Personal Property Statement With Example In Travis

Description

Form popularity

FAQ

For questions about property tax bills and collections, call the Property Tax Assistance Division's Information Services Team at 512-305-9999 or 1-800-252-9121 (press 3).

Tax Jurisdiction2024 Tax Rate2023 Tax Rate Travis County 0.344445 0.304655 Travis County Healthcare District 0.107969 0.100692 City/Village City of Austin 0.477600 0.44580085 more rows

Texas levies property taxes as a percentage of each home's appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes.

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

PROPERTY TAX CALENDAR DateEvent July 25 Certification of appraisal roll August/September Tax rates set October Property tax bills begin to be mailed out November Voter approval elections are held4 more rows

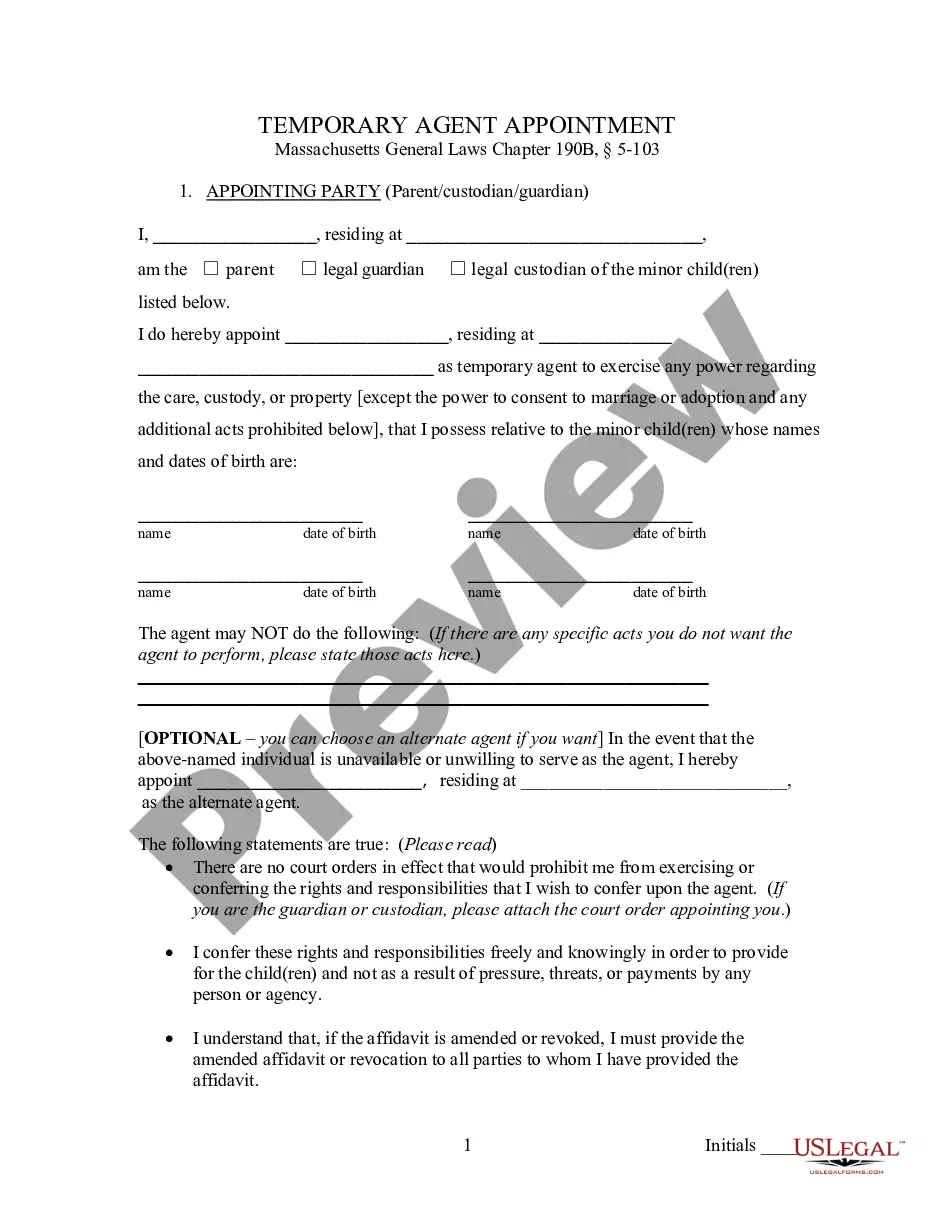

Answer: Connecticut General Statute 12-71 requires that all personal property be reported each year to the Assessor's Office. If you receive a declaration, it is because our office has determined that you may have property to report. If you feel the form is not applicable, return it with an explanation.

