Deed Of Trust Records Without Promissory Note In Utah

Description

Form popularity

FAQ

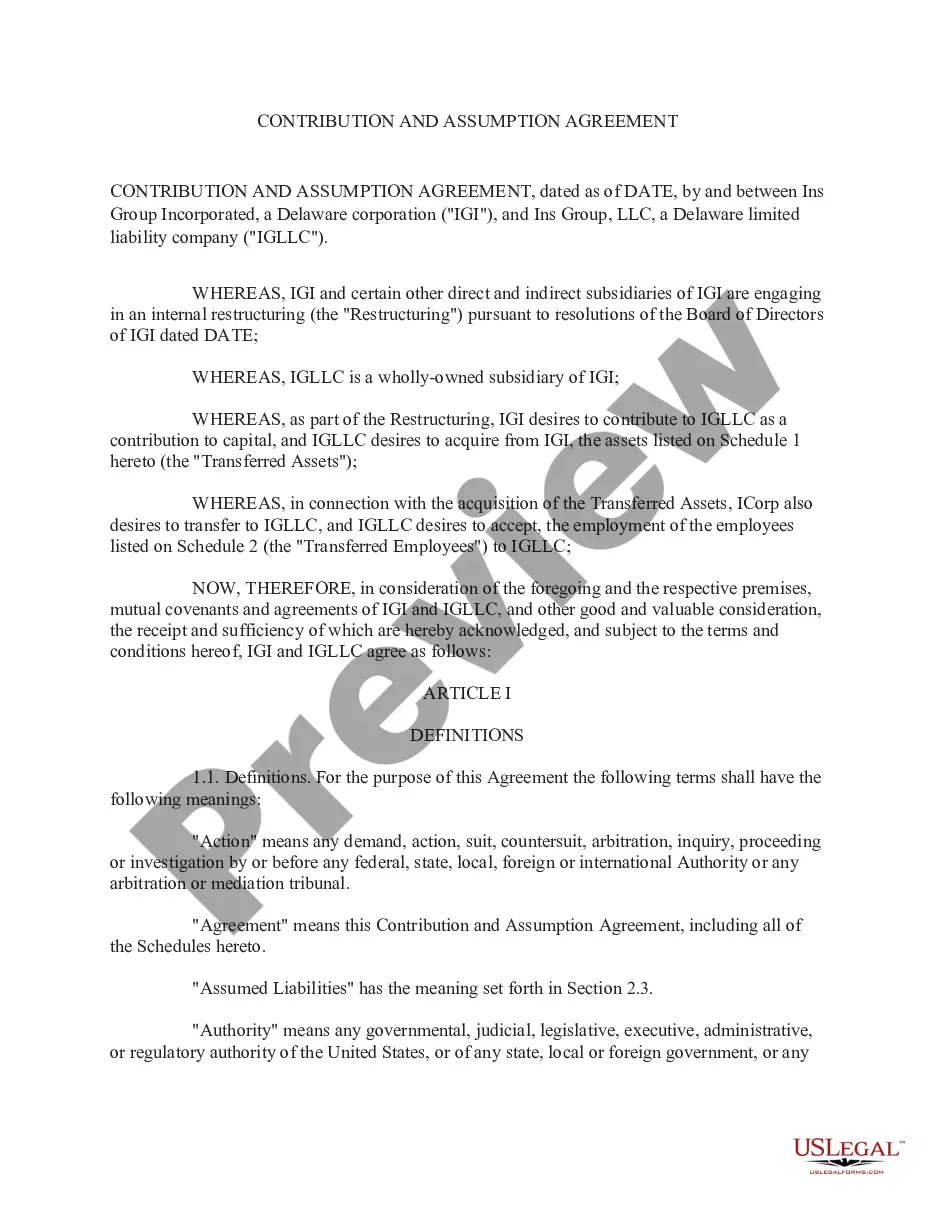

A living trust, sometimes called a revocable trust, is a legal arrangement where you (the grantor) transfer your assets into a trust while you're still alive. As the grantor, you appoint a trustee who manages the assets of the beneficiaries you've named.

Utah Code 75-7-816 defines that “when title to real property is granted to a person as trustee, the terms of the trust (the name of the trustee, the address of the trustee, and the name and date of the trust) may be given either in the deed of transfer; or in an instrument signed by the grantor and recorded in the same ...

If the title stays with the borrower this is the definition of Lien Theory and results in a non-judicial foreclosure with the Power of Sale being entrusted to a Trustee and not the lender. In a Judicial/Mortgage foreclosure, the Title is held by the lender. Utah is known as a Trust Deed and Promissory Note state.

