Cancellation Form Fillable With Calculations In Washington

Description

Form popularity

FAQ

If you no longer do business in Seattle and need to cancel your business license tax certificate, please tell us in writing. Just letting your business license tax certificate expire does not cancel your license tax certificate. To cancel your license tax certificate, complete the online form below.

Send us a message online or fax (360-586-2019) a request, making sure it includes your: Name as it appears on your license. WAOIC number.

6 Steps to Dissolving an LLC in Washington Step 1: Vote to Dissolve the LLC. Step 2: Notify Creditors About Your LLC's Dissolution. Step 3: File Final Tax Returns and Obtain Tax Clearance. Step 4: File Articles or Certificate of Dissolution. Step 5: Distribute Assets.

Complete the Out of Business Form and email, mail, fax, or delivered in person to the Department. Email: Complete and scan the Out of Business Form and email to chap@ClarkCountyNV. Please make sure that there are no outstanding fees prior to closing a business.

Follow these steps to closing your business: Decide to close. File dissolution documents. Cancel registrations, permits, licenses, and business names. Comply with employment and labor laws. Resolve financial obligations. Maintain records.

To dissolve your domestic corporation in Washington State, you submit the completed Articles of Dissolution form to the Secretary of State by mail, fax or in person. You will need to attach a Department of Revenue Clearance Certificate to your completed Articles of Dissolution.

Visit our Corporations and Charities Filing System landing page and log in to your account. Once logged in, select “Business Maintenance Filings” from the navigation bar on the left side, then select “Initial Report”.

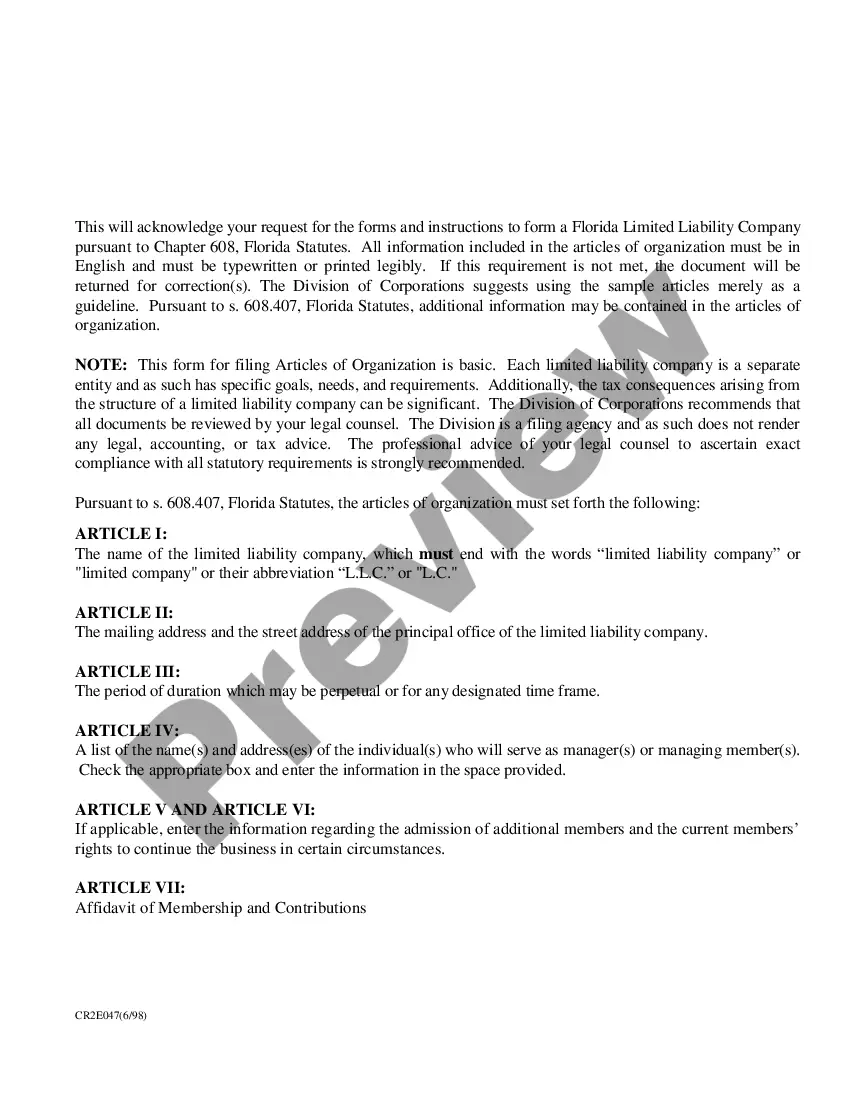

How to Form a Corporation in Washington Choose a Corporate Name. Choose Directors to serve on the Board of Directors. Prepare and file the Articles of Incorporation. Apply for a Federal Employer Identification Number (EIN) Write Corporate Bylaws. Create a Shareholder Agreement. Elect S Corporation status if desired.

How to get a Washington State LLC in 9 steps Name your Washington LLC. Choose your registered agent. Prepare and file a certificate of formation. Obtain a Washington business license. File an initial report. Receive a certificate from the state. Create an operating agreement.

How to get a Washington State LLC in 9 steps Name your Washington LLC. Choose your registered agent. Prepare and file a certificate of formation. Obtain a Washington business license. File an initial report. Receive a certificate from the state. Create an operating agreement.