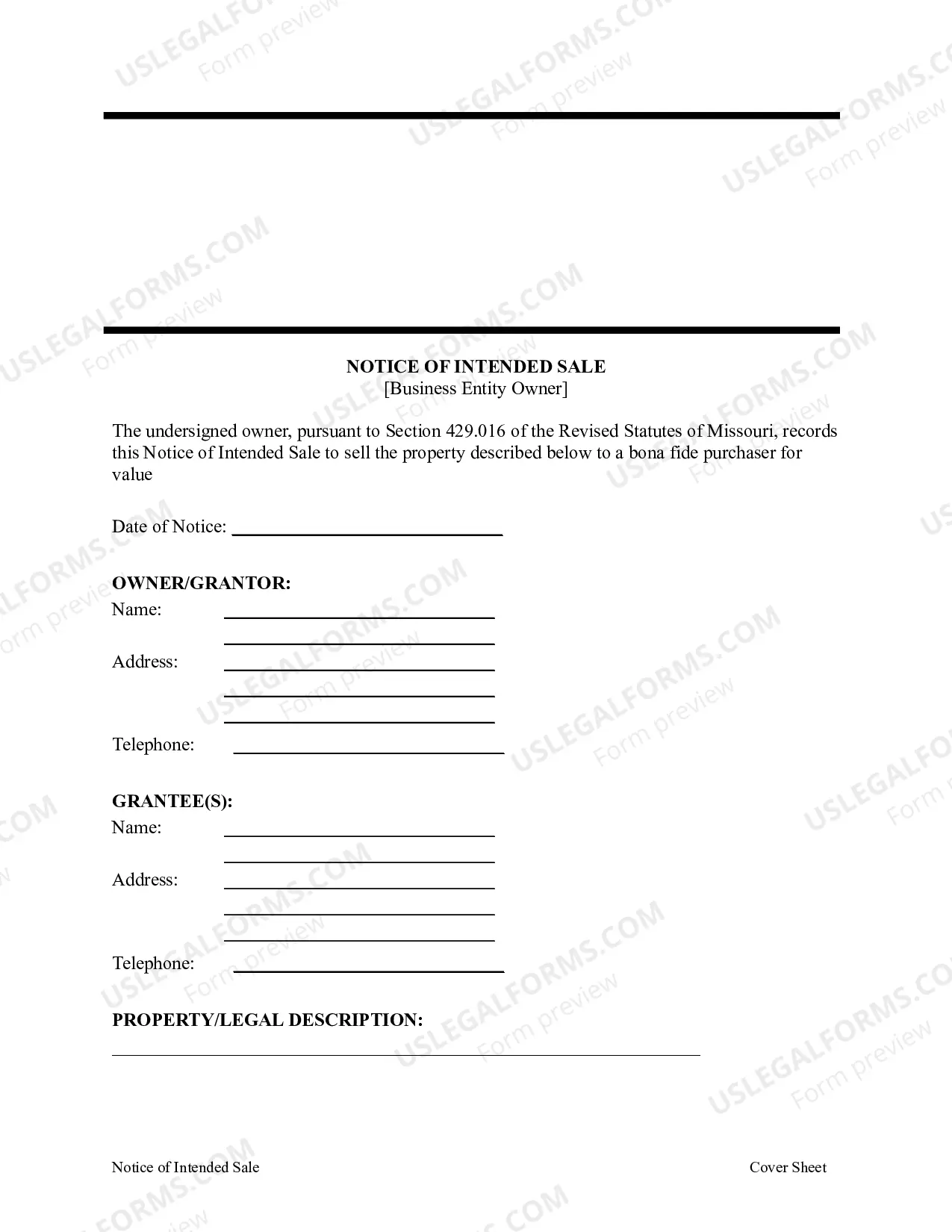

Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016

Description

How to fill out Missouri Notice Of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016?

Obtain any variation from 85,000 lawful documents such as Missouri Notification of Planned Sale - Business Entity Proprietor - Mo.Rev.Stats. Sec. 429.016 online with US Legal Forms. Each template is crafted and refreshed by state-recognized legal experts.

If you possess a subscription, sign in. Once you’re on the document’s page, click the Download button and navigate to My documents to retrieve it.

