Modification Deed Trust Form With Trust In Massachusetts

Description

Form popularity

FAQ

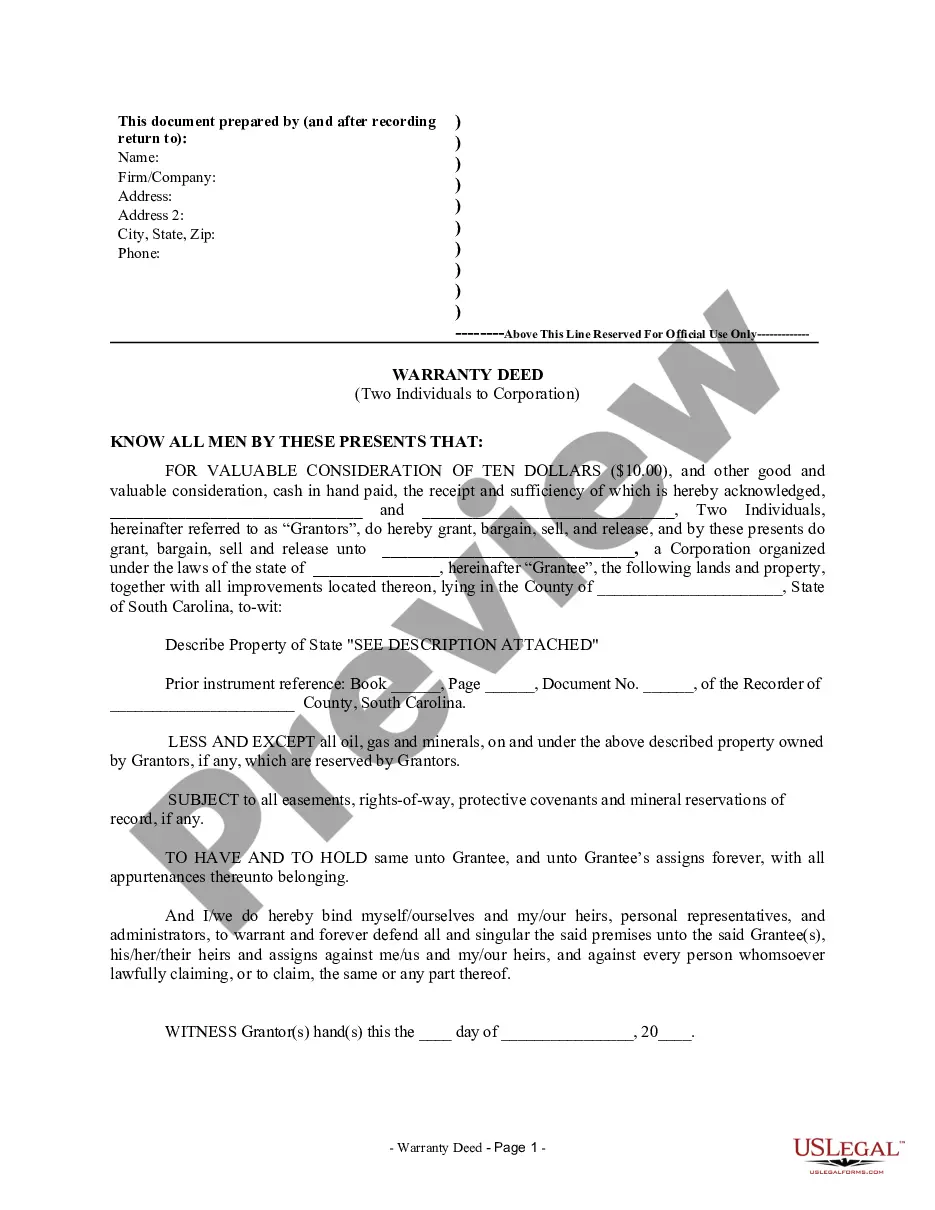

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Trusts are either revocable or irrevocable. As suggested by its name, a revocable trust is a trust that can be modified or revoked by the settlor after it has been signed. An irrevocable trust, on the other hand, cannot be modified or revoked by the settlor once it has been signed.

You can often find amendment form templates through a quick online search. You can also request one from an estate planning attorney. Identify your changes. It's important to know what you want to change and where in your trust document this information lives (such as the article number you're amending).

The Honourable Supreme Court ruled that a Trust Deed cannot be changed unless it expressly permits so. Approaching the registrar or a Court of law shall only be relevant if a change is legally permissible.

