Indenture For Notes In Travis

Description

Form popularity

FAQ

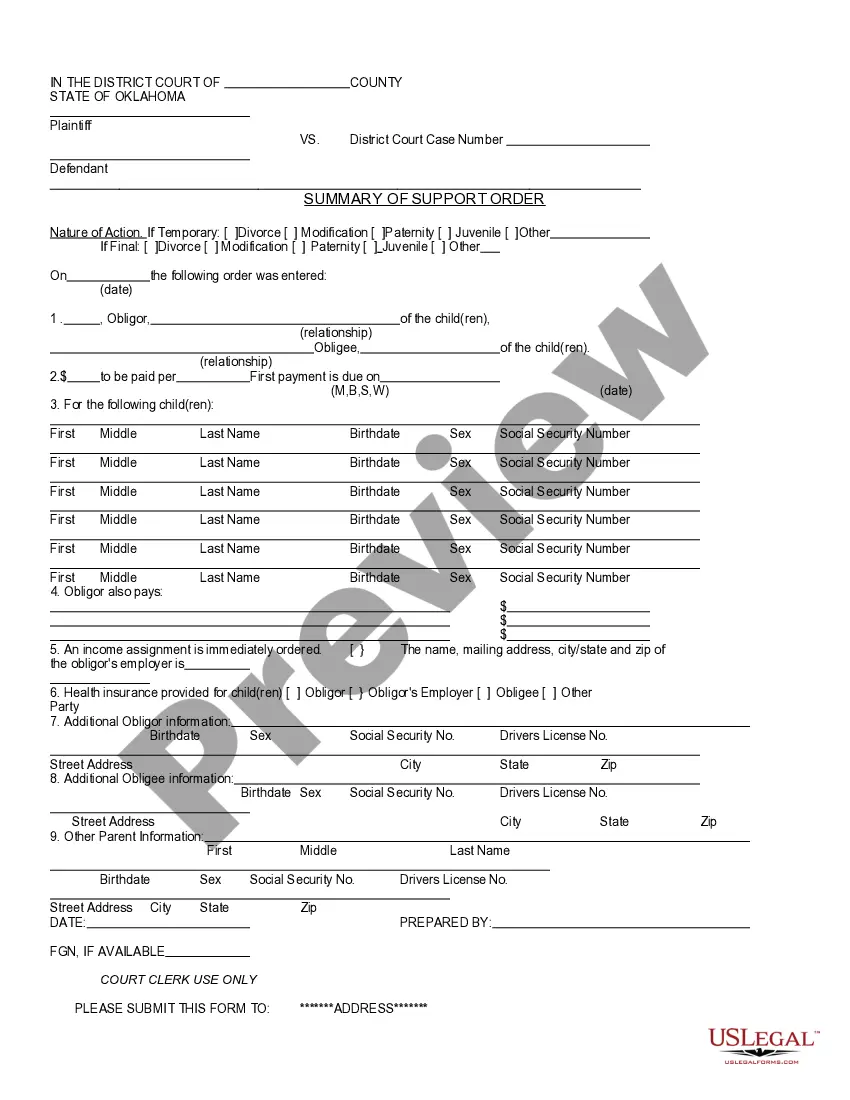

A written agreement between the issuer of debt securities (such as bonds, notes, or debentures) and the trustee for the debt securities acting as a representative of the securityholders that specifies the terms and conditions of the debt securities, including the interest rate, maturity, any redemption terms, timing, ...

The Trust Indenture Act requires certain prospectus disclosure about the debt securities in registered offerings. Most offerings of debt securities that are exempt from registration under the Securities Act of 1933 are also exempt from the Trust Indenture Act requirements.

The indenture typically: (1) clearly describes and defines the issued debt securities; (2) specifies the rights of the parties, including the duties of the trustee as a third-party administrator; (3) sets forth the borrower's obligation to make payments; and (4) outlines the remedies available to the noteholders if the ...

