Receipt Donation Document Without Comments In Nassau

Description

Form popularity

FAQ

Technically, if you do not have these records, the IRS can disallow your deduction. Practically, IRS auditors may allow some reconstruction of these expenses if it seems reasonable.

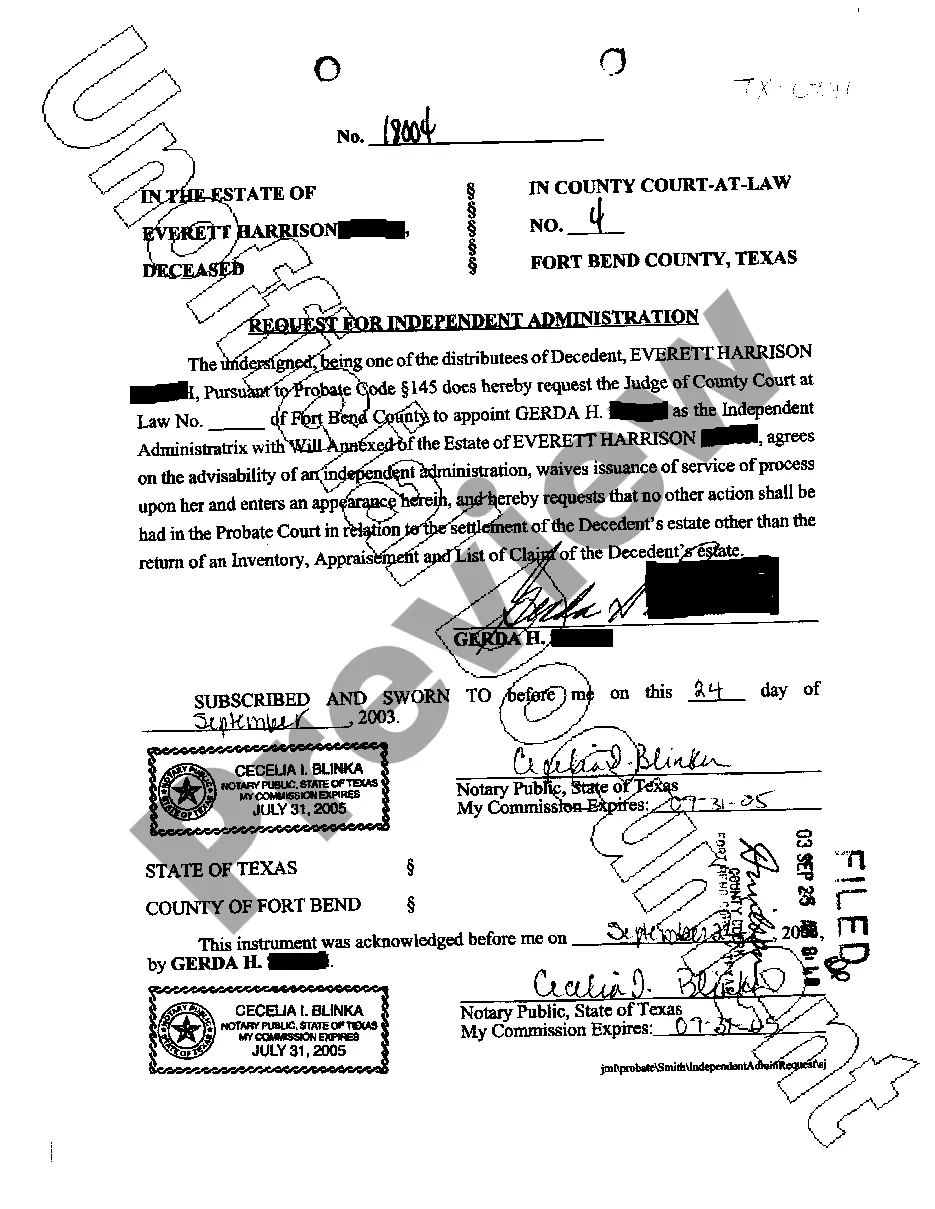

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

Yes. The IRS may not check every donation receipt, but it's best to operate as if it does. You want to be ready if the IRS decides to check your records. Incomplete records could mean disqualification of your tax-exempt status.

