Trust Of Deeds For Property In Illinois

Description

Form popularity

FAQ

The Steps Needed to Establish a Trust Include: Determining the type of trust you need. Take inventory of your investments, assets, and property. Select a trustee (the person who manages the trust). Have a lawyer draft your trust document. Sign your trust with a notary present who will notarize it.

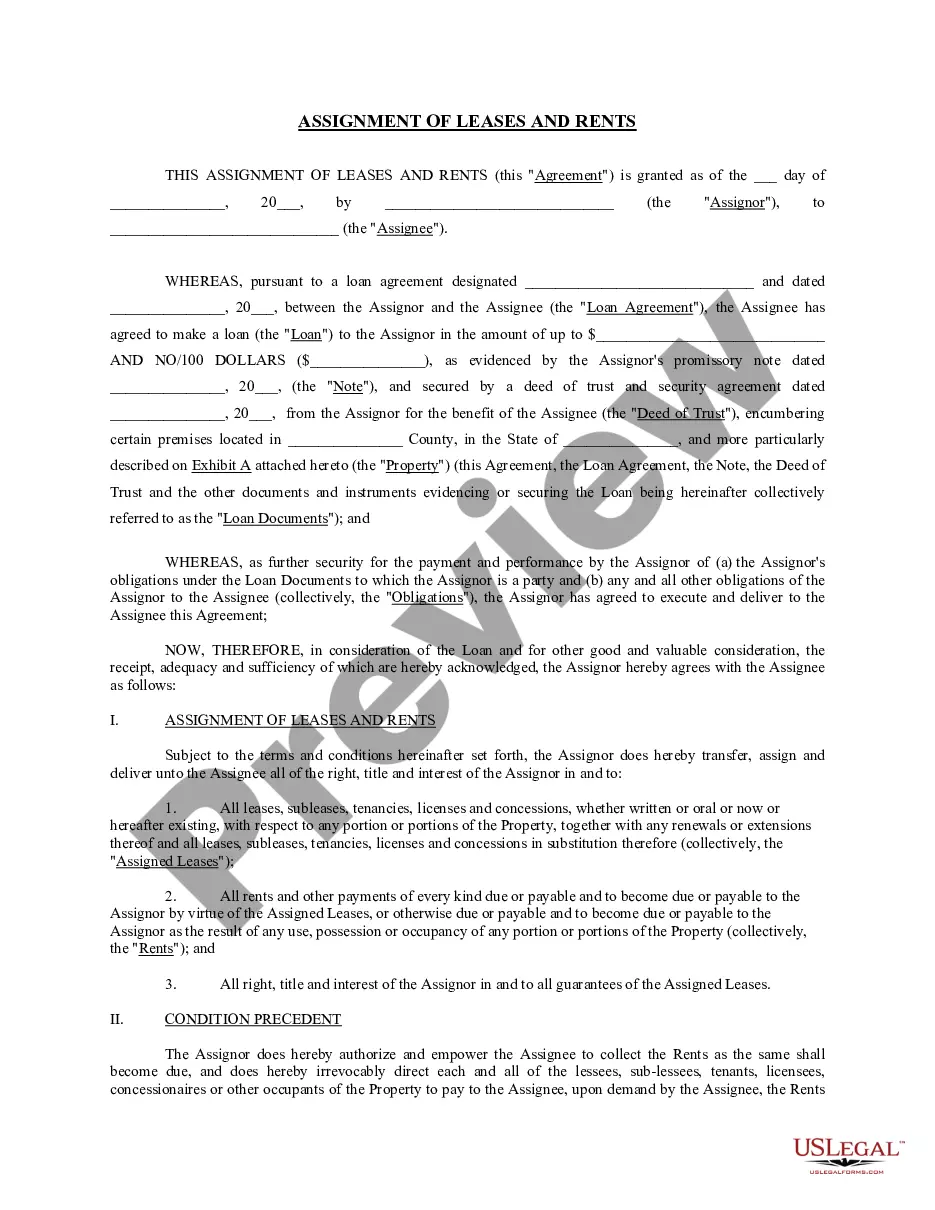

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

How do I establish a Land Trust? It's Easy as One-Two-Three… First, the beneficiary must sign a Land Trust Agreement formulated by the Grantor. Second, a Deed of Trust, when properly recorded with the County Recorder of Deeds, will transfer the property from the current owner to the name of the land trust.

One disadvantage of placing your house in a trust is the loss of direct ownership. Transferring your property to a revocable living trust makes the trust the legal owner. While you retain control as the trustee, this change in ownership may affect your ability to mortgage or refinance the property.

Putting your home in a trust has many advantages, including avoiding probate. However, the process of creating a trust and transferring ownership of your home can be complicated and must be conducted properly to avoid adverse consequences.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

The biggest difference between a title and a deed is the physical component. A deed is an official written document declaring a person's legal ownership of a property, while a title is a legal concept that refers to ownership rights.

Illinois allows the use of both a deed of trust and a mortgage. Illinois is a lien-theory state. Mortgages are considered to be liens against the property and the vast majority of the liens in Illinois are mortgages.

Under a land trust agreement, the beneficiary retains complete control of the real estate in the same manner as if the recorded title were in his or her name. The beneficiary may terminate the trust whenever desired and may add additional property to the trust at any time.