Personal Property Business Form For Central Government Employees In Collin

Description

Form popularity

FAQ

Total exemptions may be granted for public properties or those owned by qualifying organizations such as churches, schools, or charitable organizations. Homestead, over sixty-five, and disabled veterans exemptions are examples of partial exemptions, which reduce the taxable value on qualifying property.

A rendition is a form that allows you to self-report your business personal property to the County Appraisal District. The County uses this information to help estimate the market value of your property for taxation purposes.

Texas does provide a $500 exemption for business personal property (Tax Code 11.145) and mineral interests (Tax Code 11.146).

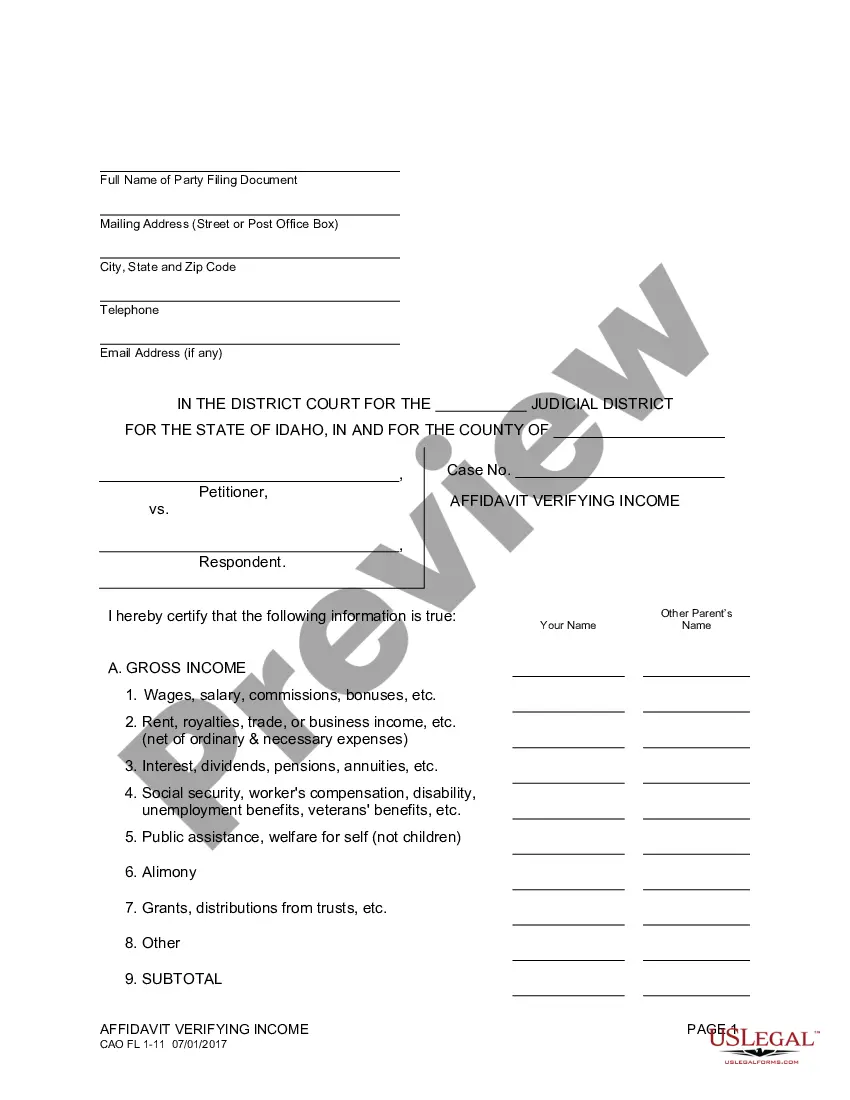

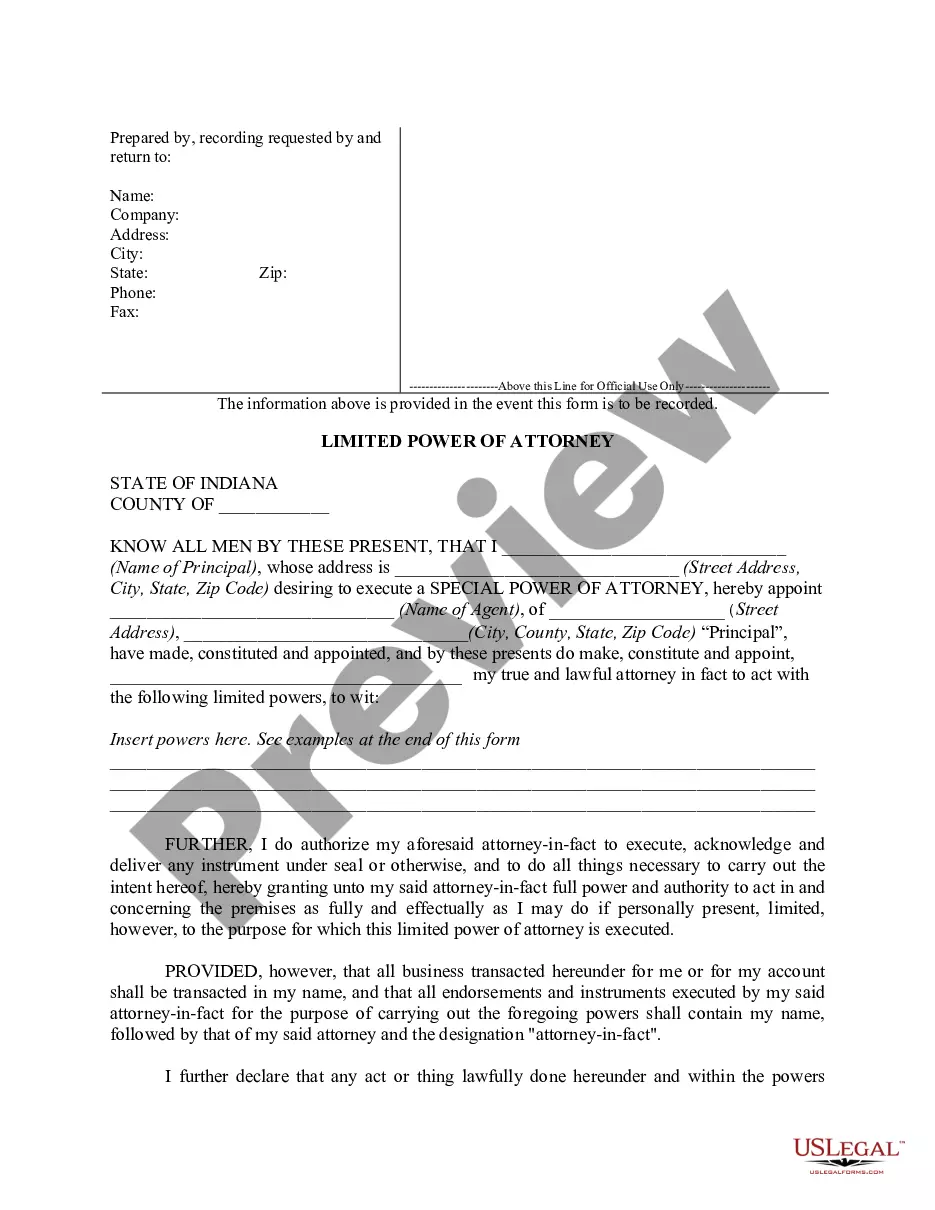

How to fill out the Business Personal Property Rendition Tax Form 50-144? Collect all necessary business and property details. Determine the market value of your property. Complete the required sections of the form. Review all information for accuracy. Submit the form to the appropriate appraisal district.

Business owners are required by State law to render business personal property that is used in a business or used to produce income. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in progress.

Exemptions for Businesses Businesses in Texas can also benefit from certain sales tax exemptions. Some common ones for businesses include: - Manufacturing equipment and machinery used directly in the production process. - Raw materials and components used to manufacture goods.

This form is designed to report tangible personal property that is owned or managed for income production. Ensure you provide accurate information as required by law. Complete the necessary sections to submit your rendition for the current tax year.

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

Homestead protections are available only to individuals–not corporations, partnerships, or LLCs and they do not include investment or business assets. Business interests are non-exempt personal property. Although a person's homestead is primarily a question of intent, it must be based in a real property interest.