No, a trustee generally cannot unilaterally amend the terms of a trust. However, they may be granted specific powers to make certain administrative changes if explicitly outlined in the trust document or with the consent of beneficiaries, when applicable.

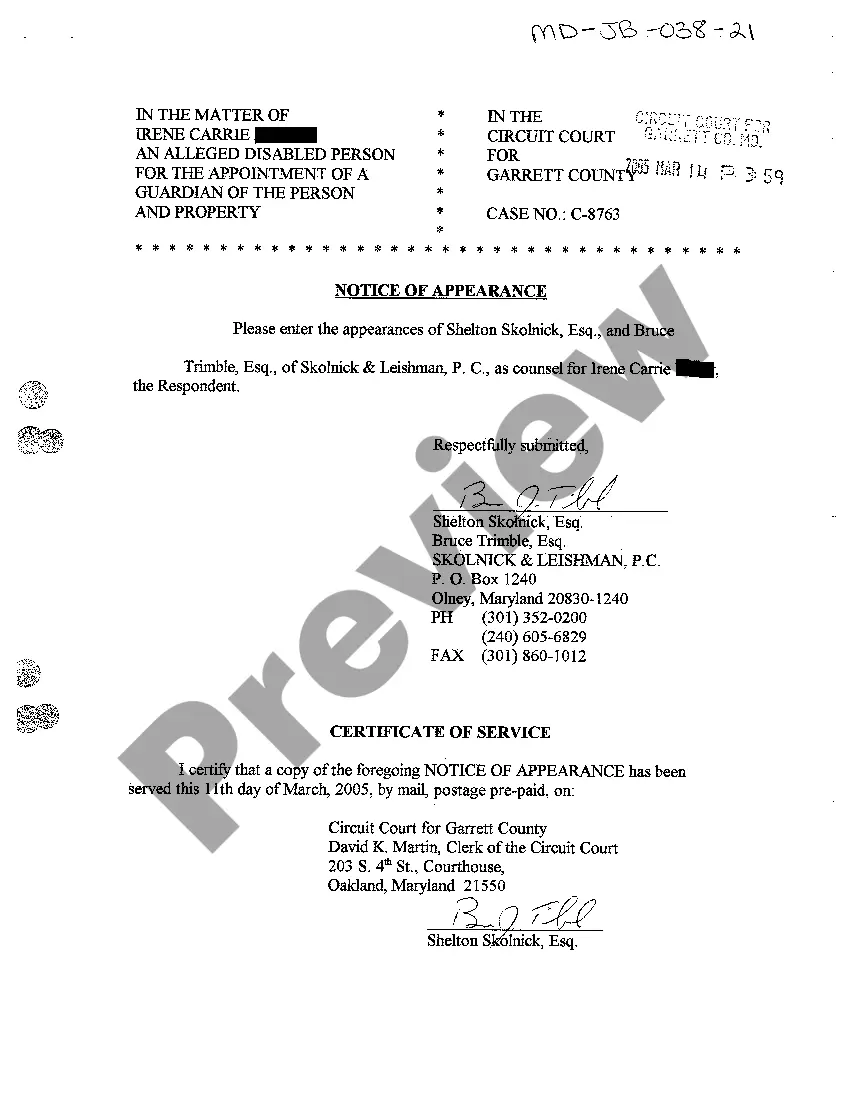

The intricacies of Massachusetts will law do not extend to trusts, making the process of amending a trust less complex. Trust amendments typically involve putting your changes in writing and securing the signature of the person who established the trust, often referred to as the Trustor or Trust Maker.

What happens when the grantor dies? Upon the grantor's death, the assets are included in the grantor's taxable estate, the trust becomes irrevocable and the assets pass to the beneficiaries ing to the trust's terms.

If it turns out that all you need is a simple change to your will, you can do this without starting all over again using a "codicil." A codicil is a simple document that allows you to modify your existing will legally and efficiently.

In some instances, trust deeds expressly permit trustees to vary the terms of the trust. In this case, trustees can rely on the relevant provision to effect the necessary amendments, subject to any restrictions or conditions attached. This is usually the simplest and quickest way in which to effect a variation.

As long as you create the irrevocable trust at least five years before you apply you may also qualify for benefits from MassHealth as the assets deposited in the trust cannot be used when assessing eligibility. If on the other hand you create a revocable trust, then none of these advantages apply to you.