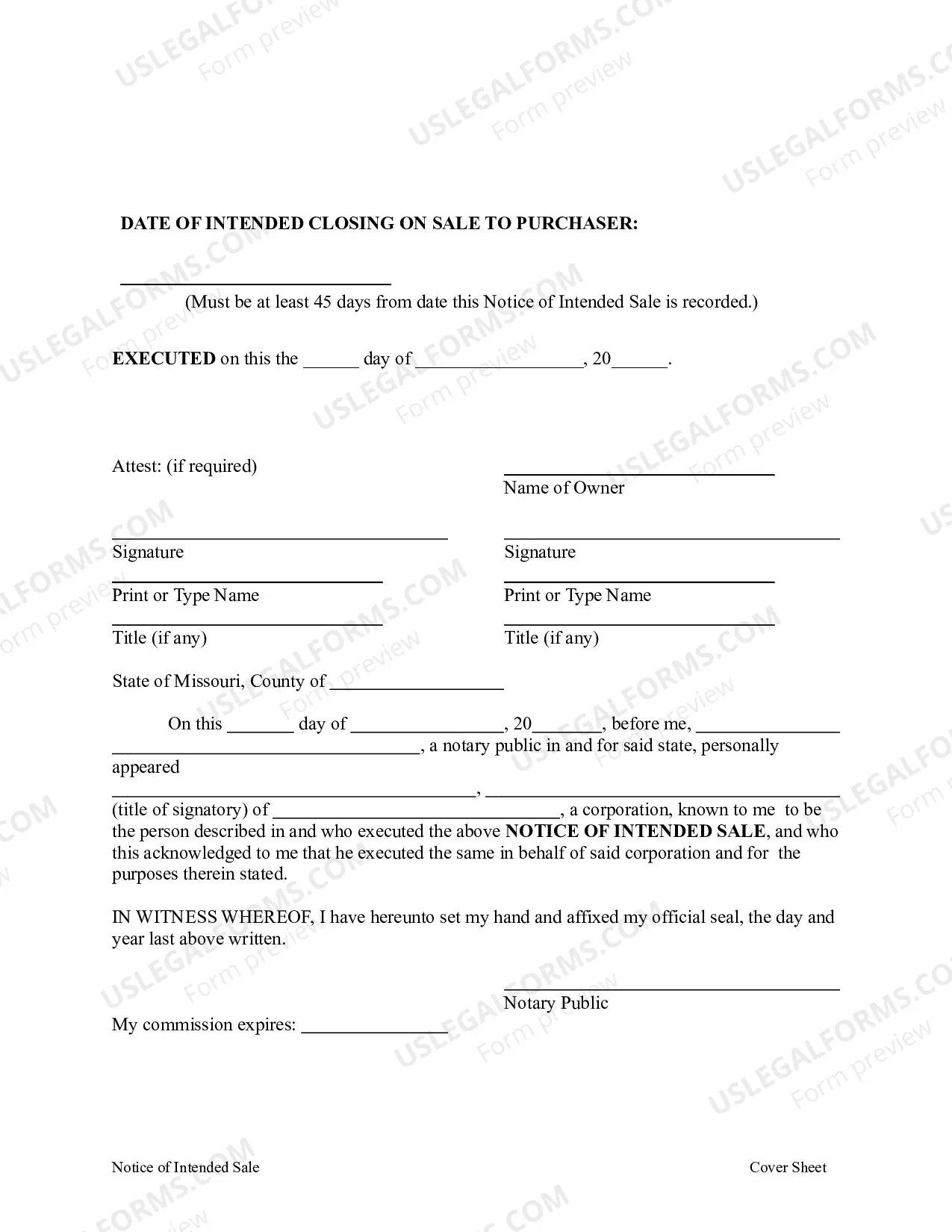

If you haven’t subscribed yet, adhere to the following suggestions: Check the state-specific criteria for the Missouri Notification of Planned Sale - Business Entity Proprietor - Mo.Rev.Stats. Sec. 429.016 you wish to employ. Browse through the description and preview the example. Once you’re sure the example meets your needs, click on Buy Now. Select a subscription plan that aligns with your budget. Create a personal account. Make a payment in one of two acceptable methods: via credit card or through PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the document to the My documents section. Once your reusable document is prepared, print it out or save it to your device.

- With US Legal Forms, you’ll consistently have immediate access to the correct downloadable template.

- The platform provides you with access to forms and categorizes them to streamline your search.

- Utilize US Legal Forms to acquire your Missouri Notification of Planned Sale - Business Entity Proprietor - Mo.Rev.Stats. Sec. 429.016 quickly and effortlessly.

Form popularity

FAQ

In Missouri, the statute of limitations on foreclosure is generally five years from the date of default. This means that lenders must initiate foreclosure proceedings within this timeframe, as outlined in the Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016. If you find yourself facing foreclosure, it is crucial to act promptly and seek legal advice. US Legal Forms can provide you with the resources and forms needed to understand your options and rights.

