Blank Deed Of Trust Form In King

Description

Form popularity

FAQ

You can seek assistance from an estate planning attorney or use online services like to guide you. After preparing the trust documents, have them executed in the presence of a notary public to render the whole trust agreement legally binding.

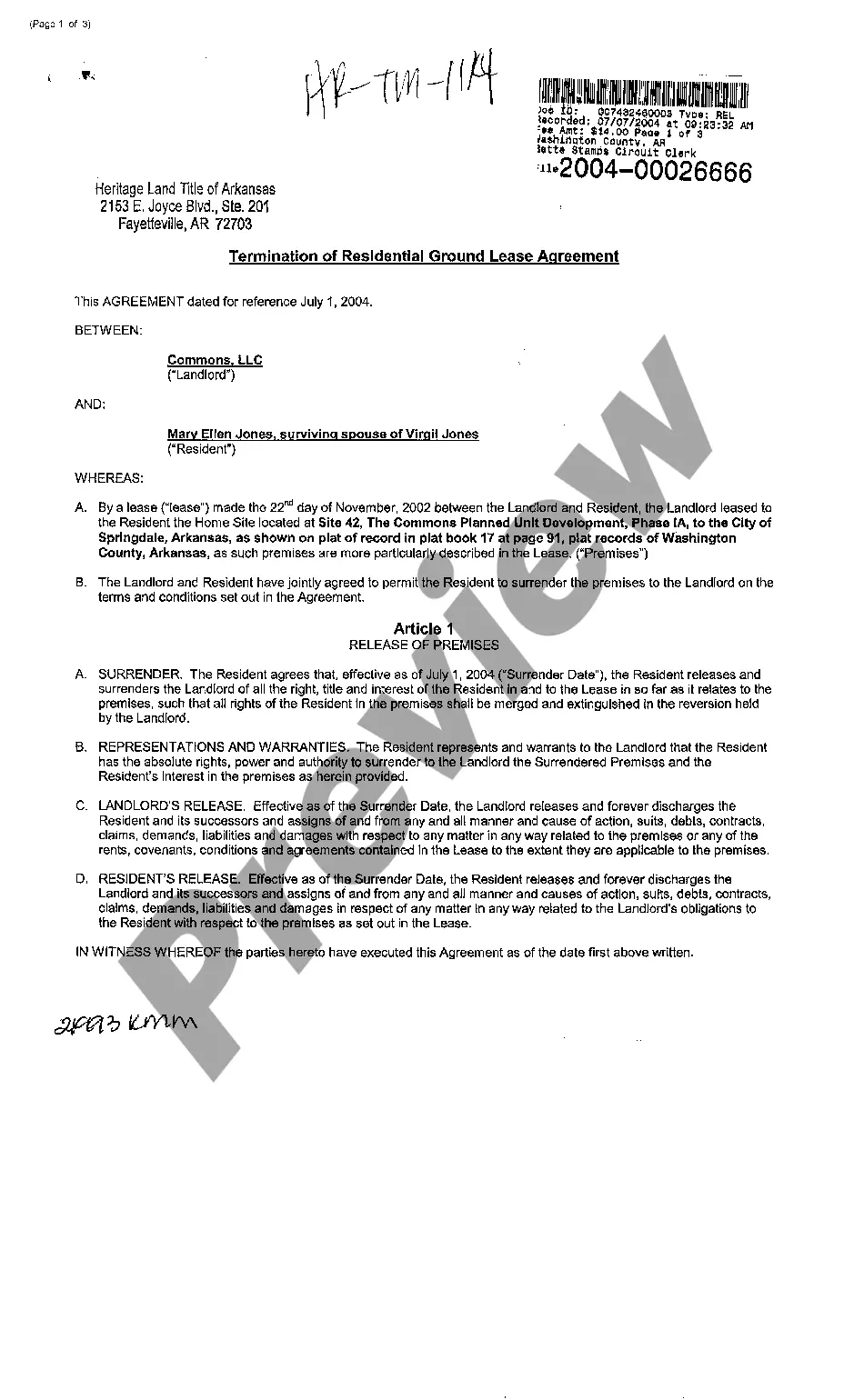

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

You cannot apply for a trust deed on your own. A 'trustee' helps you with your application. You must get debt advice to find out if a trust deed is right for you. A protected trust deed is a Scottish debt solution which is similar to an IVA.

Property ownership information can be requested from the County Registrar-Recorder/County Clerk.

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

Getting a copy of your deed in New Jersey is a relatively simple process. By visiting your County Clerk's office or their website, you can quickly obtain the necessary documents. If you encounter any difficulties, the staff at the Clerk's office can often provide assistance.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

Yes you can complete and record your own deed. It must b properly signed, witnessed, and notarized.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.