Movable Property Form For Central Government Employees In San Bernardino

Description

Form popularity

FAQ

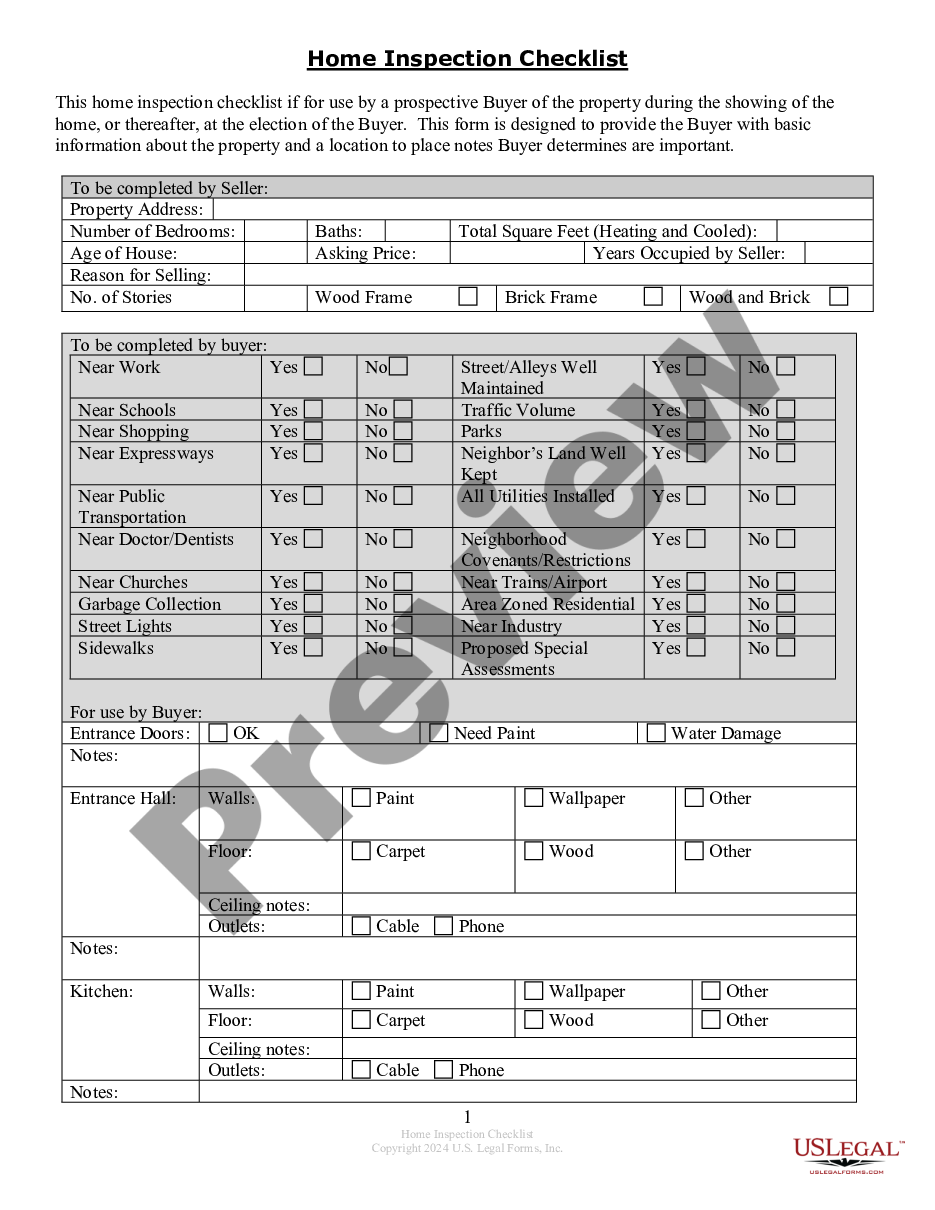

The median property tax rate in San Bernardino, CA is 1.32%, considerably higher than both the national median of 0.99% and the California state median of 1.21%. With the median home value in San Bernardino, the typical annual property tax bill reaches $2,589, which is just below the national median of $2,690.

The 1% general tax levy and tax rate for voter-approved bonds will be applied to the net assessed value of your property and the amount due will either increase or decrease each year.

Property that is owned and occupied as your principal place of residence as of the lien date (January 1st) may qualify for an exemption of $7,000 of assessed value. Contact the Assessor for details about the exemption.

