Deed Of Trust With Assignment Of Rents In Palm Beach

Description

Form popularity

FAQ

Final answer: The assignment of rents clause primarily benefits the lender or financier in a mortgage arrangement. However, in some situations, tenants can indirectly benefit from the clause by ensuring continuation of essential services.

The assignment of rents clause is a provision in a mortgage or deed of trust. It gives the lender the right to collect rents from mortgaged properties if the borrower defaults. All incomes and rents from a secured property flow to the lender and offset the outstanding debt. Clearly, this benefits the lender.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

The beneficiary is the lender. Therefore, the only answer selection that applies is the bank. A clause in a trust deed calling for an assignment of rents most benefits the: beneficiary.

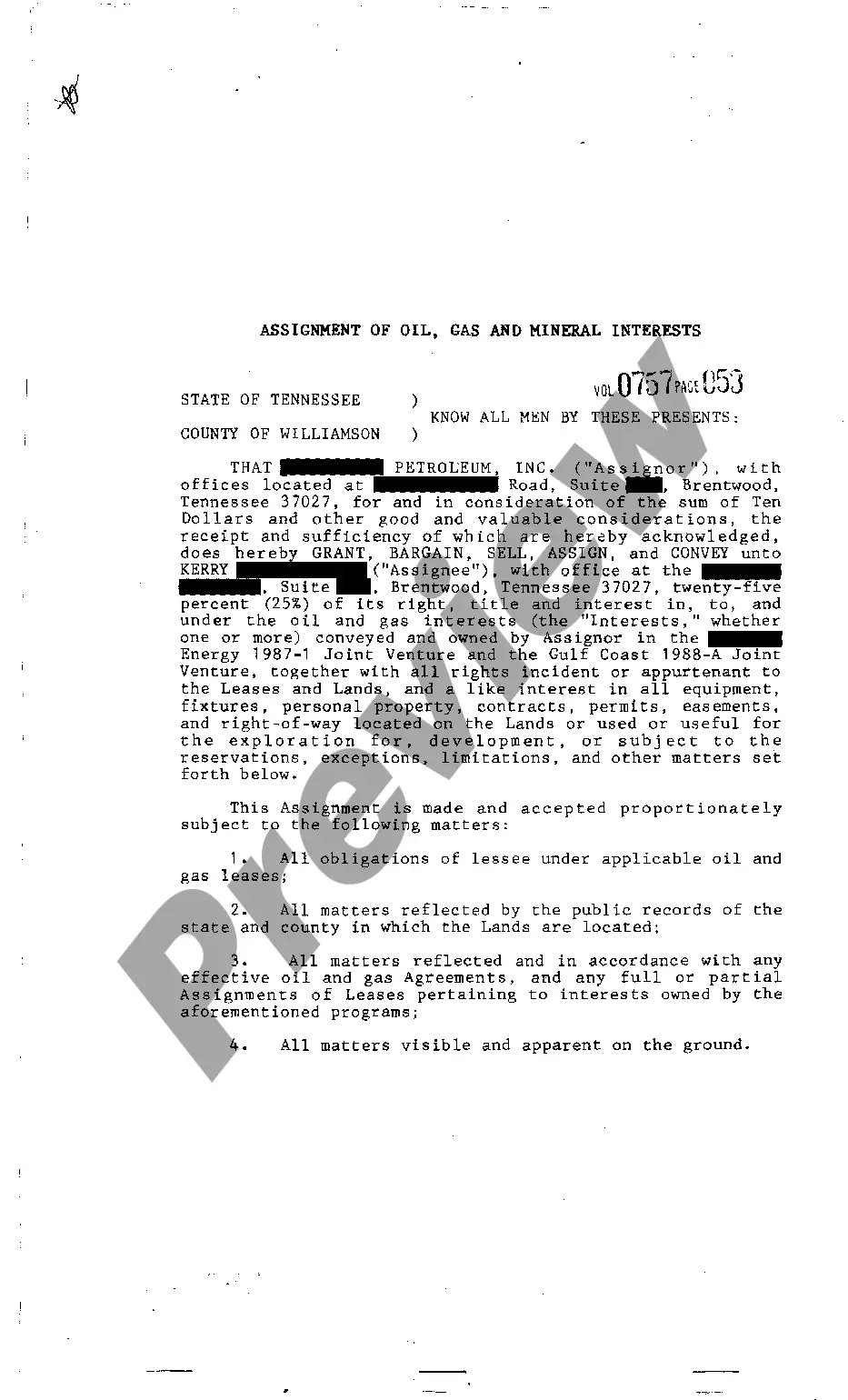

ASSIGNMENT OF RENTS - Trustor hereby assigns and transfers to Beneficiary all right, title and interest in rents generated by the property, including rents now due, past due, or to become due under any use of the property, to be applied to the obligations secured by this Deed of Trust.

Recording a Deed Must present a photocopy of a government issued photo identification for each grantor(s) and grantee(s) listed on the deed. "Prepared by" statement (name and address of the "natural" person preparing the Deed) Grantor(s) (Sellers-Party Giving Title) names legibly printed in the body of the deed.