Deed Of Trust Records Format In Virginia

Description

Form popularity

FAQ

Ideally, an SMSF trust deed should be written in a way that doesn't require regular updating. However, the deed should be reviewed at least annually to ensure it's up to date.

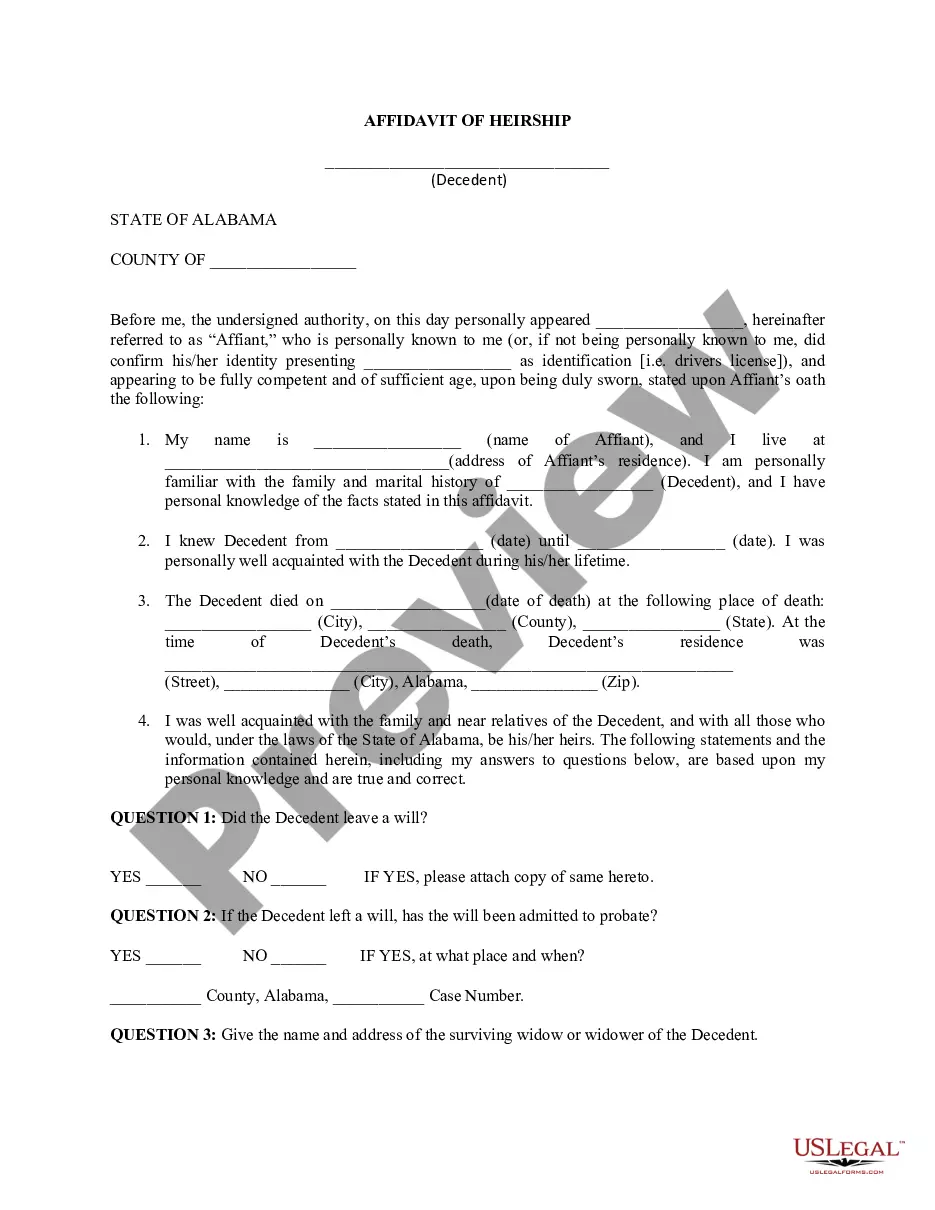

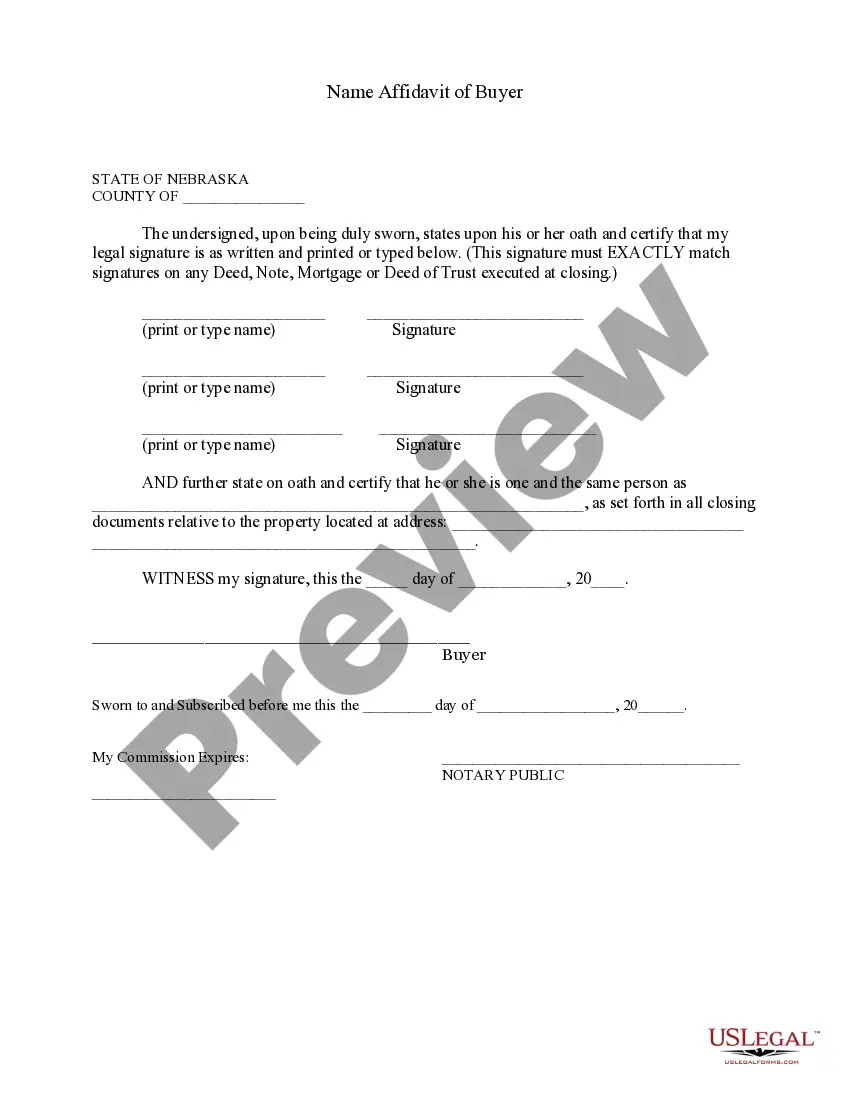

All documents put to record must be acknowledged and contain a notary seal. All acknowledgements by a Virginia notary must include their commission number, expiration date and a darkened seal. All of this information must be legible. A maximum of four documents per check will be accepted for recordation.

All deeds must be prepared by the owner of the property or by an attorney licensed to practice in Virginia. The requirements are listed below in the code section. Click here to read about e-Recording.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

In California: “An unrecorded instrument is valid as between the parties thereto and those who have notice thereof.”

All deeds, homestead deeds and leases of personal property, bills of sale, and all other contracts or liens as to personal property, which are by law required or permitted to be recorded, all mechanics' liens, all other liens not directed to be recorded elsewhere and all other writings relating to or affecting personal ...

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

The cover sheet must include the following: All grantors, grantees, and identify surname if applicable. Amount of consideration and actual value if a deed or instrument. State the Virginia or Federal law under which any exemption from recordation taxes being claimed. Tax map or pin number. Who to return to after recordation.

Yes, you can make your own Grant Deed. A lawyer is not required to prepare a valid and enforceable deed.

Yes you can complete and record your own deed. It must b properly signed, witnessed, and notarized.