Sample Invoice For Donation In Franklin

Description

Form popularity

FAQ

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

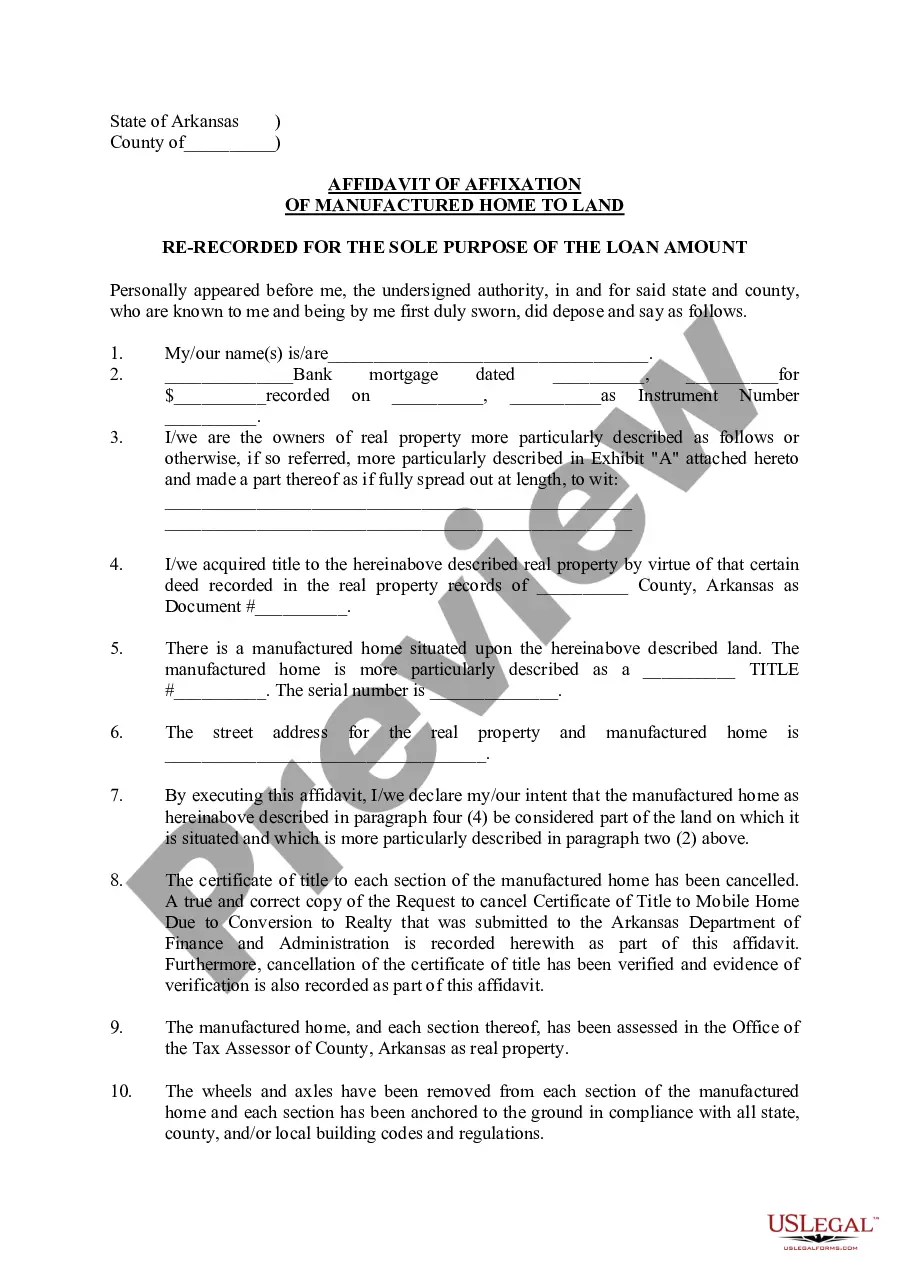

Substantiation. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written acknowledgment for any charitable deduction of $250 or more. A canceled check is not enough to support your deduction.

Use the IRS Tax Exempt Organization Search tool to find or verify qualified charities. Donations to these real charities may be tax deductible. Research a charity before sending a donation to confirm that the charity is real and to know whether the donation is tax deductible.

Craft a concise, direct donation message by clearly stating your cause, the impact of donations, and specific calls-to-action with emotional language. For example: "Your $25 gift provides a week of meals for a family in need. Text FEED to 55555 to More Meals today!"