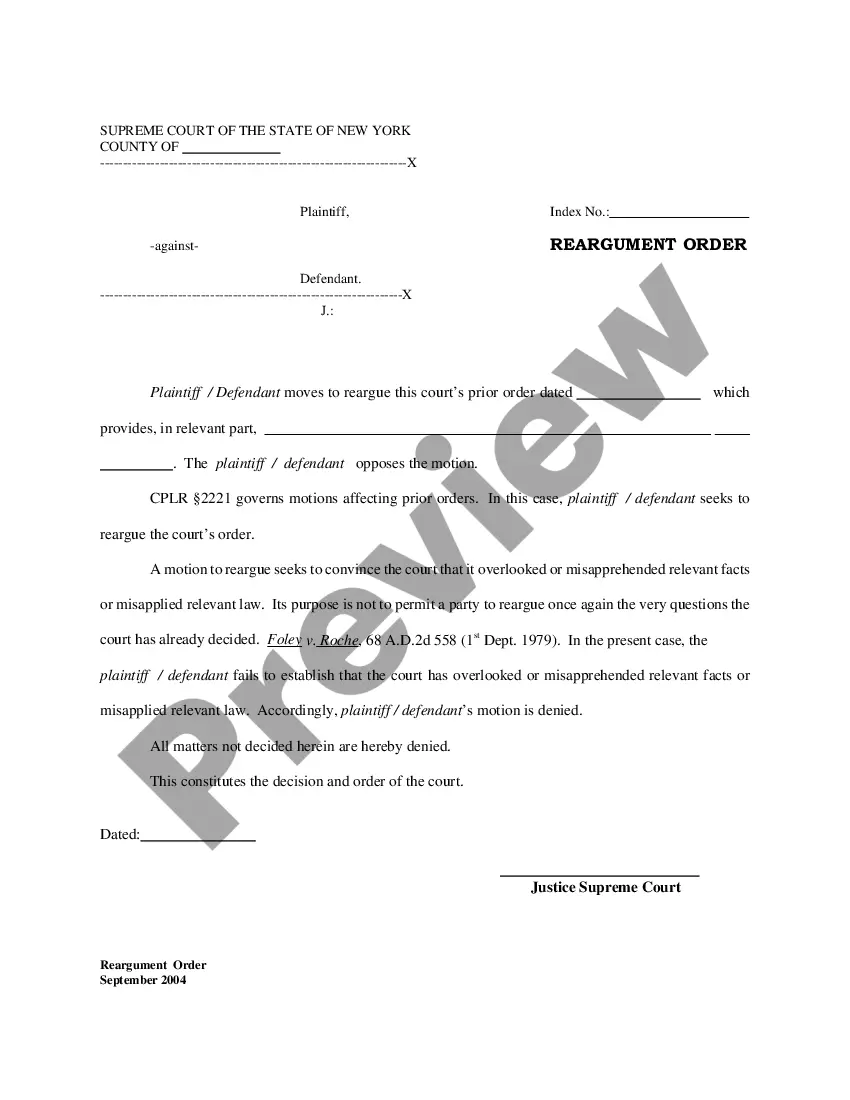

The receipt can take a variety of written forms – letters, formal receipts, postcards, computer-generated forms, etc. It's important to remember that without a written acknowledgment, the donor cannot claim the tax deduction.

You can take a deduction for a contribution of an item of clothing or a household item that isn't in good used condition or better if you deduct more than $500 for it and include a qualified appraisal of it with your return.

Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply.

Private foundations, including private corporate foundations, must publicly disclose all of their grants in their annual tax filings. You can use Foundation Directory to research foundations and see which nonprofits they give grants to.

Note: If you want to print your document without any comments, go to Review > Tracking > No Markup and then print your document.