Gift Letter Form With Words In Texas

Description

Form popularity

FAQ

In Court, you must prove three things: 1. That the person making the gift (donor) intended to make a gift, 2. The property the subject of the gift has been delivered to the person receiving the gift (donee), and 3. The acceptance of the gift by the person receiving the gift.

In Texas, there is no state-level gift tax imposed on individuals for making gifts to their loved ones. Unlike some other states, Texas does not have its own gift tax laws, meaning residents are not subject to state gift taxes on their transfers of assets during their lifetime.

In addition to completing Form 130-U, Application for Texas Title and/or Registration (PDF), both the donor and person receiving the motor vehicle must complete a required joint notarized Form 14-317, Affidavit of Motor Vehicle Gift Transfer, describing the transaction and the relationship between the donor and ...

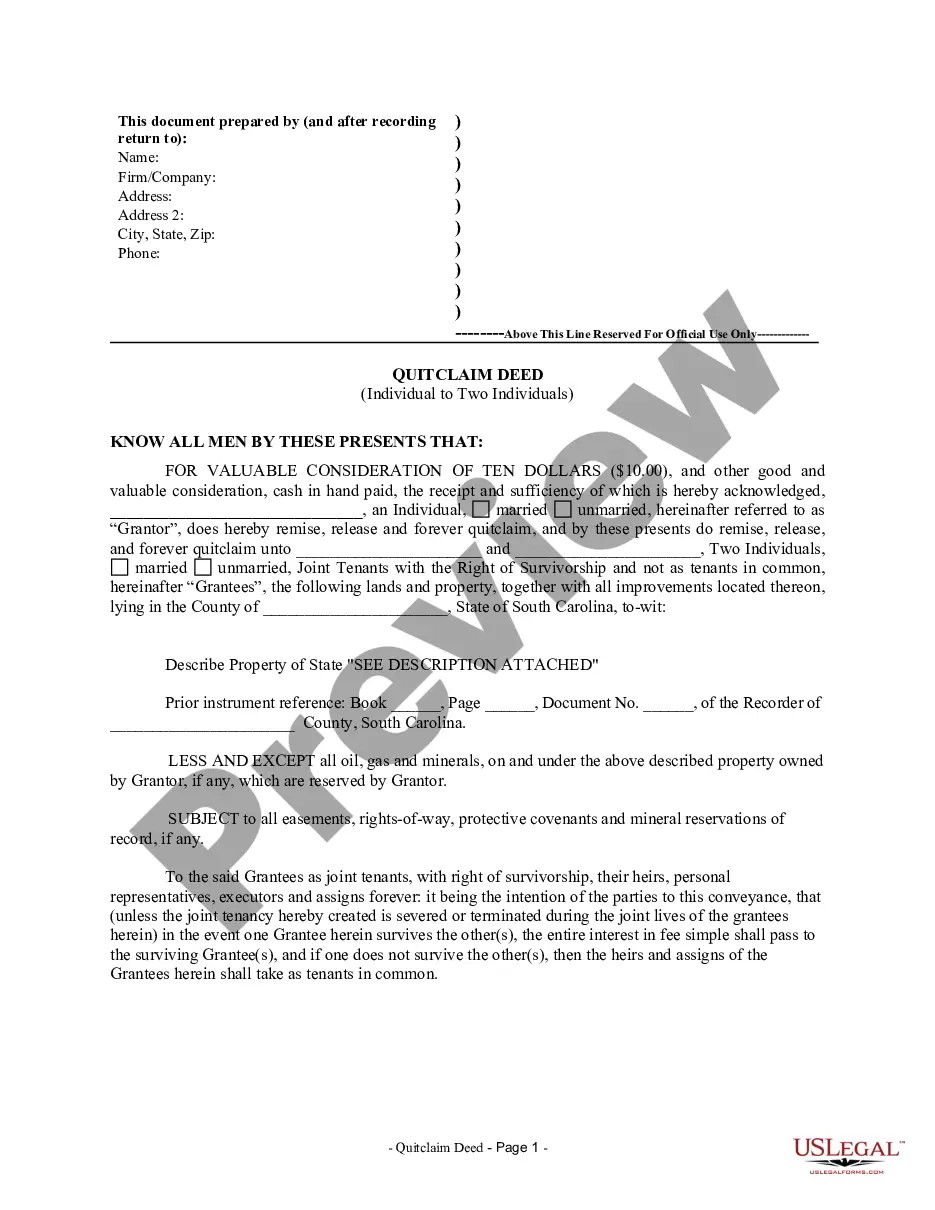

A gift deed must be (1) in writing, (2) signed, (3) describe the property, and (4) delivered. TPC §5.021. Texas further requires the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee.

