Bill Personal Property Form For Sale In Clark

Description

Form popularity

FAQ

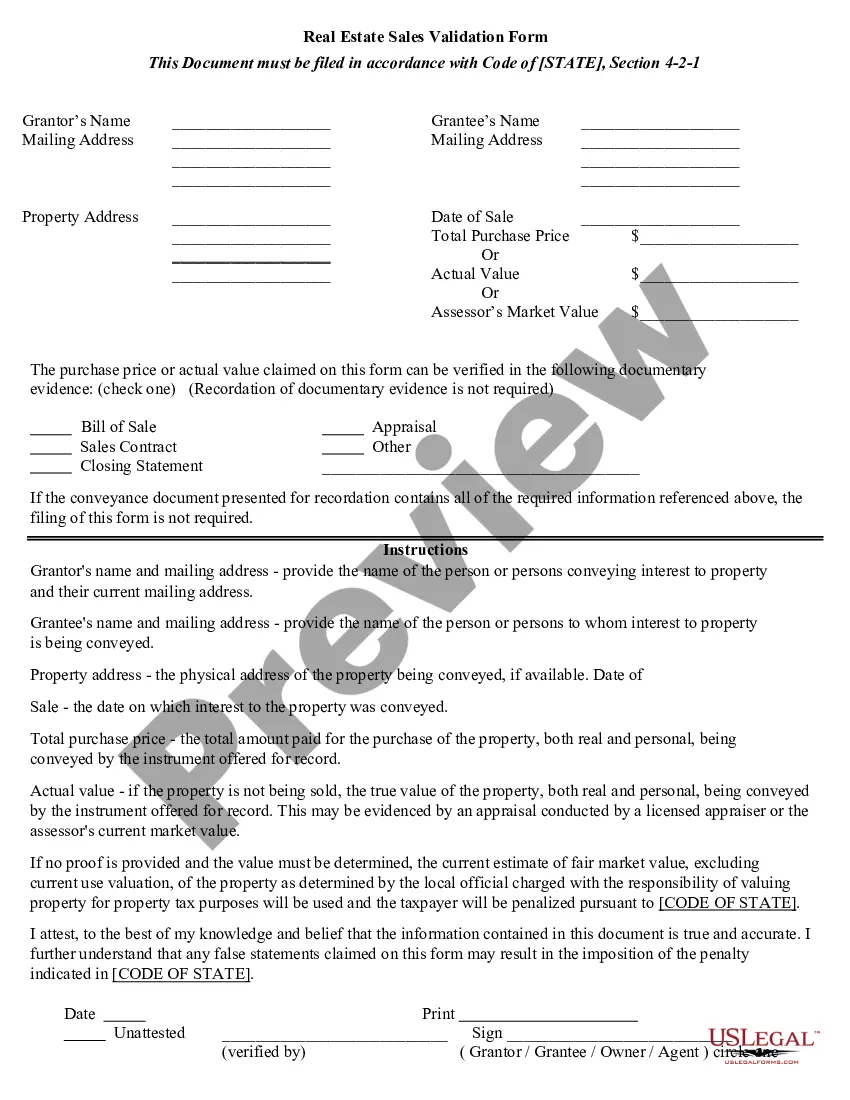

The Treasurer's office mails out real property tax bills ONLY ONE TIME each fiscal year. If you do not receive your tax bill by August 1st each year, please use the automated telephone system to request a copy. Tax bills requested through the automated system are sent to the mailing address on record.

Sections 14 and 15 of this bill entitle each person who is 66 years of age or older who: (1) owns his or her primary residence and whose household income is less than or equal to the federally designated level signifying poverty to receive a partial refund of the property taxes due for the fiscal year in which a claim ...

