Personal Property Business Form With Two Points In Travis

Description

Form popularity

FAQ

This form is designed to report tangible personal property that is owned or managed for income production. Ensure you provide accurate information as required by law. Complete the necessary sections to submit your rendition for the current tax year.

A personal property rendition is a report that lists all business assets (personal property) that are subject to personal property tax, which is typically all tangible personal property unless a specific exemption applies.

Business Personal Property tax is an ad valorem tax on the tangible personal property that is used for the production of income. The State of Texas has jurisdiction to tax personal property if the property is: Located in the state for longer than a temporary period.

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

Protesting property taxes in Texas can lead to significant tax savings. When you successfully challenge your property's assessed value, you can lower your tax liability.

Business owners are required by State law to render personal property that is used in a business or used to produce income. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process.

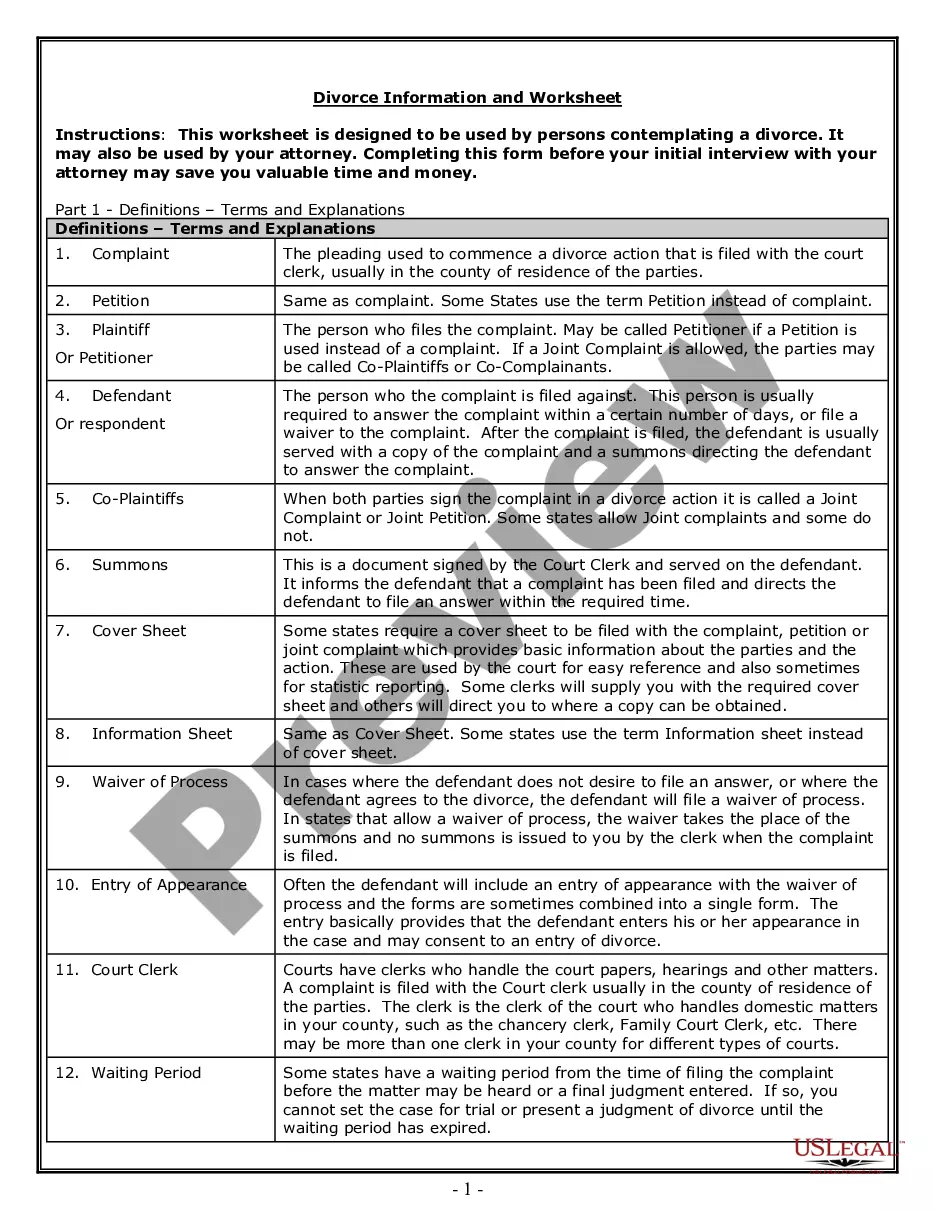

A rendition statement shall contain: (1) the name and address of the property owner; (2) a description of the property by type or category; (3) if the property is inventory, a description of each type of inventory and a general estimate of the quantity of each type of inventory; (4) the physical location or taxable ...

Fill in the business start date, sales tax permit number, and check any boxes that apply. If sold, please fill in the New Owners name. If moved, please fill in the new location address. Please check the box with the value that describes the property owned and used by the business.

A personal property rendition is a report that lists all business assets (personal property) that are subject to personal property tax, which is typically all tangible personal property unless a specific exemption applies.

Ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.