It is in English. We know it is a lease because of the following characteristics: It is an indenture, that is, the top of the deed is cut in a wavy line. This indicates that the deed was made between two or more parties.

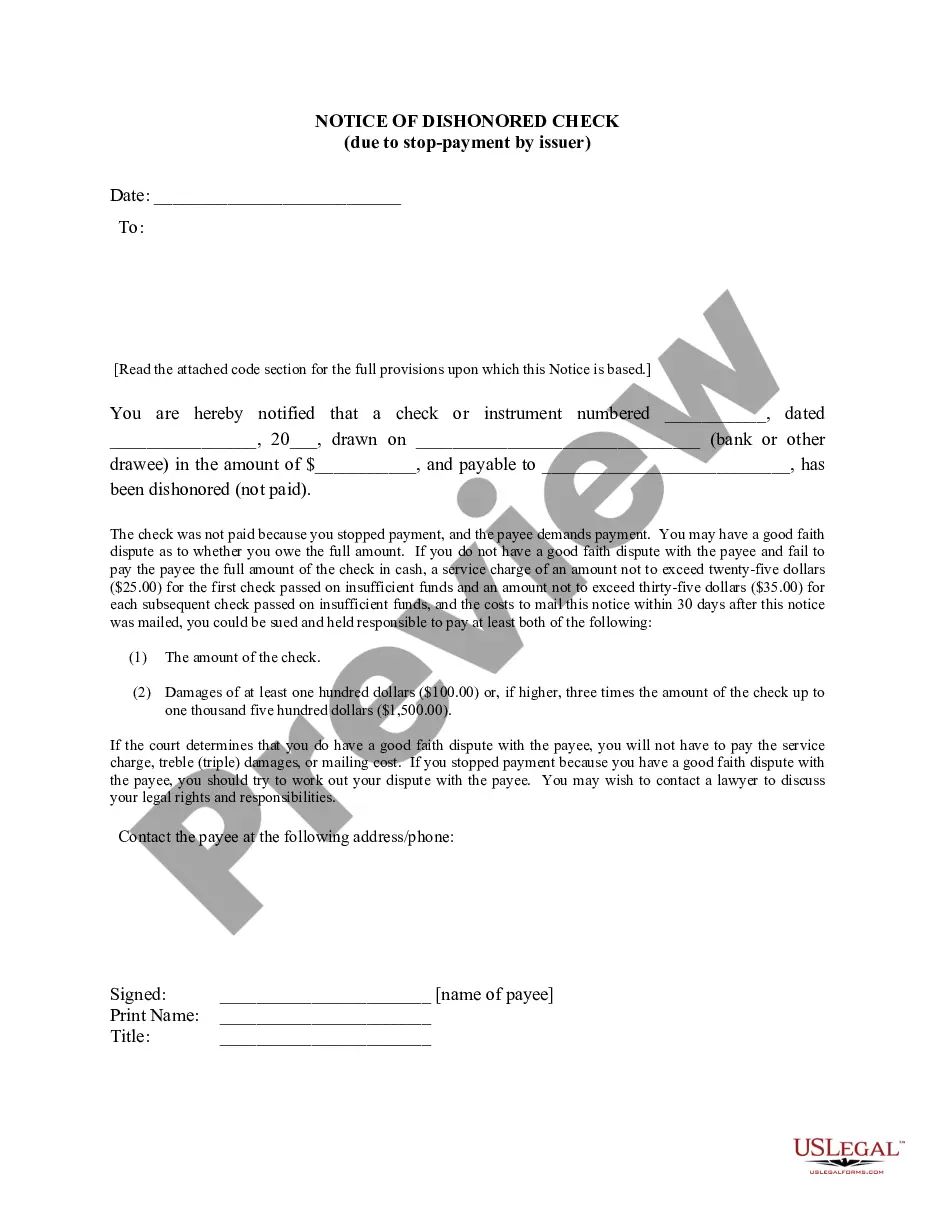

An indenture is a deed that establishes ongoing responsibilities between two parties in real estate.

