Deed Of Trust Records Foreclosure In Massachusetts

Description

Form popularity

FAQ

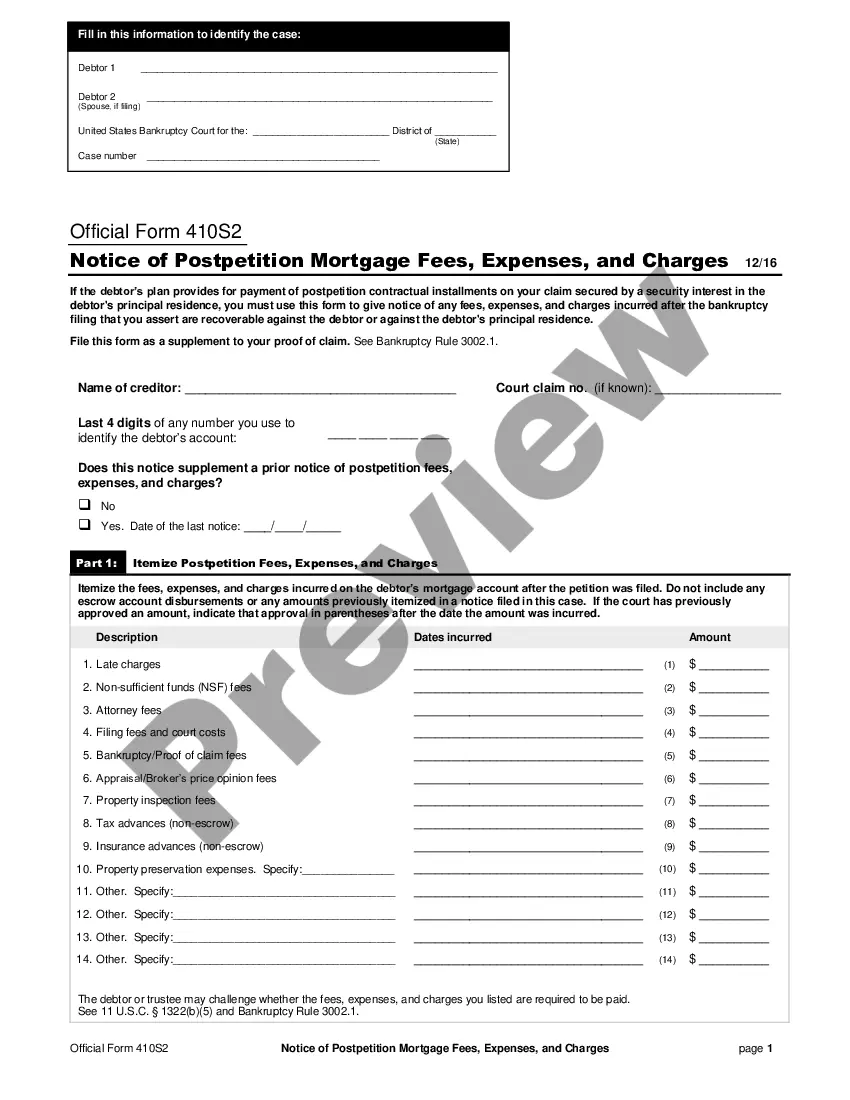

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

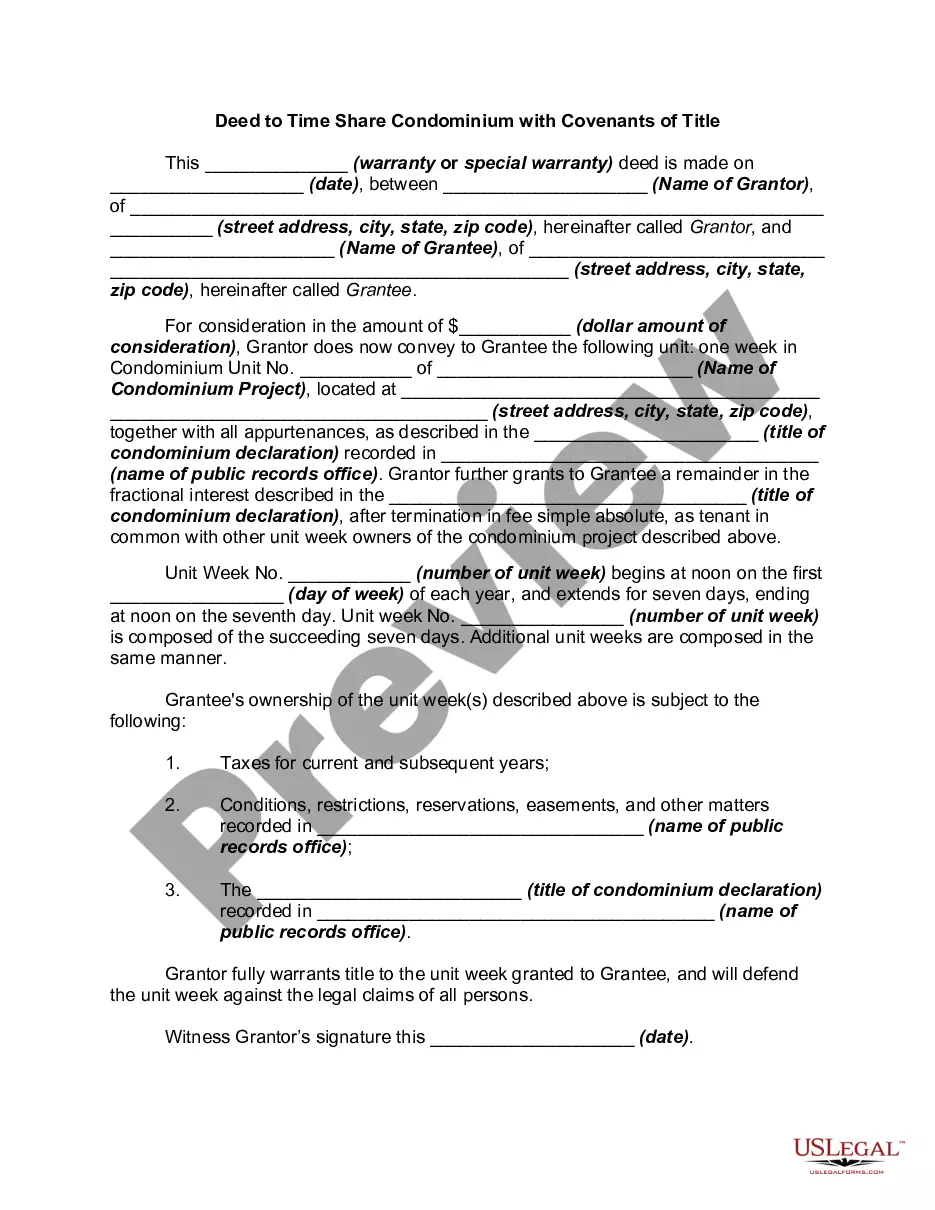

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

1) A D.O.T. is much easier to foreclose upon then a mortgage because the process to foreclose on a D.O.T. bypasses the judicial process. Assuming the Trustee gives the right notices (Notice of Default and Notice of Sale) the process will go to sale without court involvement at all.

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

1) A D.O.T. is much easier to foreclose upon then a mortgage because the process to foreclose on a D.O.T. bypasses the judicial process. Assuming the Trustee gives the right notices (Notice of Default and Notice of Sale) the process will go to sale without court involvement at all.

In California, lenders can foreclose on deeds of trust or mortgages using a nonjudicial foreclosure process (outside of court) or a judicial foreclosure process (through the courts). The nonjudicial foreclosure process is used most commonly in our state.