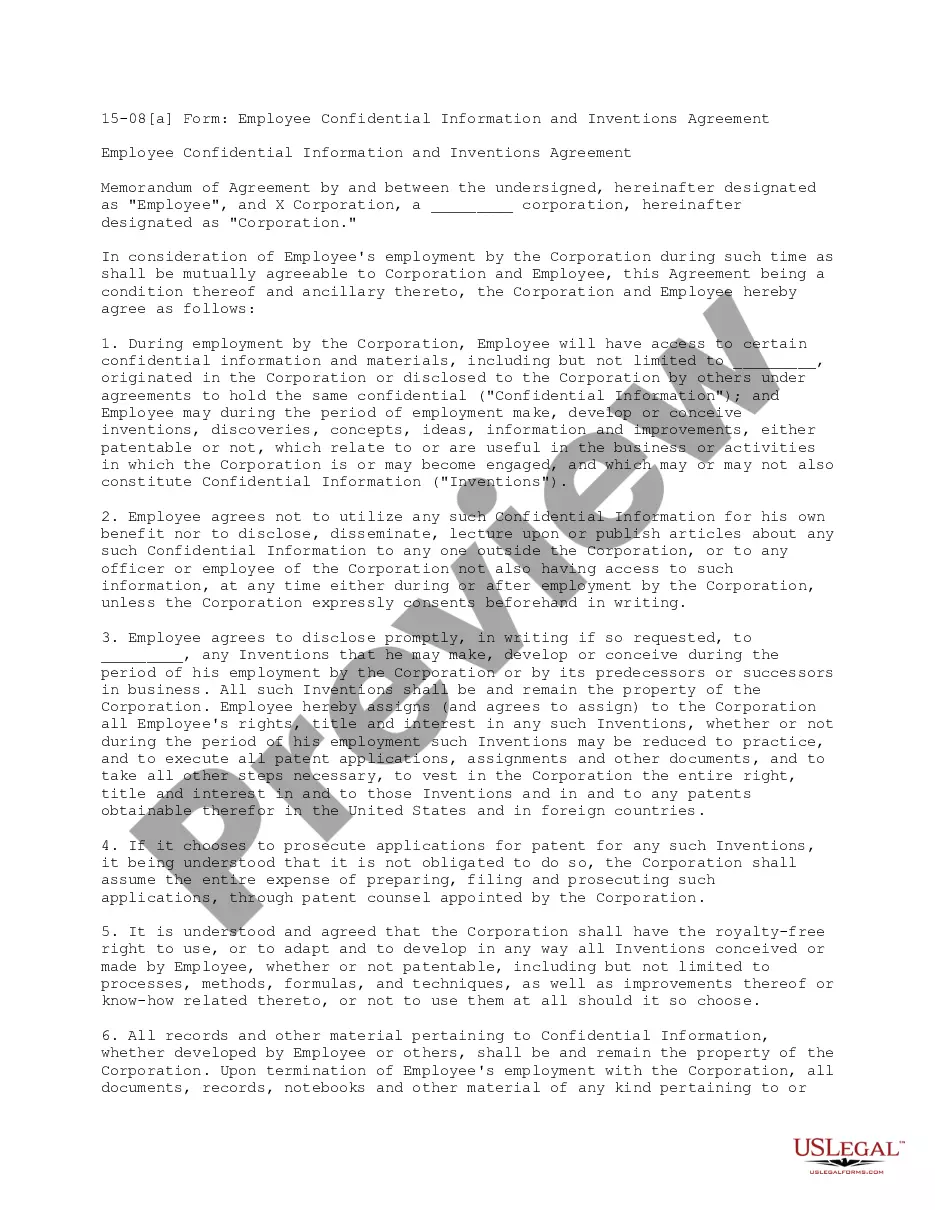

This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Sba Loan Agreement With Collateral Pdf In Clark

Description

Form popularity

FAQ

The SBA may consider a release of liens on real or personal property collateral for consideration. In cases where a bankruptcy has been filed, a formal offer in compromise may not be necessary since the underlying Note has been discharged in the bankruptcy proceeding.

A third party agreement is an contract between two parties that is used to add a third party to be governed under the terms of the original agreement. The third party agreement has more than one form and the characteristics of the contract depend entirely on the initiative of the parties.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

Advance payment guarantees This type of guarantee also acts as a collateral to ensure that the buyer/client's advance payment would be reimbursed should the seller fail to deliver their end of the bargain per the agreed contract.

When seeking a lien release, borrowers should approach the SBA with a well-prepared case that highlights the equity in their assets and the potential for a fair settlement. It is essential to gather documentation and evidence that supports your position and demonstrate your willingness to resolve the debt.

Any release of collateral must not materially cause an adverse effect to the project's operation or financial condition and the remaining collateral must be sufficient to provide for adequate collateral coverage. Such assurance must be supported by written documentation from the lender and be acceptable to the Agency.

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

It's important to note that all SBA loans require some form of collateral from the borrower.

The ConsensusDocs' 750 Constructor and Subcontractor Agreement provides a standard agreement between a constructor and subcontractor, with the general terms and conditions and the construction agreement terms conveniently integrated into one document.