This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Records With Future Advance Clause In Wayne

Description

Form popularity

FAQ

No trustee acting, or purporting to act, in the execution of the trusts hereby declared shall be liable for any loss not attributable to that trustee's own dishonesty, or to the willful commission or omission by that trustee of any act known by that trustee to be a breach of trust; and, in particular, no trustee shall ...

There must be a granting clause, operative words of conveyance (e.g., “I hereby grant”); 6. The deed must be signed by the party or parties making the conveyance or grant; and 7. It must be delivered and accepted.

Power of Sale Clause A power of sale provision is a significant element of a deed of trust, as it states the conditions when a trustee can sell the property on behalf of the beneficiary. Typically, this predicts when you will be delinquent on your mortgage.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Deeds of trust almost always include a power-of-sale clause, which allows the trustee to conduct a non-judicial foreclosure - that is, sell the property without first getting a court order.

RECORDING REQUIREMENTS Documents must have all original signatures and the names must be printed, stamped, or typed beneath the signatures. Documents executed in Michigan which convey or encumber real estate require a notary's acknowledgment.

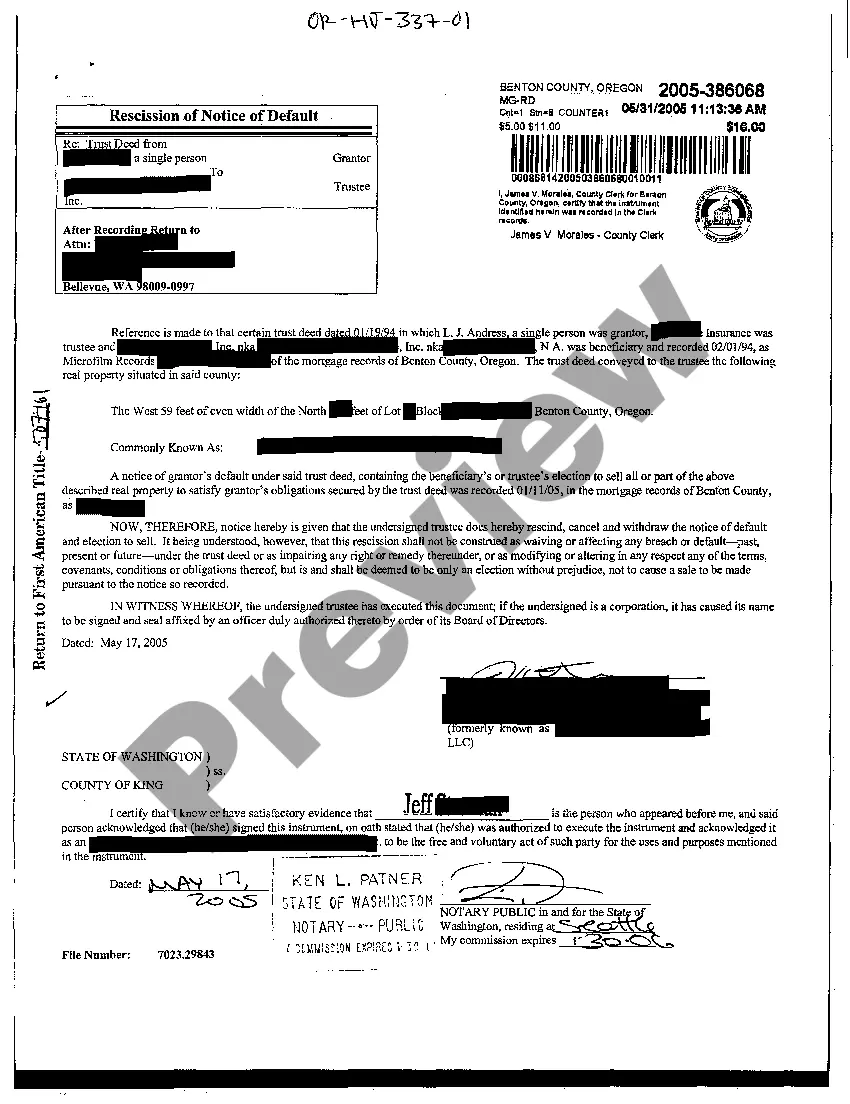

Court Decision: If a court decides to reconvey property, it means the court has found sufficient legal grounds to return ownership of the property. This might occur in cases like foreclosure, where the original owner has redeemed their property, or in disputes where ownership rights are clarified.

Reconveyance means the return of title to the original owner.

When the debt or obligation secured by a deed of trust has been satisfied, the beneficiary, or successor, must execute a request for full reconveyance and any other documents necessary to cause the deed of trust to be reconveyed and submit these documents to the trustee.

These include vital records (birth and death certificates, marriage and divorce licenses), criminal records, court records, professional licenses (such as medical, law, and driver's licenses), tax and property records, reports on publicly-traded companies, and FOIA or FOIL-able documents related to the operations of ...