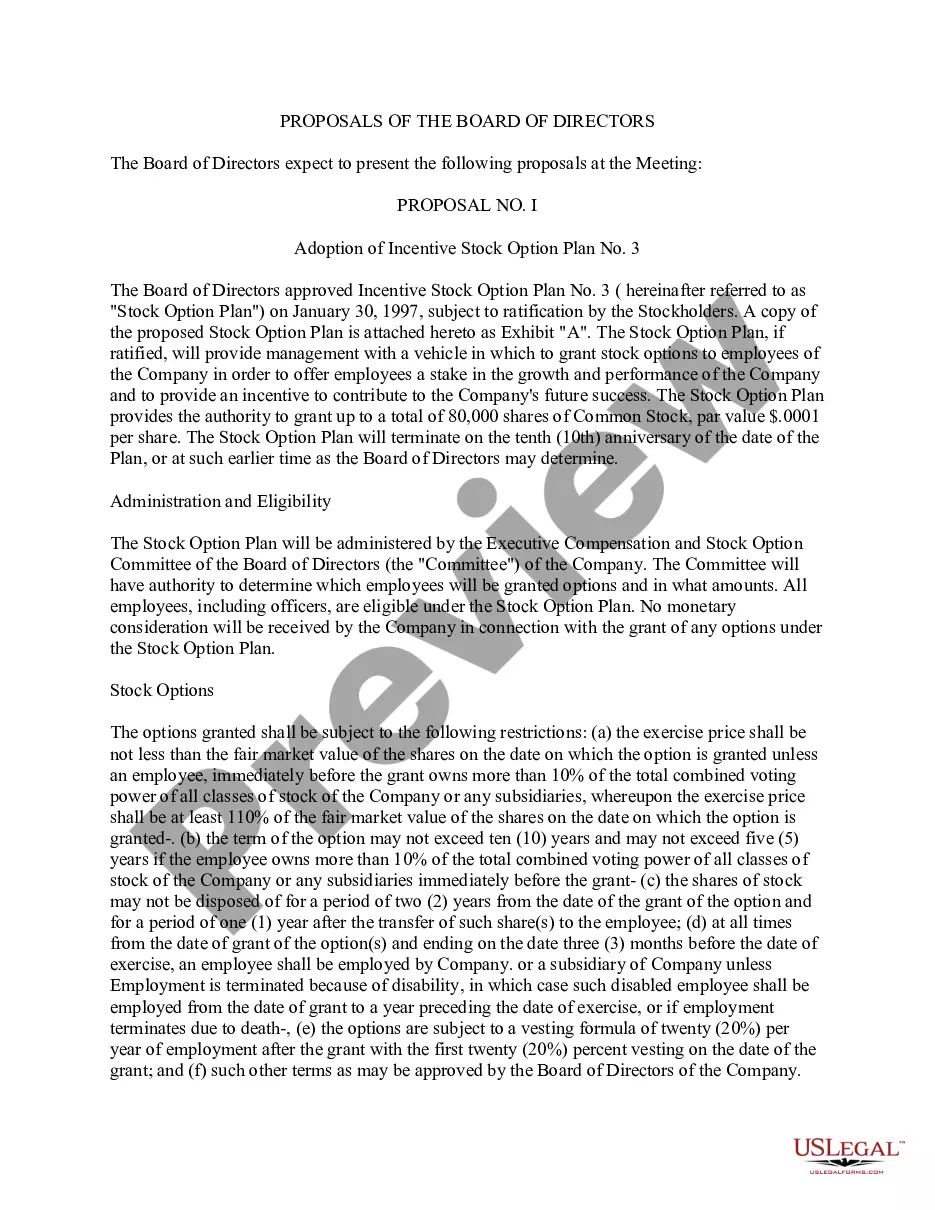

Note:- The declaration form is required to be filled in and submitted by member of Class – I and Class – II services under rule 18 (2) of the CCS (Conduct) Rules, 1964 on first appointment to the service and thereafter at the interval of every twelve months, giving particulars of all immovable property owned, acquired ...

San Bernardino County sales tax details The minimum combined 2025 sales tax rate for San Bernardino County, California is 7.75%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%. The San Bernardino County sales tax rate is 0.25%.

The tax rate is determined by the amount of the tax levy to be raised from all, or part, of a taxing district and the district's taxable assessed value. The assessment is determined by the assessor and is based on the estimated market value of your property less any applicable property tax exemptions.

Since September 2023, Law No. 048/2023 dated 05/09/2023, determining the sources of revenue and property of decentralized entities, has established a tax on the sale of immovable property, levied at two different rates of 2 percent and 2.5 percent.

An asset that does not have the capability to move from one place to the other is considered immovable property. In the real estate market, immovable property includes residential properties, warehouses, manufacturing units, and factories.

City Transfer Tax COUNTYCONTACT NUMBERCOUNTY TRANSFER TAX (Per Thousand) San Benito 831.636.4016 Seller-$1.10 San Bernardino 855.732.2575 Seller-$1.10 San Diego 619.238.8158 Seller-$1.10 San Francisco 415.554.5596 Seller Pays – City & County same55 more rows