Change Deed Trust With Mortgage In Suffolk

Description

Form popularity

FAQ

How do I add/remove a name on a Deed? You would have to record a new deed adding or removing the person(s) name. Because it is a legal document with legal consequences, we HIGHLY advise you work with an attorney to do so.

Here's a breakdown of the potential drawbacks of using a land trust: Potential Loss of Control: Transferring the property title to a trustee reduces your direct control over the asset. The terms of the trust agreement will dictate what actions you can take without the trustee's consent.

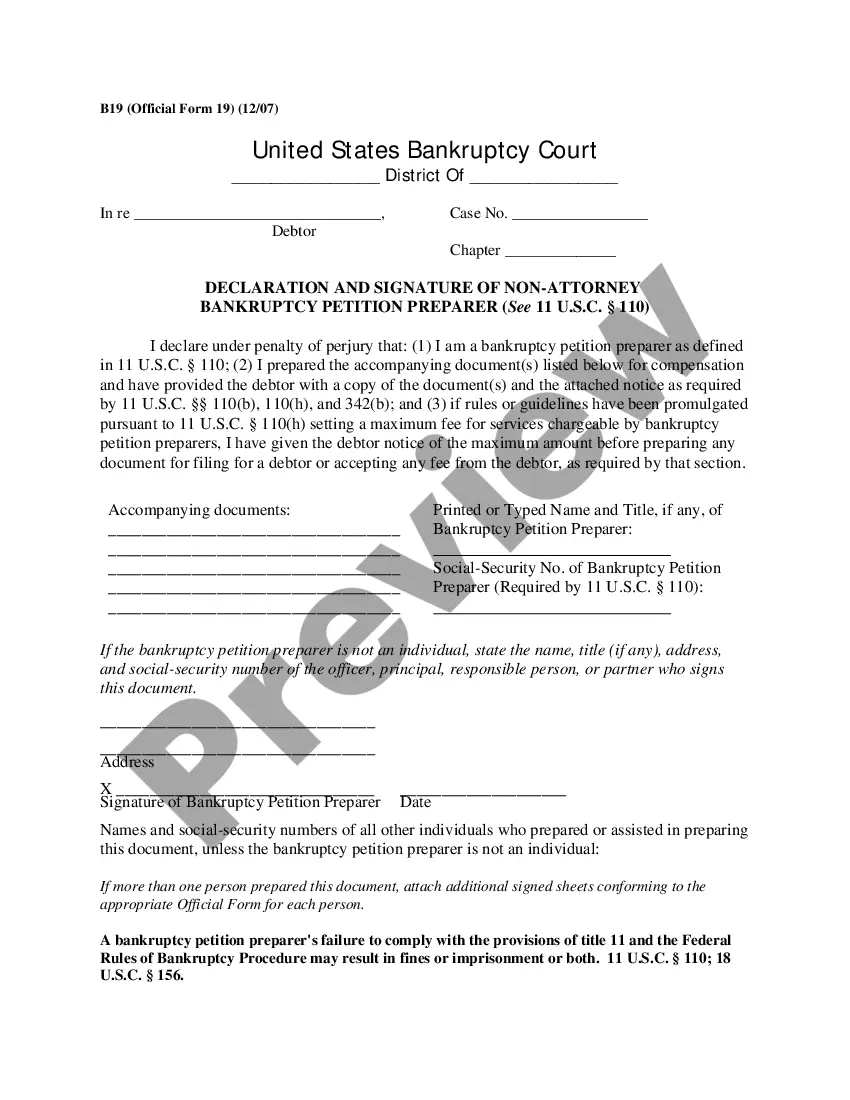

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

The main benefit of putting your house in a trust is to bypass probate when you pass away. All your other assets, regardless of whether you have a will, will go through the probate process.

Summary. Placing a mortgaged property in a trust is possible and common, although key considerations must be taken into account. Some considerations to keep in mind are mortgage payments, refinancing, and the due-on-sale clause.

Under federal law, if someone inherits a home, the mortgage stays in place as long as payments keep getting made. The mortgage company can't do anything about it.

No, you can not add anyone to a mortgage without refinancing. Exactly why do you want to burden your new wife with a mortgage?