Forge Trust Deeds In Ohio

Description

Form popularity

FAQ

Forge Trust Co. is a non-depository trust company that custodies and administers alternative investments in self-directed IRAs to preserve their tax-advantaged status. Forge Trust provides you with the control to select and direct your own IRA investments.

Forge Trust is a non-depository trust company chartered by the State of South Dakota and regulated by the South Dakota Division of Banking. We welcome all types of investors looking for a trusted custodian partner.

A custodian must hold the assets in an IRA, whether it's a traditional IRA, Roth IRA or self-directed IRA. That's partly so the IRS can ensure that owners are following contribution limits, age requirements and other IRA rules. For example, the custodian must report early withdrawals to the IRS.

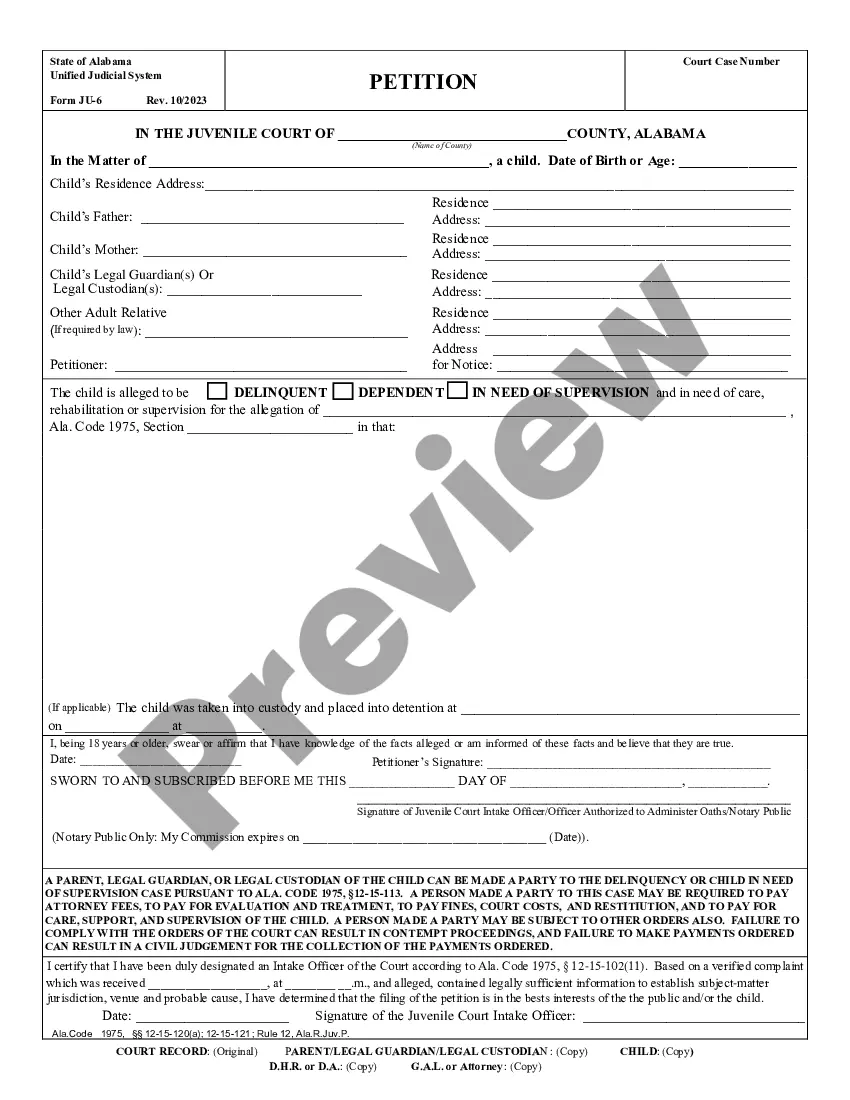

Trusts may be declared upon registered land, or upon any interest therein, by deed or other instrument in writing, fully and clearly defining the trusts, conditions, and limitations, and the powers and duties of the trustee and giving his name, residence, and post-office address and the name, residence, and post-office ...

Forge Trust as custodian is prohibited from giving investment related advice. However, we can help you if you have questions about managing your account, conducting transactions, or understanding regulations: you can reach out to us via phone at (800) 248-8447 or via email at info@ForgeTrust.

With over 40 years of experience, Forge Trust is a leading custodian for alternative assets and a smart choice for an IRA custodian, expertly supporting investors' alternative investments and unlocking a world of diversified investing opportunities.

Instructions for filling out deeds Read the entire form carefully. Enter all the names of the current owners of the property as the grantors on the deed. Enter all the names of the persons you want to be owners of the property as the grantees. Attach the legal description of the property from the prior deed.

A deed must be recorded in person, UNLESS the deed already reflects ALL of the necessary auditor and engineer stamps and approvals. The deed must be legibly prepared, signed, and notarized BEFORE presented for recording.

An attorney licensed to practice law in Ohio must prepare deeds, powers of attorney, and other instruments that are to be recorded. One exception is that a party to the transaction may prepare an instrument in which they are a party.