll need to provide the Tax Commission with certain information about your business, including but not limited to: Business name, address, and contact information. Federal EIN number.

Are digital downloads taxable in Utah? Yes. You owe tax for the sale of digital downloads to customers in Utah.