Bill Personal Property Form With Two Points In Fairfax

Description

Form popularity

FAQ

Qualify for Personal Property Tax Relief Per the Code of Virginia §58.1-3524, personal property tax relief (PPTR) gives tax relief on the taxes due for the first $20,000 in assessed value on qualified personal vehicles. No relief is given on any assessment amounts over $20,000.

Age 65 or over: Each filer who is age 65 or over by January 1 may claim an additional exemption. When a married couple uses the Spouse Tax Adjustment, each spouse must claim his or her own age exemption. Blindness: Each filer who is considered blind for federal income tax purposes may claim an additional exemption.

Taxpayers Age 65 & Older If you, or your spouse, were born on or before January 1, 1958, you may qualify to claim an age deduction of up to $12,000 each for 2022. The age deduction you may claim will depend upon your birth date, filing status and income.

The Virginia General Assembly enacted legislation which allows Loudoun County to determine an alternative rate of tax on one vehicle (automobile and pickup trucks) owned and used primarily by or for anyone at least 65 years of age or anyone permanently and totally disabled.

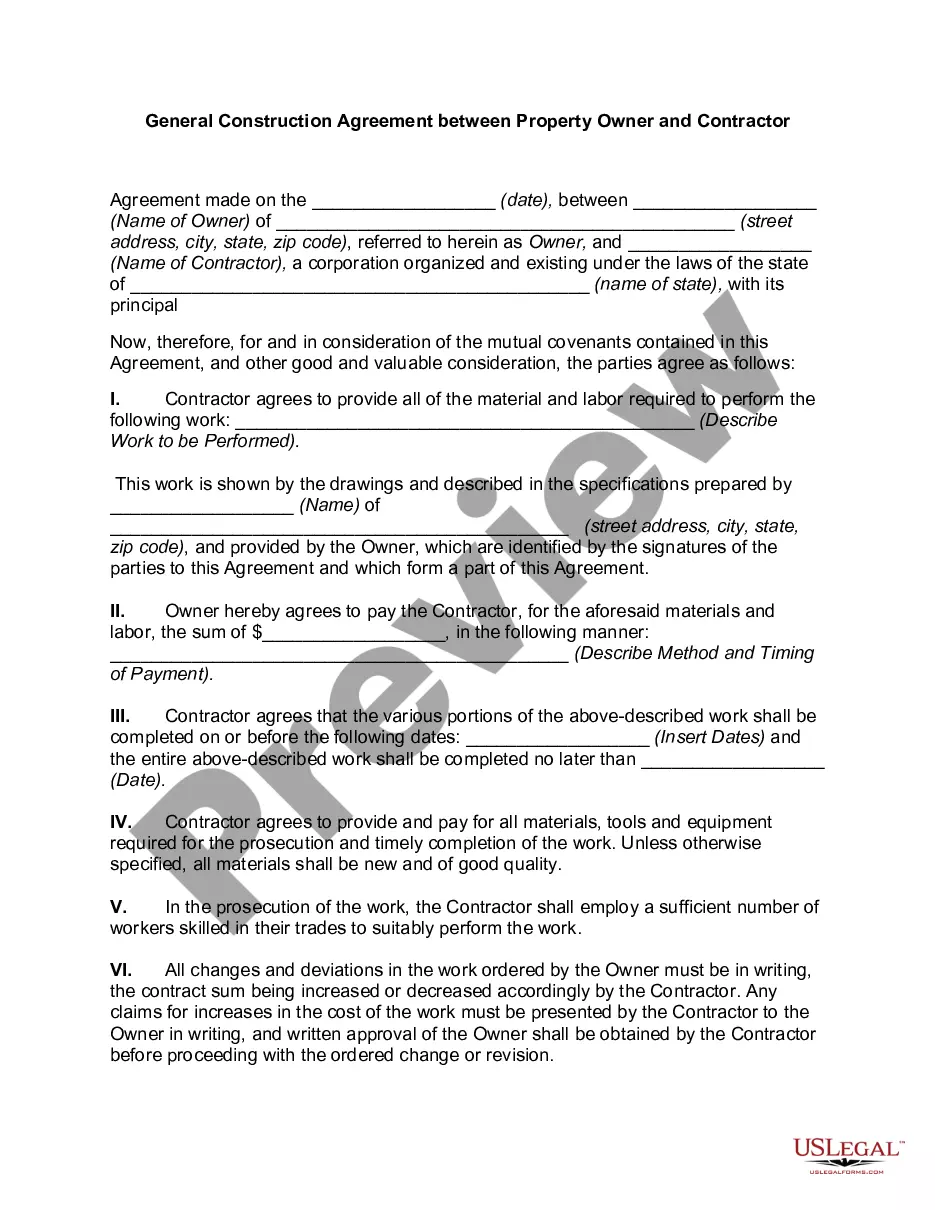

What must be declared on the Personal Property Declaration? All personal property items used in the conduct of operating the business including items donated, given to you or owned prior to starting your business, unregistered motor vehicle(s), etc.