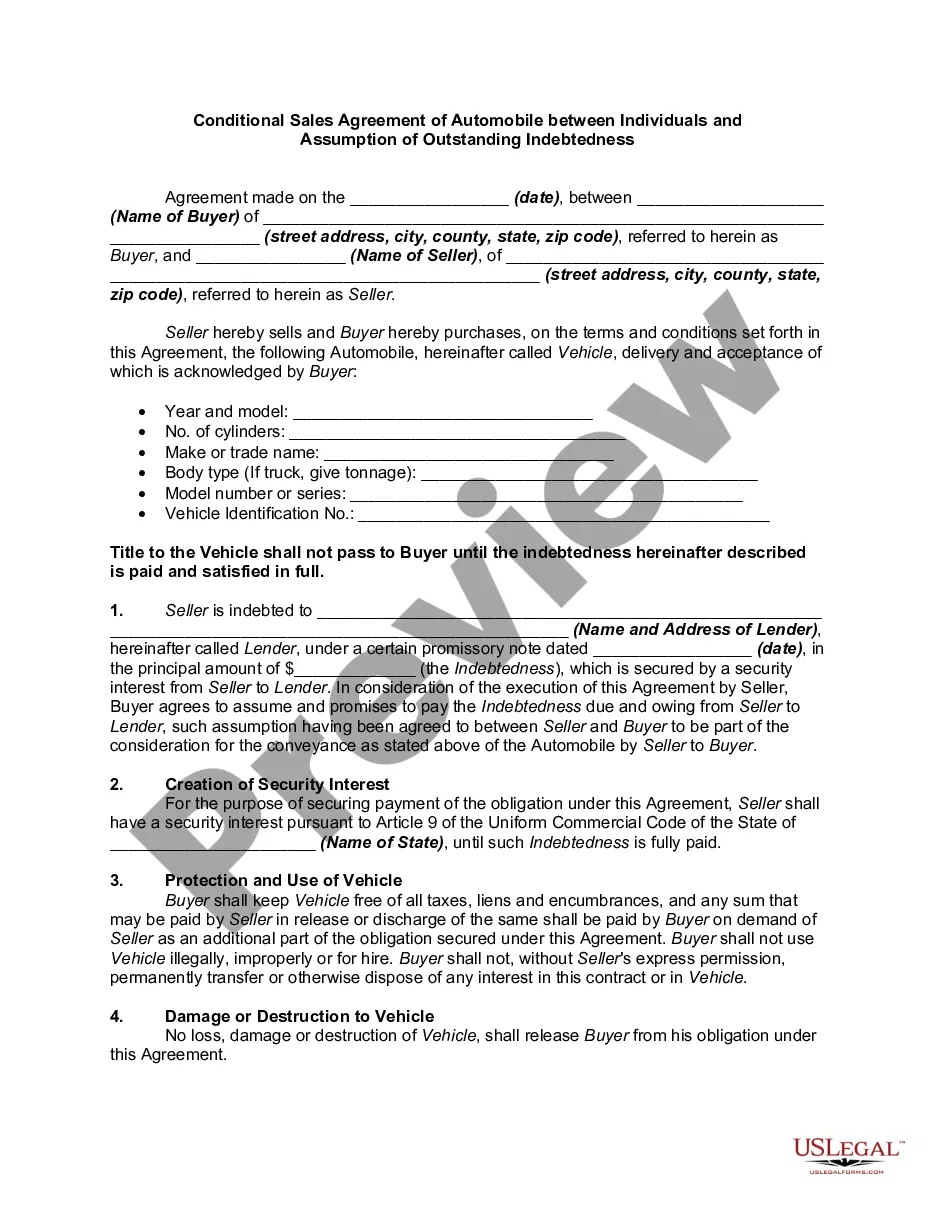

Motor vehicles required to be registered with the Nevada Department of Motor Vehicles and Public Safety are exempt from the property tax, though subject to a governmental service tax.

What must be declared on the Personal Property Declaration? All personal property items used in the conduct of operating the business including items donated, given to you or owned prior to starting your business, unregistered motor vehicle(s), etc.

You can also check your tax cap percentage by visiting the Treasurer's webpage. If your tax cap rate is stated incorrectly, please call the Assessor's Office at (702) 455-3882.

Finding your property tax ID number is easier than you might think. If you already own the property, you can find this number on property tax bills, deeds, or title reports. However, for those who do not own the property or need a different approach, many local government websites provide online databases.

If you sold a personal use asset for more than what you bought it for, then you would generally report that on the Stock or Investment Sale Information screen. You can report any selling expenses by reducing the amount you enter as "Sale Proceeds" by the amount of your selling expenses.

Assessed value is computed by multiplying the taxable value by 35%, rounded to the nearest $1.00.

The Form 1099S is the reporting form adopted by the I.R.S. for submitting the seller's gross proceeds information required by law. The information is transferred onto magnetic media by the settlement agent who will make the required report to the I.R.S.