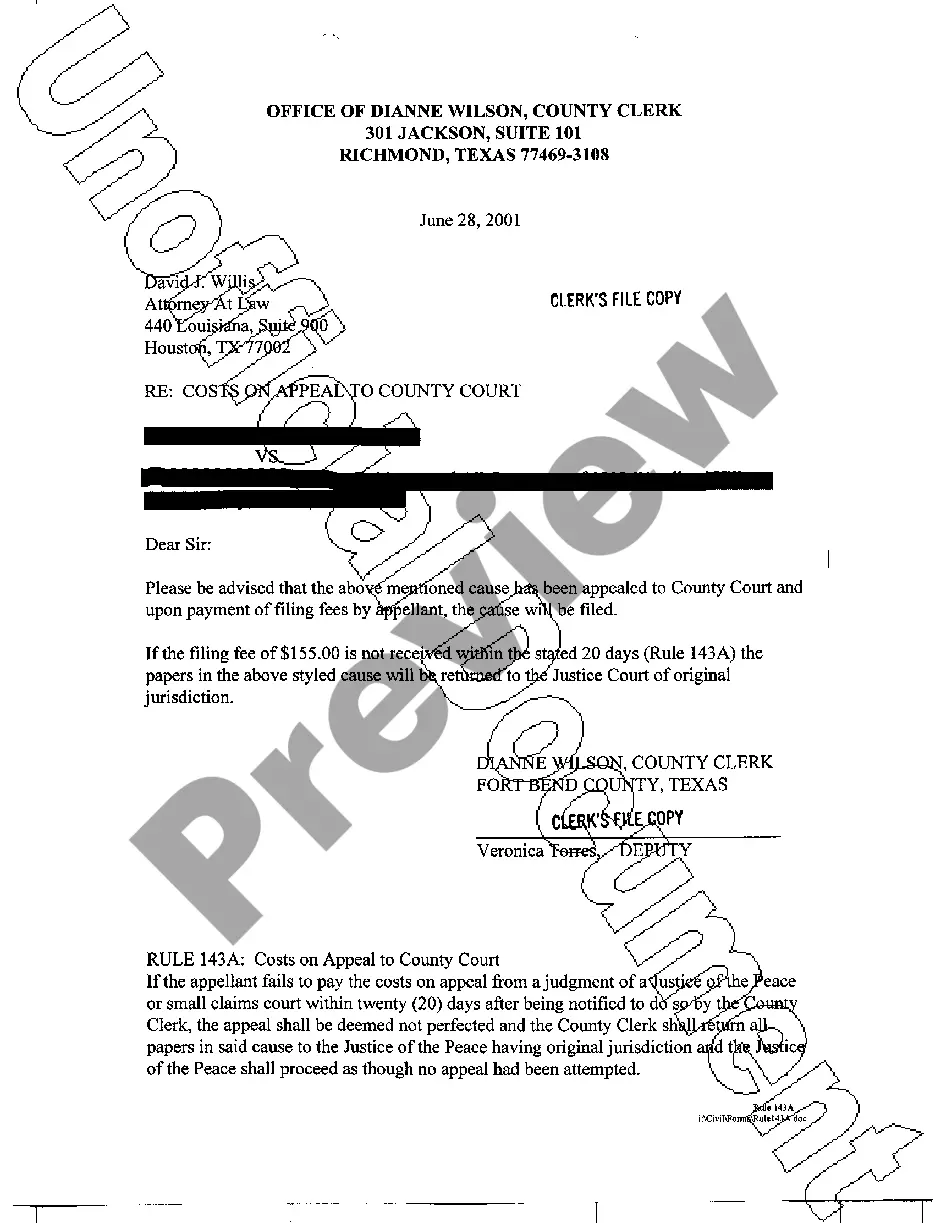

What to include on your invoice for a charitable donation. The donor's name. The name of the nonprofit or charity (plus the gift officer's name and title, if applicable) The date that the donation was made. The donation amount. A signature from the nonprofit or charity that verifies the invoice.

Typically, they are only necessary for people who make donations of $250 or more. Nonprofit or charitable organizations typically create donation invoices after they've processed incoming donations. These organizations then send the donation invoices back to their donors.

The receipt can take a variety of written forms – letters, formal receipts, postcards, computer-generated forms, etc. It's important to remember that without a written acknowledgment, the donor cannot claim the tax deduction.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

A donation receipt is an official document that confirms a donor's contribution to your nonprofit organization. It typically includes important information such as the date and amount of the donation, your organization's name and contact information, and the donor's name and address.

Anyone can receive a donation invoice for a donation that has occurred in any capacity. However, a 501c3 donation receipt is given when a donation is granted to an officially titled 501c3 organization.