This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Records With Future Advance Clause In San Antonio

Description

Form popularity

FAQ

The parties agree and acknowledge that the Secured Party, although under no obligation, may advance the Debtor additional funds from time to time. The future advances shall become secured pursuant to the terms and conditions as contained herein. Future Advance.

The granting clause grants the property with its related rights and appurtenances, beginning with “grants, sells, and conveys.” The habendum clause defines the extent of property ownership conveyed to the grantee, beginning with “to have and to hold.” The warranty clause describes the warranties of title made by the ...

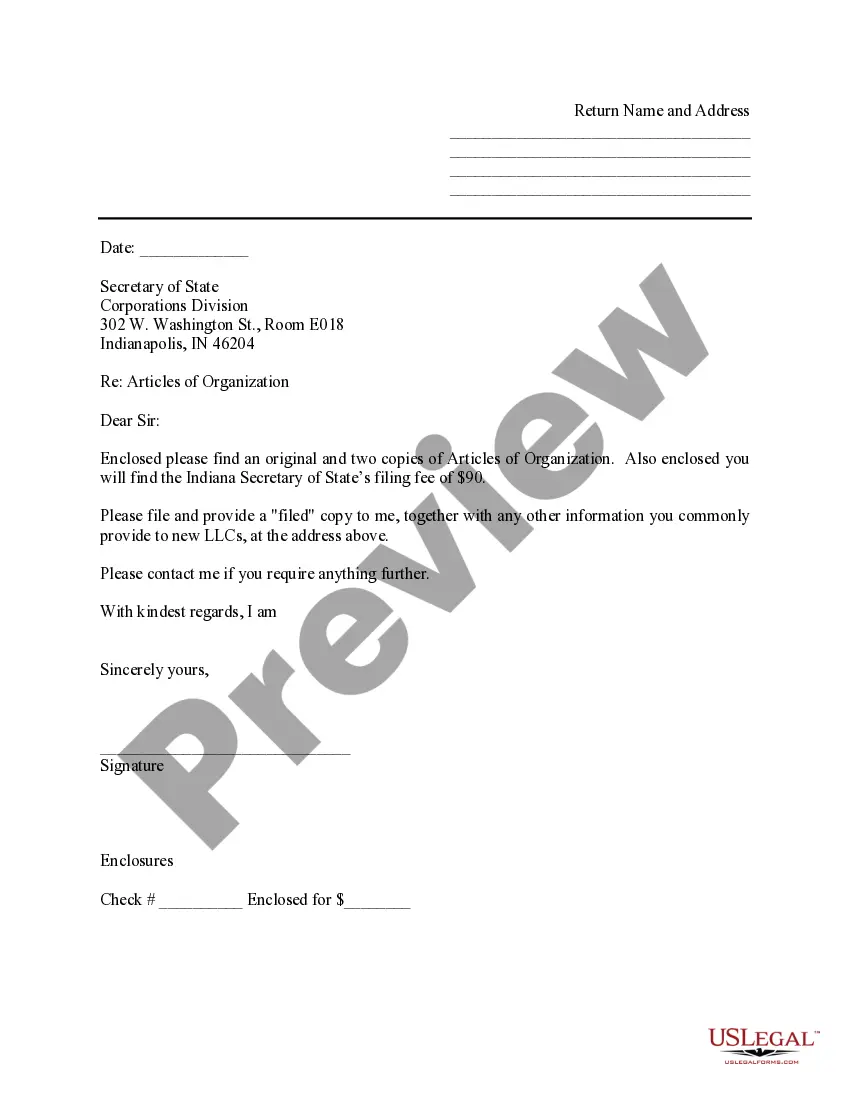

WHERE DO I RECORD THE DEED? After the deed has been signed and notarized, the original needs to be filed and recorded with the county clerk in the county where the property is located. You can mail the deed or take it to the county clerk's office in person. Only original documents may be recorded.

Transferring real estate to a living trust in Texas involves signing a deed that transfers the interest in the property to the trust and then recording this deed with the county to formalize the transfer. A wide range of financial accounts, including bank accounts, can also be transferred to a living trust.

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

It is commonly found in an open-end mortgage or deed of trust, which allows the borrower to borrow additional sums in the future, secured under the same instrument and by the same security.

In order to qualify for a non-judicial foreclosure, the lienholder must have a deed of trust with a "power of sale" clause, giving them the authority to sell the property. These foreclosures are governed by Section 51.002 of the Texas Property Code as well as the contractual documents.

You will usually be discharged after four years, but some trust deeds can last for longer. This information will be included in the terms of the trust deed.

Ideally, an SMSF trust deed should be written in a way that doesn't require regular updating. However, the deed should be reviewed at least annually to ensure it's up to date.