Deeds Of Trust In English In Wayne

Description

Form popularity

FAQ

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

There are three (3) convenient ways to retrieve a document from our extensive files: Visit waynecountylandrecords - available 24 hours a day. Visit our office in historic Greektown (kiosks are now only available to be used from am - pm) Request a Search-by-Mail.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

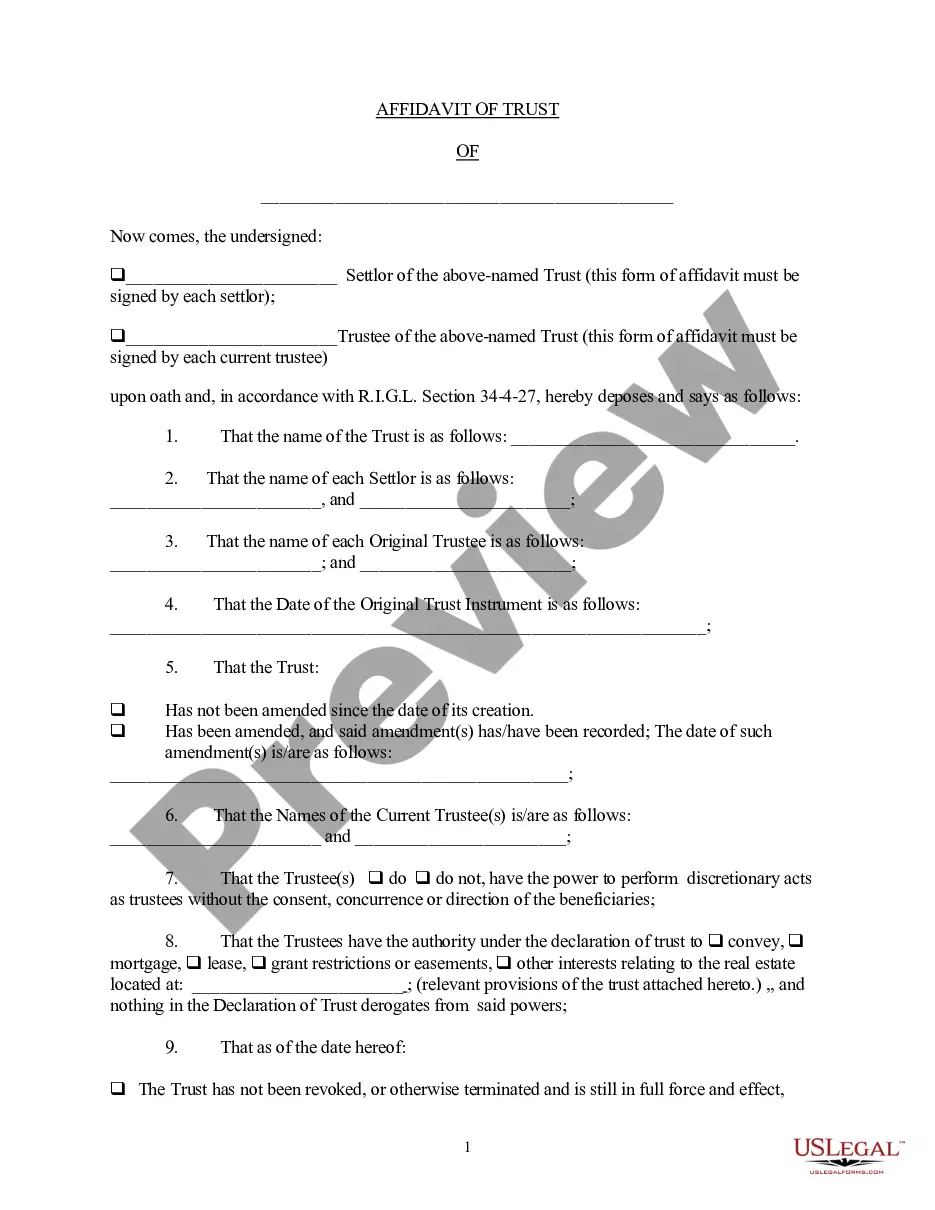

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

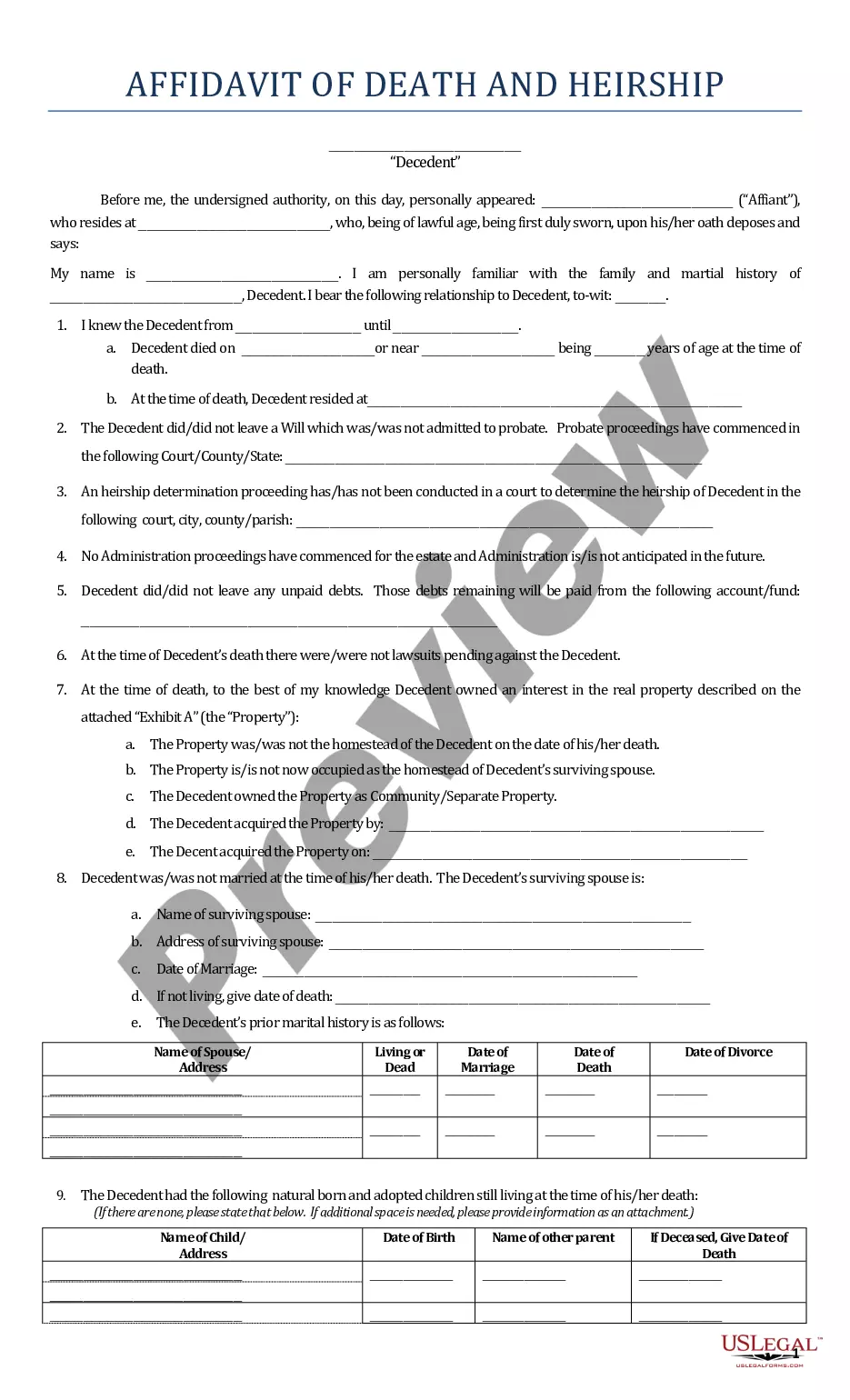

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Documents executed in the State of Michigan after April 1, 1997, must have a 2 1/2 inch top margin of unprinted space on the first page and at least 1/2 inch on all remaining sides of each page. Exemptions to this include certified documents, surveys and land corners.

Or you may email in the request to registerofdeeds@waynegov.

The biggest difference between a title and a deed is the physical component. A deed is an official written document declaring a person's legal ownership of a property, while a title is a legal concept that refers to ownership rights.

The Beneficiary of a Deed of Trust is the Lender, and the Deed serves to protect their investment. The Trustor is the borrower. While the legal title on the property is put into a Trust, as long as timely and consistent payments are made, the borrower has equitable title.