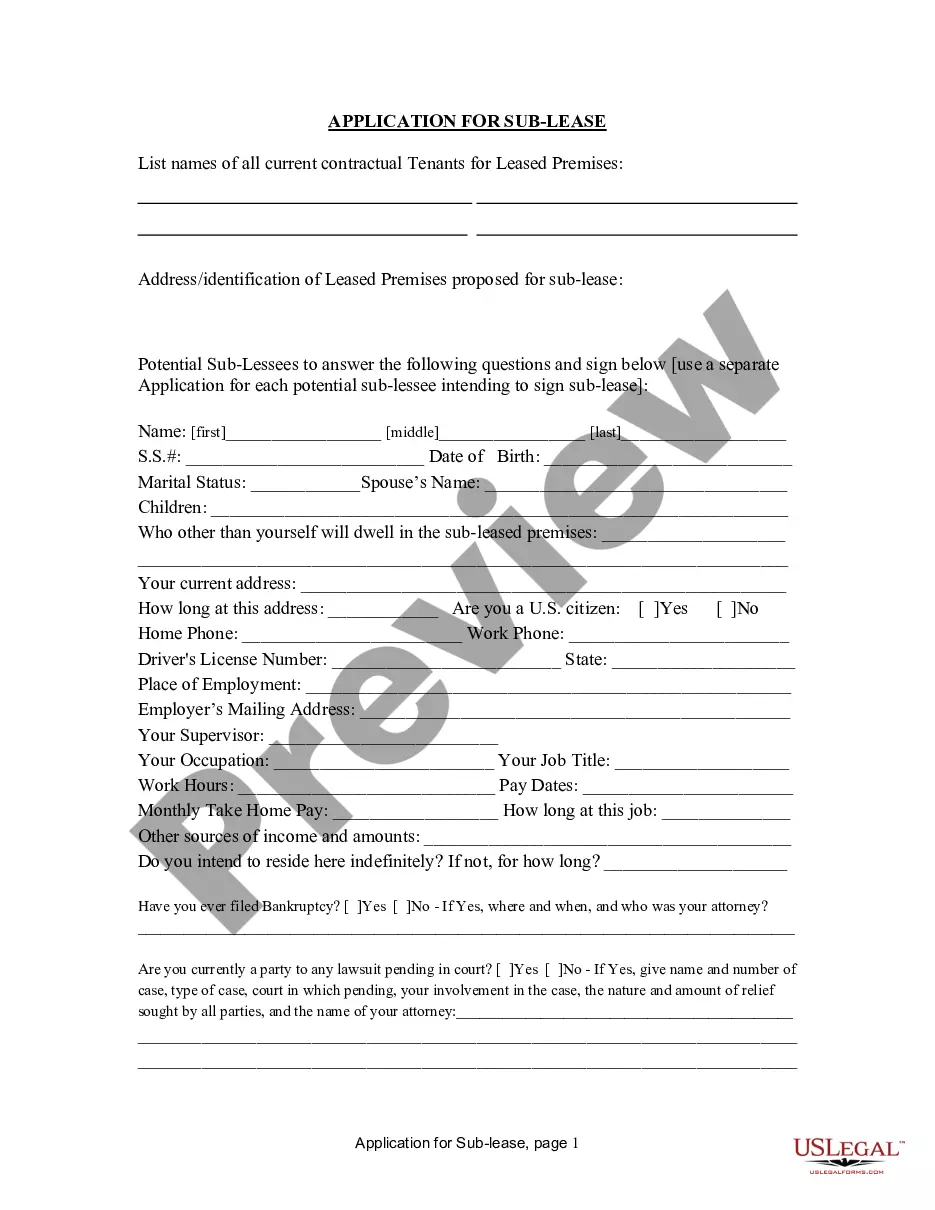

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

To calculate property taxes, tax rate (millage rate) is multiplied by the appraised value. Most homeowners have several taxing entities that are authorized to tax their property. Excluding any exemptions, tax rates and appraised value will be used to determine your property taxes.

Thus, the main characteristic of personal property is that it is movable, unlike real property or real estate. Tangible property is personal property that can be physically handled, such as clothes, jewelry, furniture, etc.