Distributorship Agreement Sample With Gst In Virginia

Description

Form popularity

FAQ

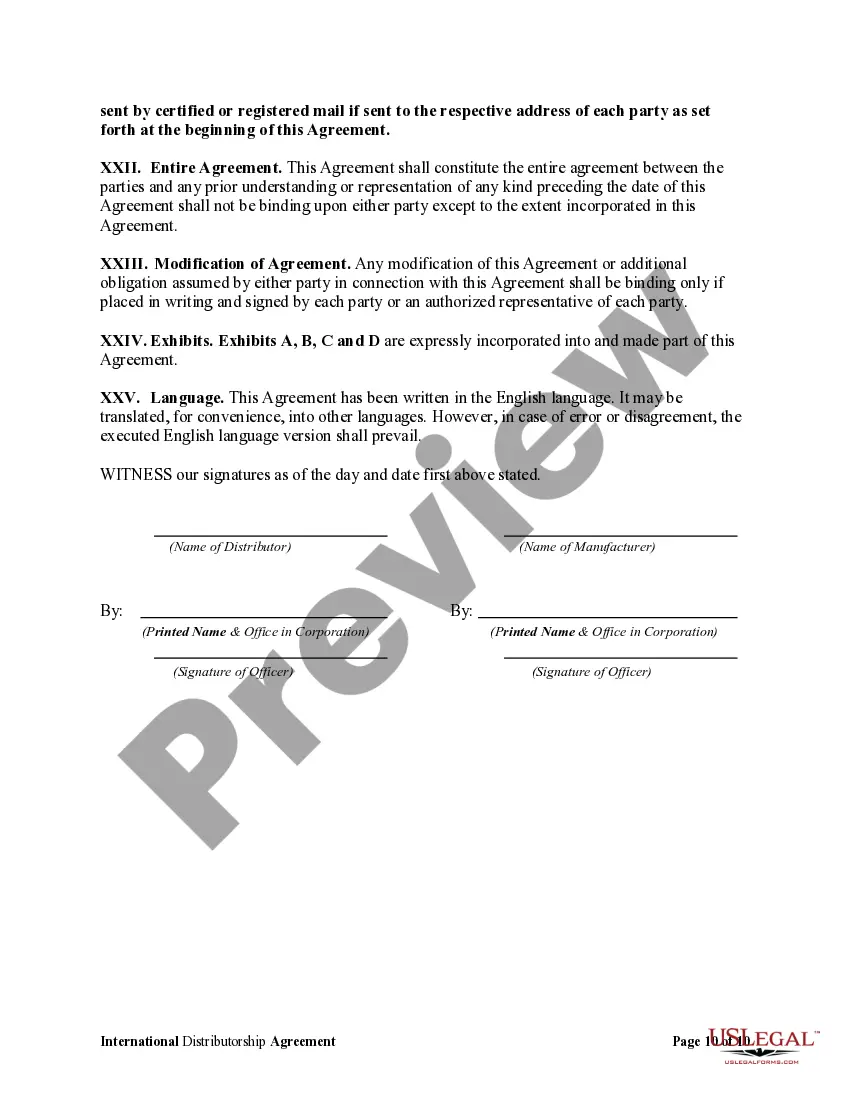

A distribution agreement is a contract between a manufacturer and a distributor. The manufacturer grants the distributor the right to sell its products or services in a specified territory or market.

Sales Tax Rates In all of Virginia, food for home consumption (e.g. grocery items) and certain essential personal hygiene items are taxed at a reduced rate of 1%. Sales of aircraft, watercraft, and motor vehicles are taxed at different rates than those listed above.

The general sales tax rate for Virginia is 5.3 percent (4.3 percent state tax and 1 percent local tax). Note on “use tax”: Although the name of the Act implies two separate taxes, it is one tax levied by the Commonwealth on the end user of tangible personal property and taxable services.

You can request forms and instructions from the Virginia Department of Taxation's Forms Department by calling 804-440-2541.

IF YOUR VIRGINIA TAXABLE INCOME IS: Not over $3,000, your tax is 2% of your Virginia taxable income. The tax table can be used if your Virginia taxable income is listed in the table. Otherwise, use the Tax Rate Schedule.

Tax 1 is items that are not grocery, and are taxed at that higher percentage. Tax 2 is the grocery tax, cut in half pretty much and it applies to grocery.

Now this is both Shoppers at Walmart. And other retailers. Some people tell me they think they'veMoreNow this is both Shoppers at Walmart. And other retailers. Some people tell me they think they've been double taxed. But that's not the case now take a look at this receipt. It is from Saturday.

An agreement of license between a trademark owner and a manufacturer is an official document that states that the manufacturer of a product has the permission to manufacture the product by the company or the individual who has trademarked it.

A distribution agreement, also known as a distributor agreement, is a contract between a supplying company with products to sell and another company that markets and sells the products. The distributor agrees to buy products from the supplier company and sell them to clients within certain geographical areas.

This is a manufacturing agreement, under which the manufacturer is obligated to produce and supply products that are specified by the customer. Typically, a detailed product specification will be provided, and this may be incorporated into the agreement or supplied as and when required by the customer.