You transfer your home to the trust by signing a deed that names the trust as the new owner of the property. The deed then needs to be recorded with the local county recorder's office. Once recorded, the trust is now "on title" as the legal owner of the property.

While that's a reasonable question, the fact is, trust documents generally avoid the court completely. As such, they are not matters of public record. This means that you likely will not be able to secure a copy of the trust from the Office of the County Clerk or the courthouse in the same way you would a will.

If you don't put the right protections in place upfront, your children's inheritance could evaporate, get wasted, or be tied up in legal battles. Of all the mistakes we see parents make when creating trusts, none wreaks more havoc than appointing an unqualified trustee to manage the fund.

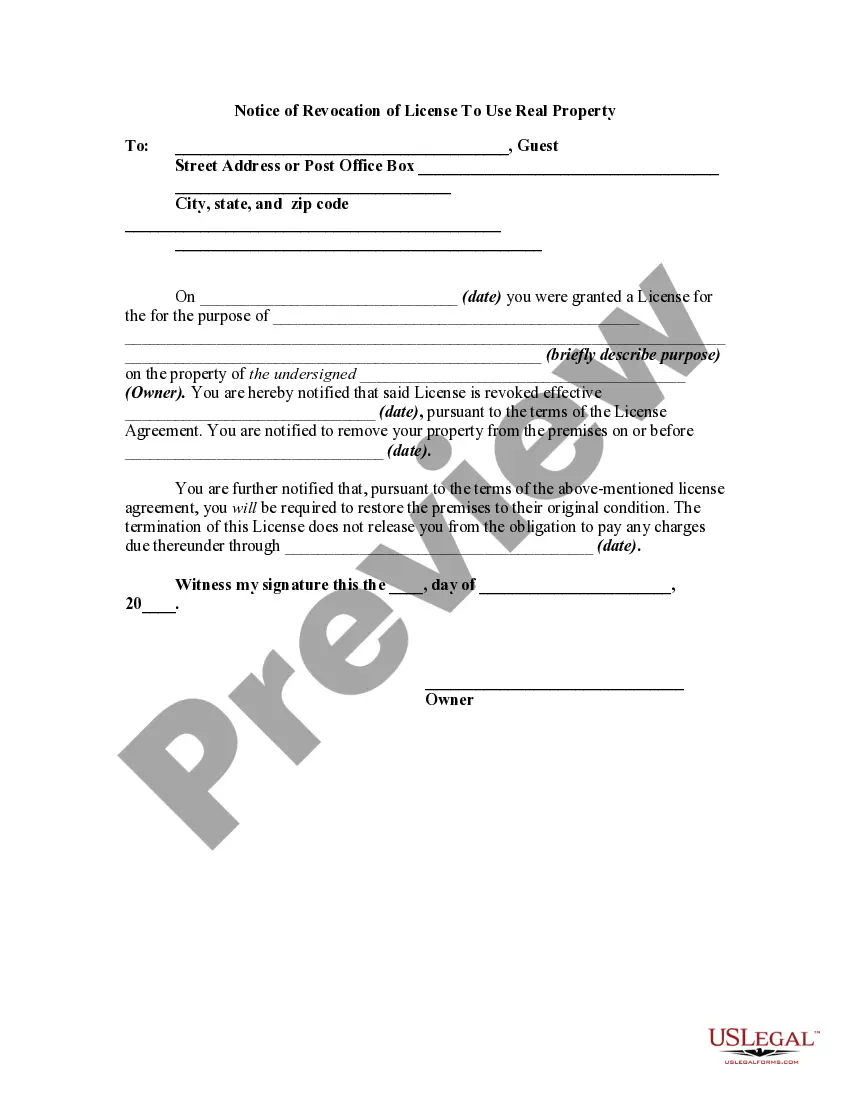

Sale of trust property by trustee -- Action to recover balance due upon obligation for which trust deed was given as security -- Collection of costs and attorney's fees.

Notice of trustee's sale -- Description of property -- Time and place of sale. by mailing the notice, including the statement required under Subsection (3)(b), to the occupant of each dwelling unit on the property to be sold. The sale shall be held at the time and place designated in the notice of sale.

A conveyance made by an owner of an estate for life or years, purporting to convey a greater estate than the owner could lawfully transfer, does not work a forfeiture of the estate, but passes to the grantee all the estate which the grantor could lawfully transfer.

Definitions -- Confidentiality of commercial information obtained from a property taxpayer or derived from the commercial information -- Rulemaking authority -- Exceptions -- Written explanation -- Signature requirements -- Retention of signed explanation by employer -- Penalty.