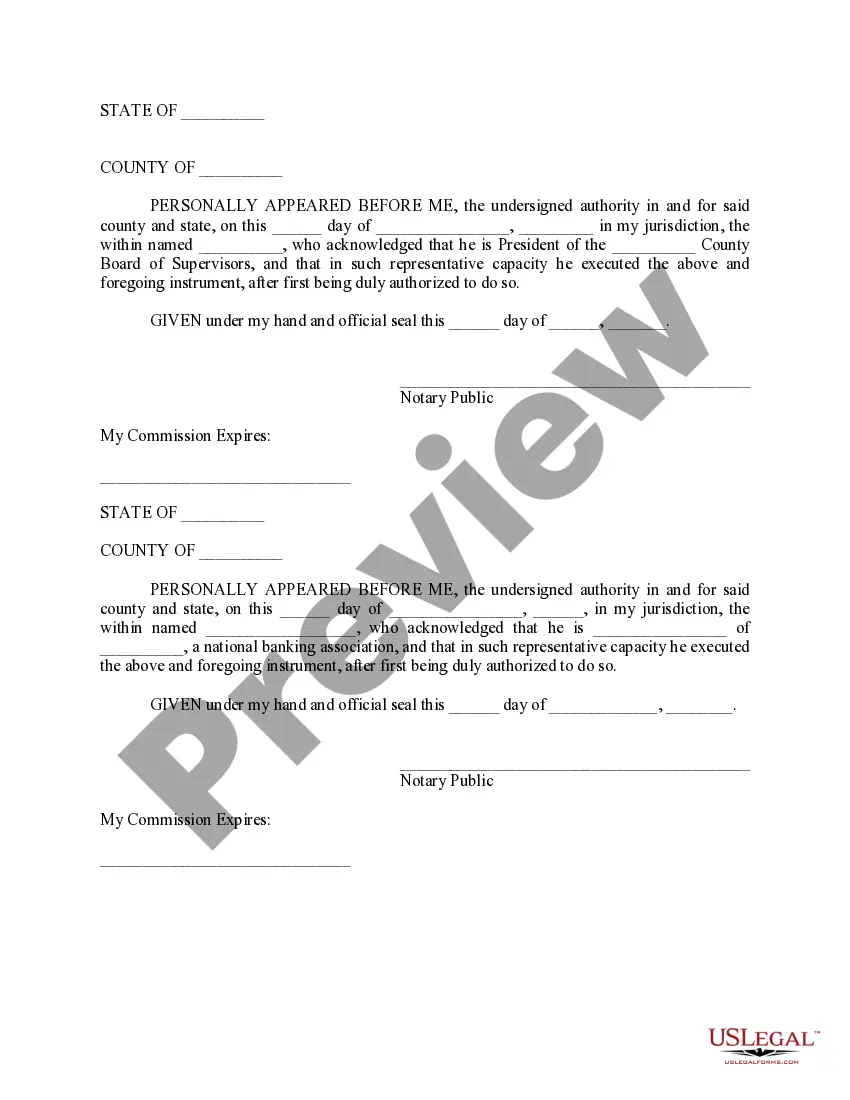

The term is used for any kind of deed executed by more than one party, in contrast to a deed poll which is made by one individual. In the case of bonds, the indenture shows the pledge, promises, representations and covenants of the issuing party.

In real estate, an indenture is a deed in which two parties agree to continuing obligations. For example, one party may agree to maintain a property and the other may agree to make payments on it.

The Indenture pledges certain revenues as security for repayment of the Bonds. The Trustee agrees to act on behalf of the holders of the Bonds and to represent their interests.

Note Indenture means the trust indenture entered into between COT and the Note Trustee for the issuance of the Notes by COT. “Note Trustee” means the trustee under the Note Indenture, including any successor trustee thereunder.

The terms of the Indenture are tailored to reflect the specific type of transaction and issuer. Like credit agreements,1 an Indenture contains lending and repayment terms. In contrast to credit agreements, however, the lender is not a party to an Indenture.