Security Debt Any With Example In San Diego

Description

Form popularity

FAQ

Chapter 7 bankruptcy provides for the discharge of most types of unsecured debt. Once unsecured debt is discharged in bankruptcy, you are no longer obligated to repay the debt. The creditor can no longer attempt to collect such debt from you.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

If the debt is unsecured, the creditor can: Stop doing business with you. Report your debt to a credit reporting agency. Bring a lawsuit to collect the debt.

Here are the steps you can take: Send a written request: Draft a formal letter to the debt collector requesting debt verification. Include your name, address, and account number associated with the debt. Clearly state your intention to verify the debt and request all relevant information and documentation.

In order to garnish, an unsecured creditor (one for which there is no collateral securing the debt, i.e. credit cards, personal loans, medical bills) must first sue the debtor. Typically this does not occur until the debt is around six months delinquent.

If the debt is unsecured, the creditor can: Stop doing business with you. Report your debt to a credit reporting agency. Bring a lawsuit to collect the debt.

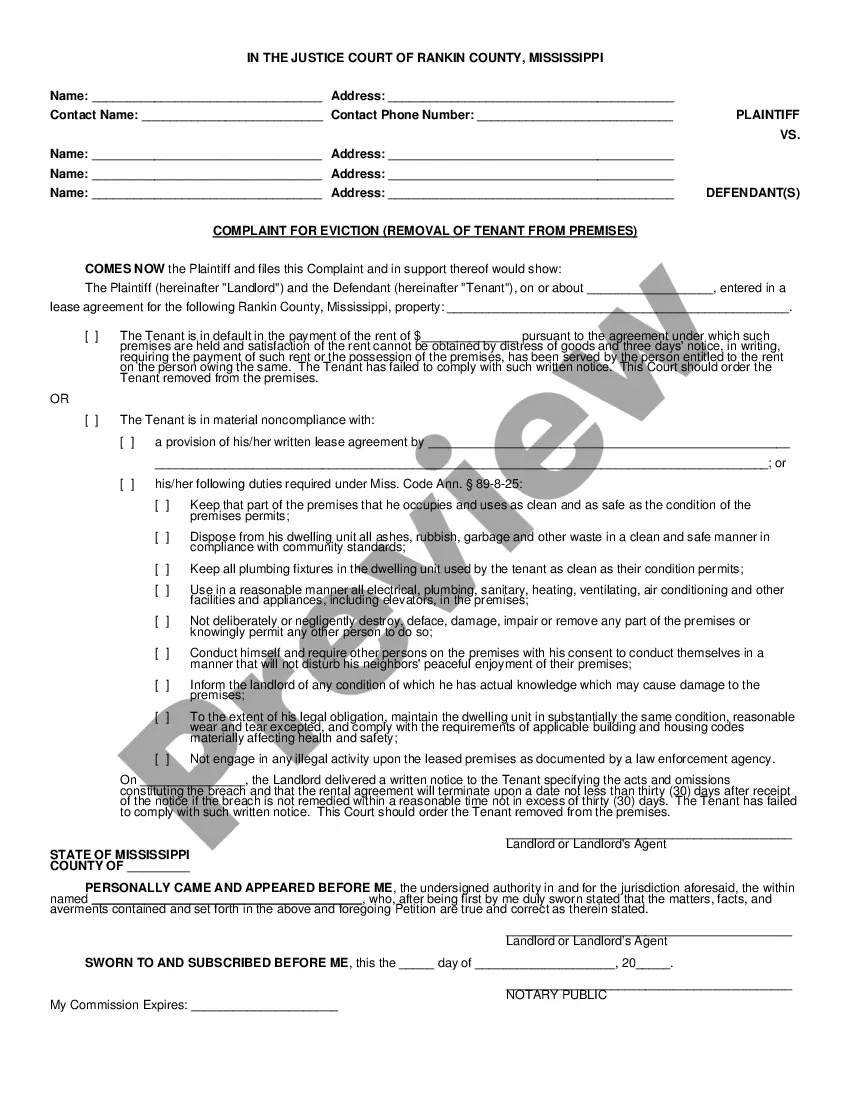

A landlord can only deduct certain items from a security deposit. The landlord can deduct for: Cleaning the rental unit when a tenant moves out, but only to make it as clean as when the tenant first moved in. Repairing damage, other than normal wear and tear, caused by the tenant and the tenant's guests.

