Modification Deed Trust Form For Canada In Chicago

Description

Form popularity

FAQ

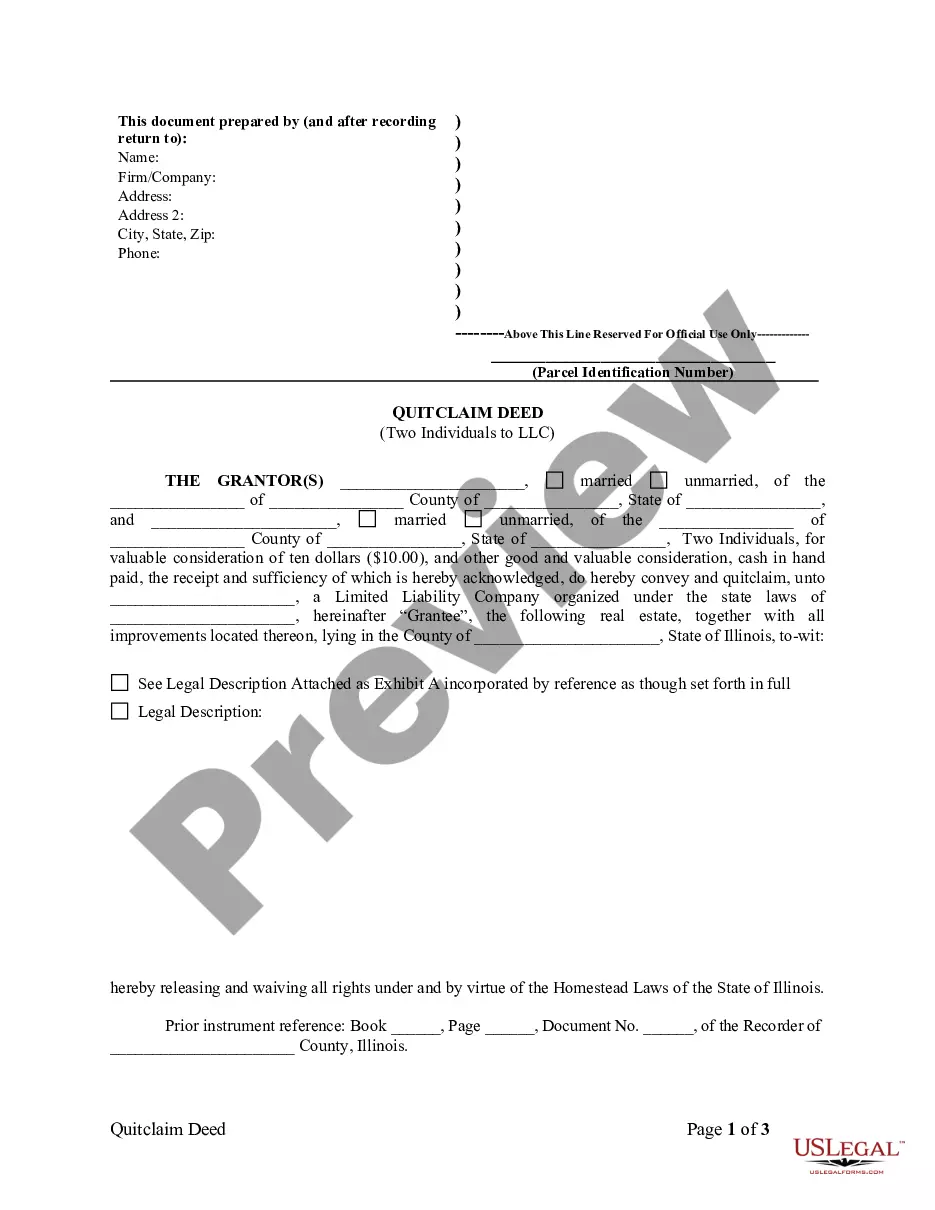

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

How To Transfer a Deed? Contact a lawyer to help advise and oversee the process. Conduct a title search on the property to ascertain its ownership history and validity of the title. Draft the deed to provide the appropriate details on the property, the grantor, and the grantee. The grantor should then sign the document.

You must file Form PTAX-203, Illinois Real Estate Transfer Declaration, and any required documents at the county recorder's office within the county where the property is located. It is due within three business days after the transfer or at the time of recordation, whichever is earlier.

Illinois allows the use of both a deed of trust and a mortgage. Illinois is a lien-theory state.