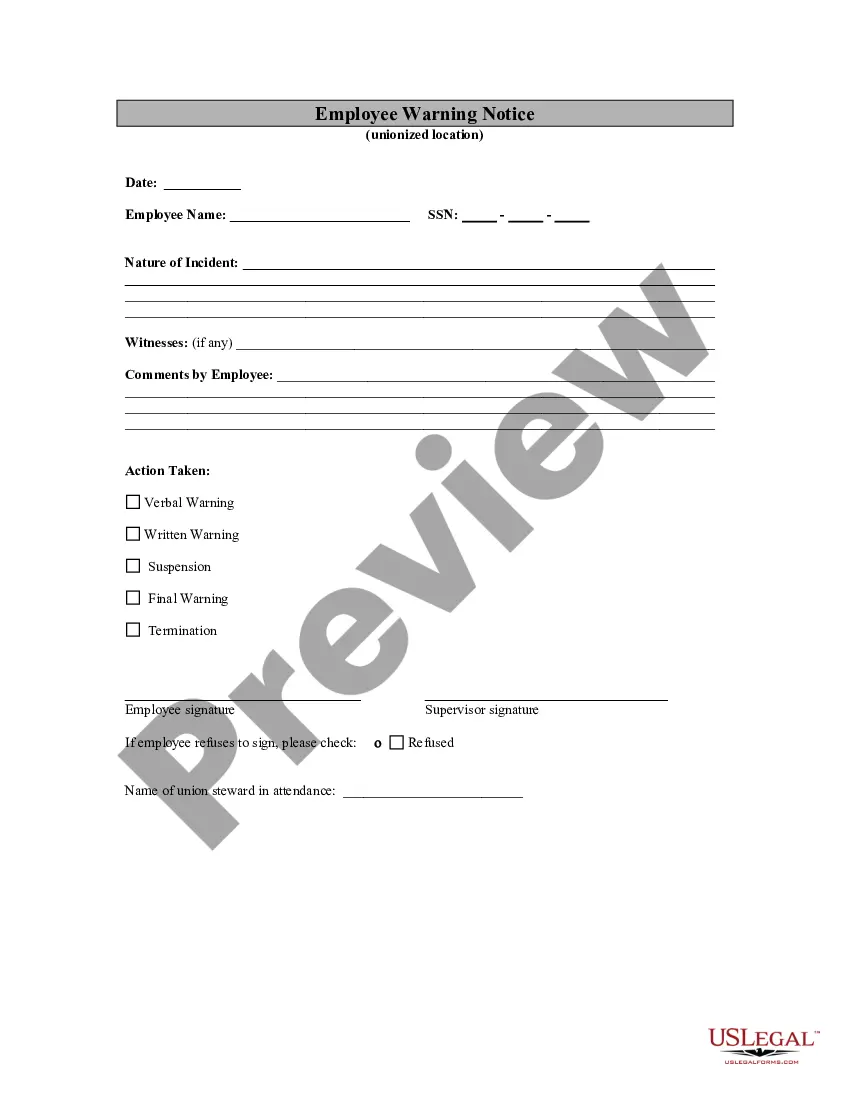

You may view your tax information online or request a copy of the bill by emailing DTARCD@fairfaxcounty or calling 703-222-8234, TTY 711.

Senior Homestead Exemption Must have reached age 65 or older during the tax year. Apply for the exemption at the Township Assessor's office. You will need to bring proof of age and residency with you when you apply.

To qualify for real estate tax deferral, you must be at least 65 years of age or permanently and totally disabled. Applicants who turn 65 or become permanently and totally disabled during the year of application may also qualify for tax deferral on a prorated basis.

Appealing a Personal Property Tax Assessment Any taxpayer may submit an appeal to the Commissioner or the Revenue regarding the assessment of their taxable personal property including, but not limited to, airplanes, boats, mobile homes, motorcycles, motorized vehicles, trailers and trucks.