Three elements must be met for a gift to be legally valid: Intent to give (the donor 's intent to make a gift to the recipient), delivery of the gift to the recipient, and acceptance of the gift.

A gift deed must be (1) in writing, (2) signed, (3) describe the property, and (4) delivered. TPC §5.021. Texas further requires the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee.

Form 130-U The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle. a gift from one eligible party to another eligible party. an even trade between two parties. a new resident tax.

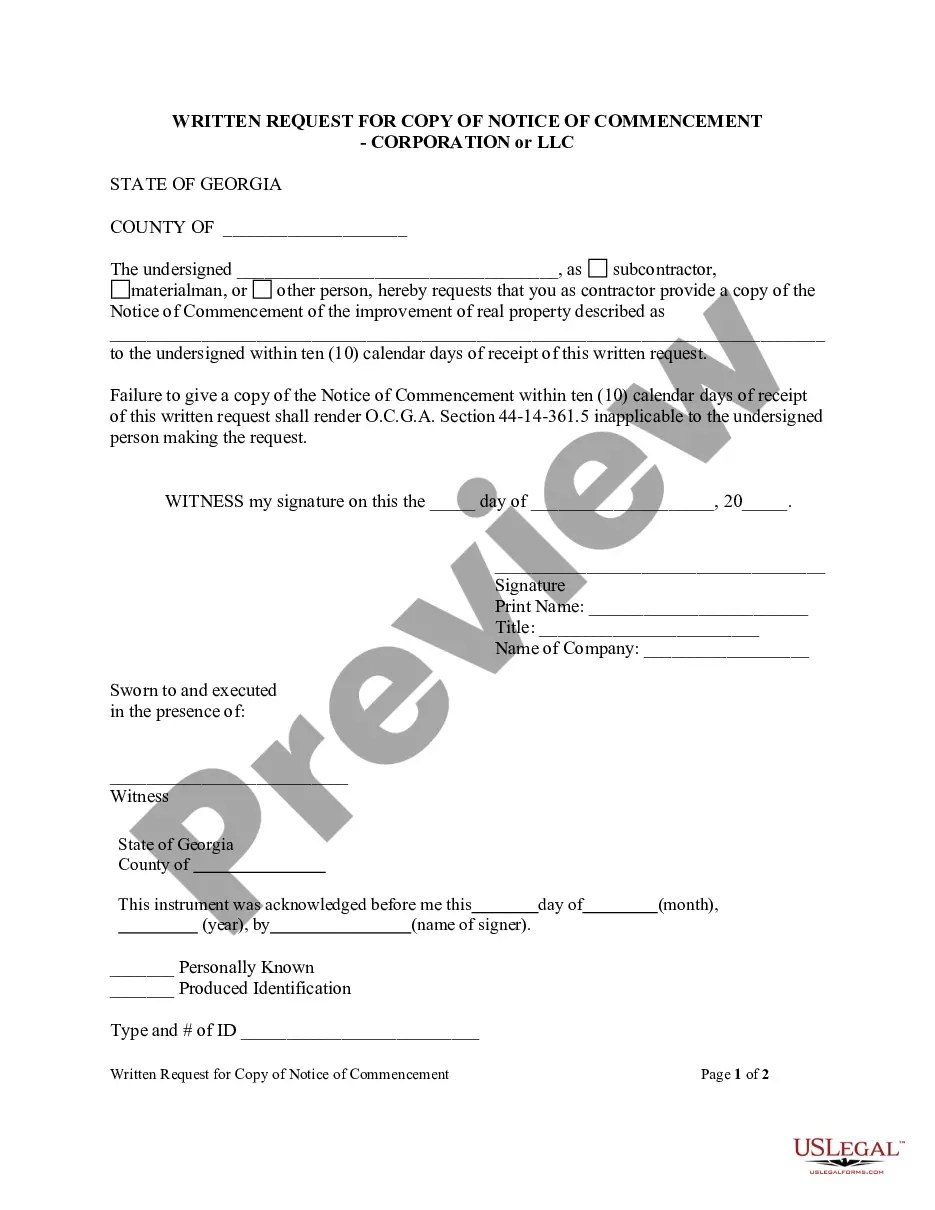

To be valid, this affidavit must be properly completed and contain the signatures of all principal parties to the transaction, sworn to and subscribed in front of one of these individuals: a notary public of Texas or the equivalent from another state or jurisdiction; or.

The signed negotiable title and completed Application for Texas Title and/or Registration (Form 130-U), must be provided to the county tax office to title the vehicle. The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317).

Do Both Parties Have to be Present to Transfer a Car in Texas? If the seller or person gifting the car properly signed the title, they do not have to be present at the DMV to transfer the title. However, the person receiving the vehicle must present the Application for Texas Title in person at the DMV.