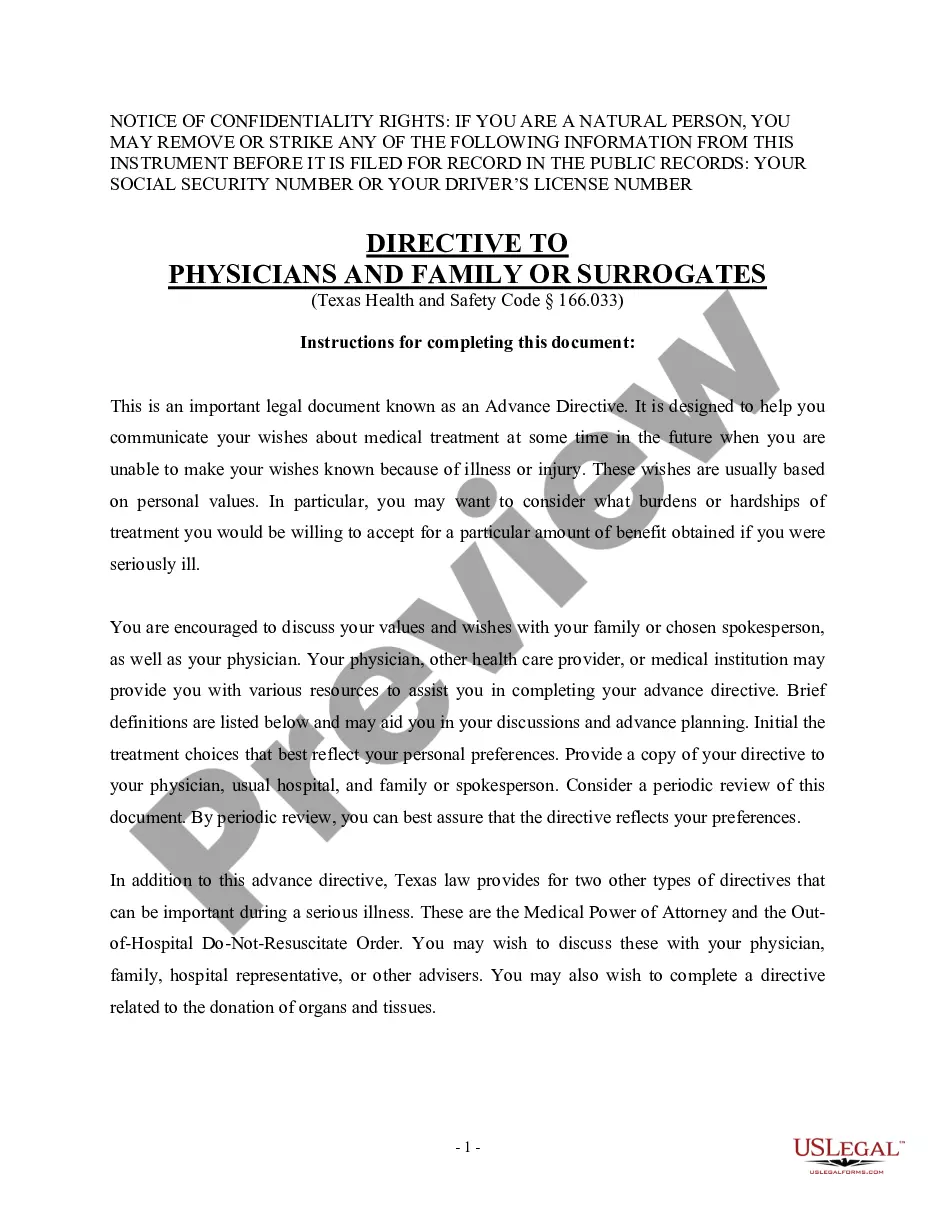

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

The following transactions are exempt from the transfer tax under 35 ILCS 200/31-45. (a) Deeds representing real estate transfers made before January 1, 1968, but recorded after that date and trust documents executed before January 1, 1986, but recorded after that date.

You must file either (1) Form PTAX-203 and any required documents with the deed or trust document or (2) an exemption notation on the original deed or trust document at the County Recorder's office within the county where the property is located.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Yes you can complete and record your own deed. It must b properly signed, witnessed, and notarized.

How to set up a family trust in Canada? A family trust is set up by preparing a written trust agreement or trust deed. An estate planning lawyer and a tax lawyer, accountant, or other financial advisor should be involved in preparing the trust document, as there are several important decisions to be made at this stage.