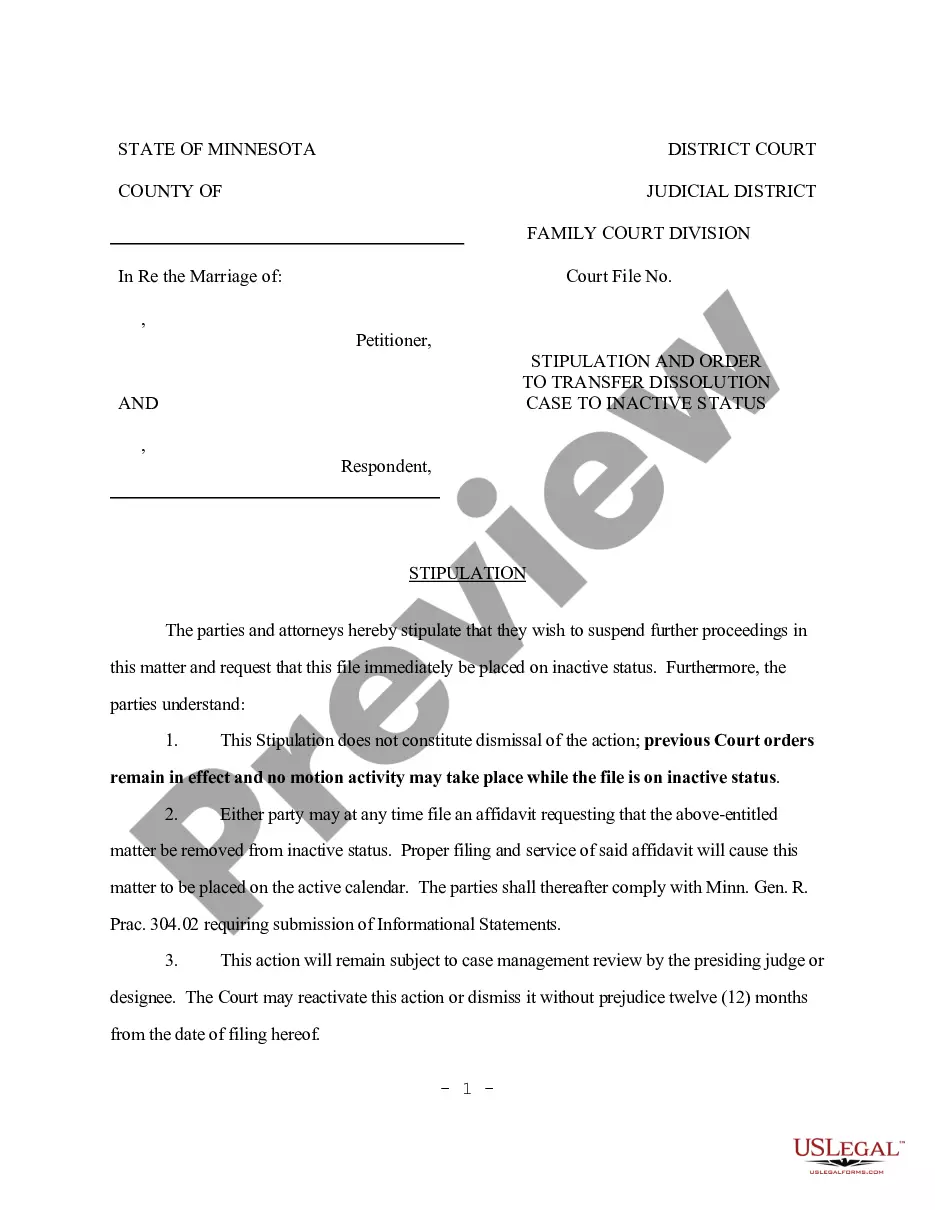

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

If the landlord doesn't return the entire security deposit within 21 days or the tenant doesn't agree with the deductions they can write a letter asking the landlord to return the security deposit. The tenant should keep a copy of the letter for their records.

Normal wear and tear generally refers to the expected deterioration of a rental unit as a result of the tenant's everyday use. This can include things like loose doorknobs, worn out carpet, and minor scratches on the walls and floors.