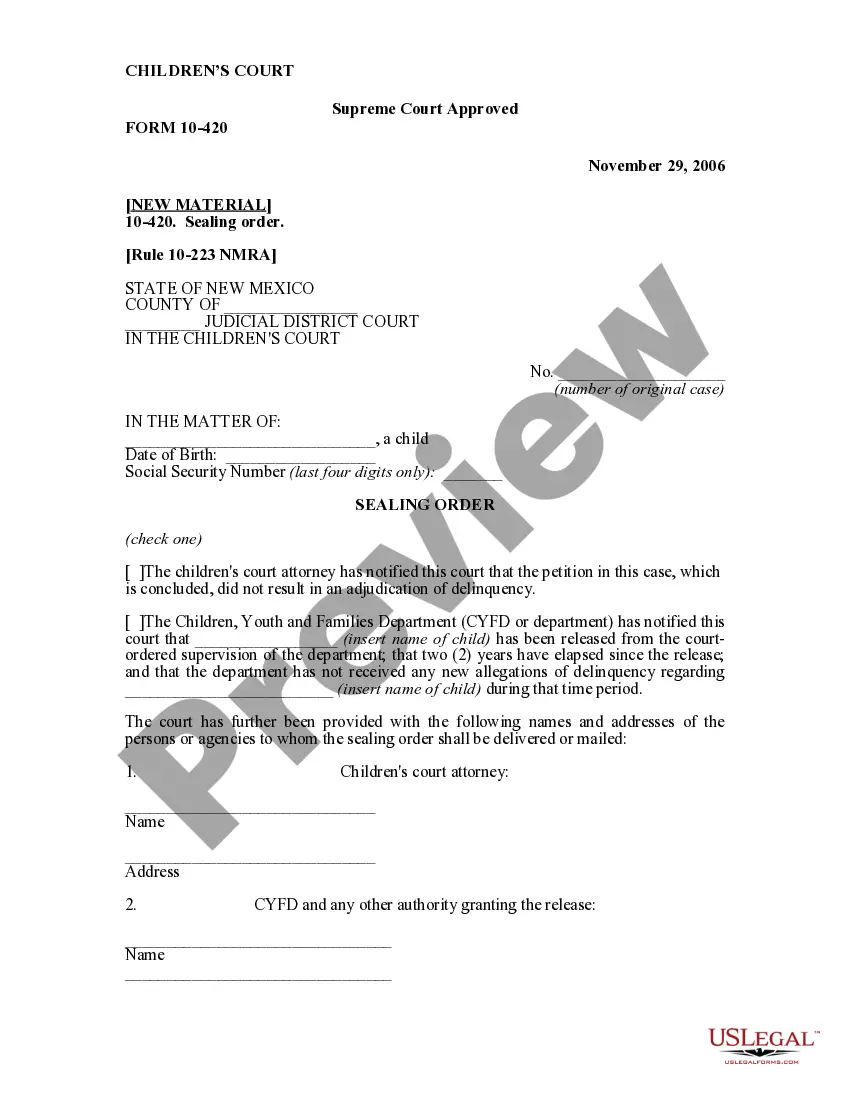

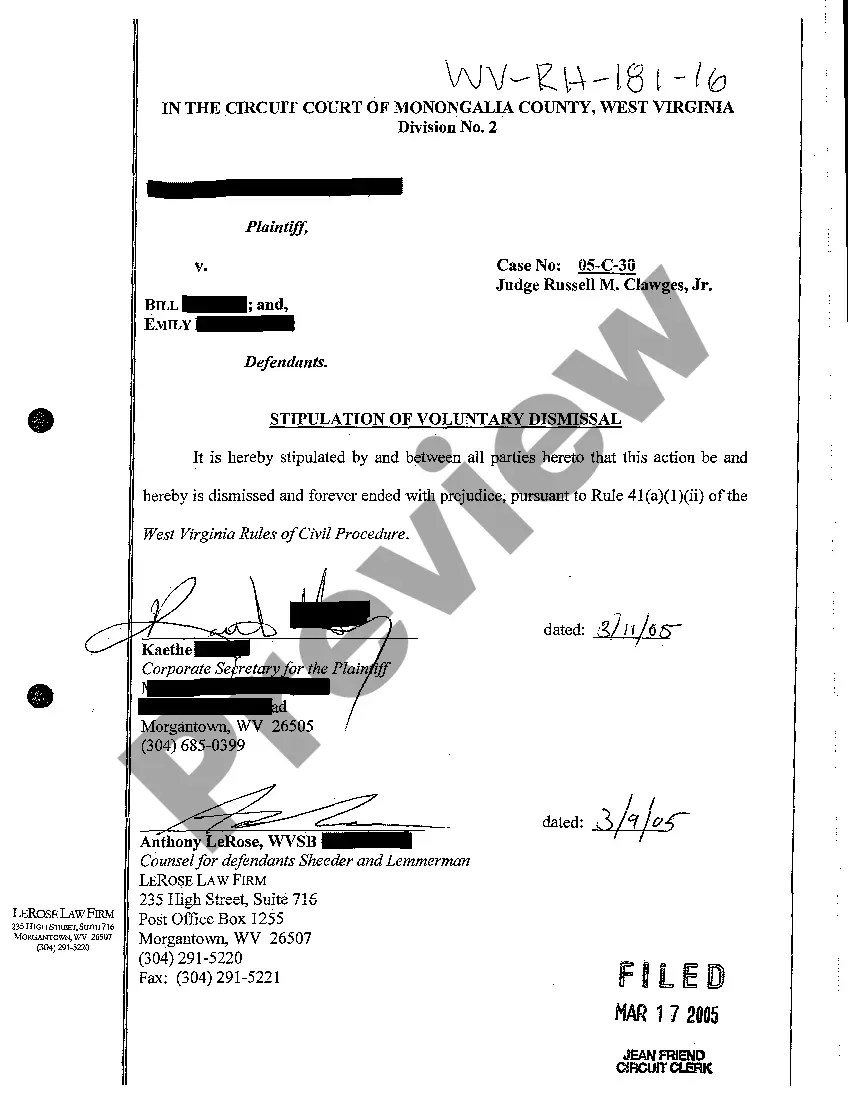

Form with which the Directors of a corporation waive the necessity of an annual meeting of directors.

Annual Meeting Do For Llc In Utah

Description

Form popularity

FAQ

Having an annual meeting and keeping a record of what was discussed helps validate that business owners are treating the limited liability company as a separate legal entity. That measure reinforces the corporate veil that protects LLC members' personal assets from the company's legal and financial liabilities.

All Utah LLCs must be renewed every year. If you don't renew your LLC, it will “Expire” and you'll then have to Reinstate it or file a new LLC altogether. If you don't want to go through the Annual Report filing process every year, you can hire an Annual Report service.

The renewal is due one year from the date of registration and due annually thereafter unless you are filing a DBA, in which, the renewal is 3 years from the date and registration and due every 3 years after that. However if you wish to be sure, you can do a Business Registration Search .

When is the renewal due? The renewal is due one year from the date of registration and due annually thereafter unless you are filing a DBA, in which, the renewal is 3 years from the date and registration and due every 3 years after that.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553 PDF for all required information and to determine where to file the form.

The renewal is due one year from the date of registration and due annually thereafter unless you are filing a DBA, in which, the renewal is 3 years from the date and registration and due every 3 years after that. However if you wish to be sure, you can do a Business Registration Search .

After an initial filing, some states—such as California, Iowa, and Indiana— require LLCs to file a report every other year. In some states, you'll file a report every two years from the year you formed your LLC.