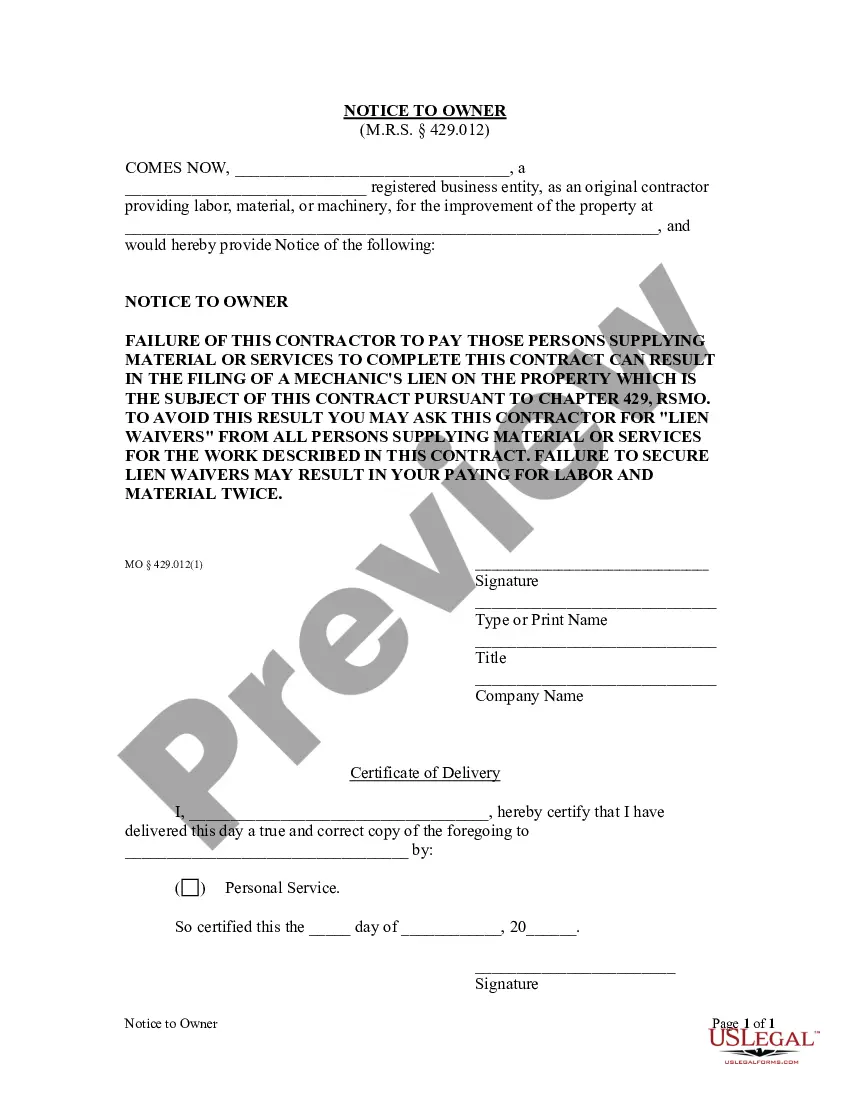

A notice of lien in Missouri serves as a formal declaration that a creditor claims an interest in a property due to unpaid debts. Under the Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016, this notice ensures that property owners are aware of any claims against their property. It protects the rights of contractors and suppliers by providing legal recourse for unpaid services. For more details, US Legal Forms can help you understand the process and provide necessary documentation.

In Missouri, a contractor can file a lien even if there is no formal contract, but certain conditions must be met. The Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016 provides guidelines for this process. Contractors must demonstrate they provided labor or materials that improved the property. If you need assistance navigating these regulations, consider using the US Legal Forms platform for accurate forms and guidance.

In Missouri, a contractor generally has six months from the date of the last work performed or materials supplied to file a lien. This time frame is vital to understand, particularly in relation to the Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016. If a contractor misses this deadline, they may lose their right to claim payment through a lien. For further assistance, consider exploring the US Legal Forms platform, which offers tools and resources to help contractors navigate lien filing efficiently.

In Missouri, lien waivers do not necessarily need to be notarized, but having them notarized can provide an extra layer of protection and verification. This step is especially useful to ensure that the parties involved are who they claim to be. When dealing with the Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016, clear documentation is crucial to avoid disputes. Utilizing resources from US Legal Forms can help you create a robust lien waiver that meets all legal requirements.

To file a contractor's lien in Missouri, begin by preparing a lien statement that includes essential details like the property description, the amount owed, and the contractor's information. Next, file this statement with the appropriate county recorder's office where the property is located. It is essential to adhere to the timelines set forth in the Missouri Notice of Intended Sale - Business Entity Owner - Mo.Rev.Stats. Sec. 429.016 to ensure your lien is valid. You may also consider using the US Legal Forms platform to access templates and guidance for filing your lien correctly.