Secure Debt Shall With No Interest In Chicago

Description

Form popularity

FAQ

The Illinois Statute of Limitations on debt collection sets the time limits within which a creditor or debt collector can legally pursue repayment. In Illinois, the statute of limitations typically ranges from five to ten years, depending on the type of debt.

A collector can contact you in person, by mail, telephone, telegram or email. However, a collector may not contact you at unreasonable times or places, such as before 8 a.m. or after 9 p.m., unless you agree. A debt collector also may not contact you at work if the collector knows that your employer disapproves.

Yes. This is known as the statute of limitations, and it is based on the date when you first stopped paying the original debt. Each state has it's own statute of limitations, ranging from as little as 3 or 4 years, to as much as 7 or 10 years (or even longer).

While a debt's age matters, the seven-year credit reporting limit doesn't protect you from lawsuits.

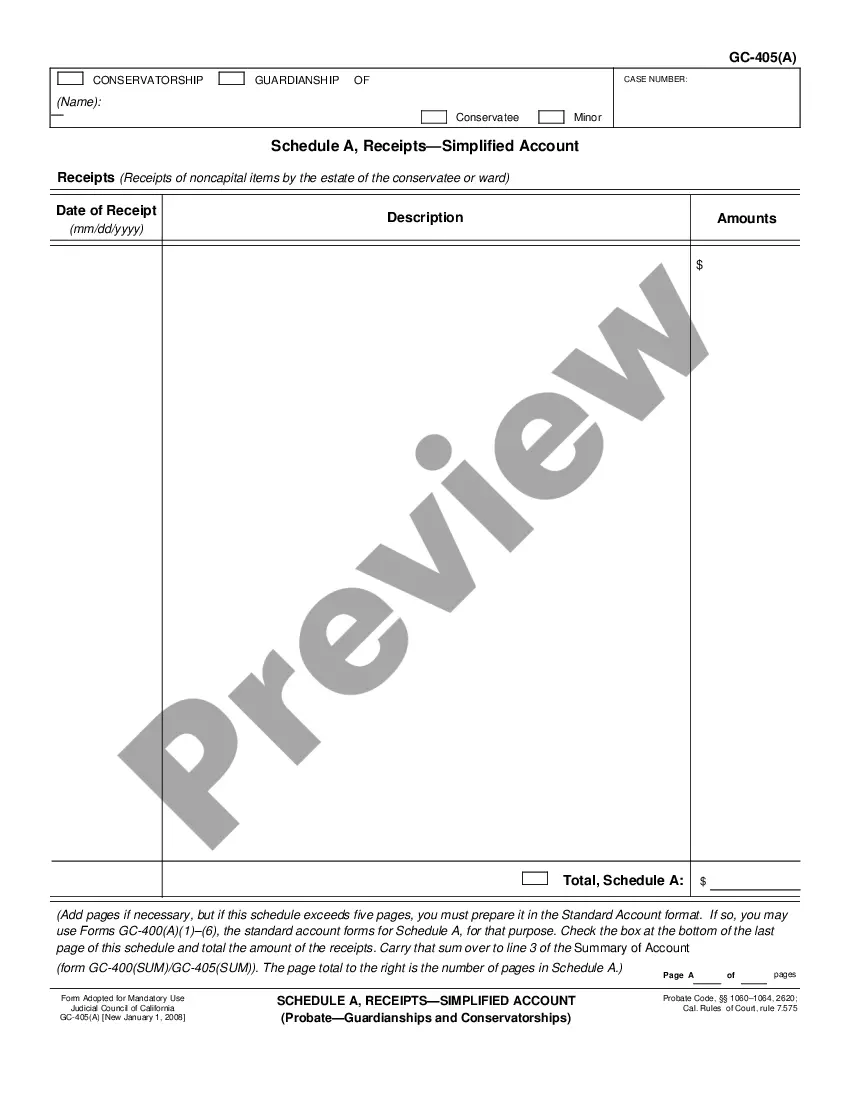

Statutes of Limitations for Each State (In Number of Years) StateWritten contractsOpen-ended accounts (including credit cards) Georgia 6 6 Hawaii 6 6 Idaho 5 4 Illinois 10 547 more rows

A landlord must give a tenant a receipt for a security deposit that includes the owner's name, the date it was received and a description of the dwelling unit. The receipt must be signed by the person accepting the security deposit.

The five major debt relief options are debt management programs, debt consolidation loans, nonprofit debt settlement, traditional for-profit debt settlement and bankruptcy. Each program has benefits and negatives, depending on the consumer's financial situation.

If you're struggling with a lot of unsecured debt — like credit card bills, personal loans or private student loans — debt relief companies, also known as debt settlement companies, can negotiate with your creditors to get your balance lowered.

In California, absent an exception which we discuss in depth below, the maximum allowable interest rate for consumer loans is 10% per year. For non-consumer loans, the interest rate can bear the maximum of whichever is greater between either: i) 10% per annum; or ii) the “federal discount rate” plus 5%.