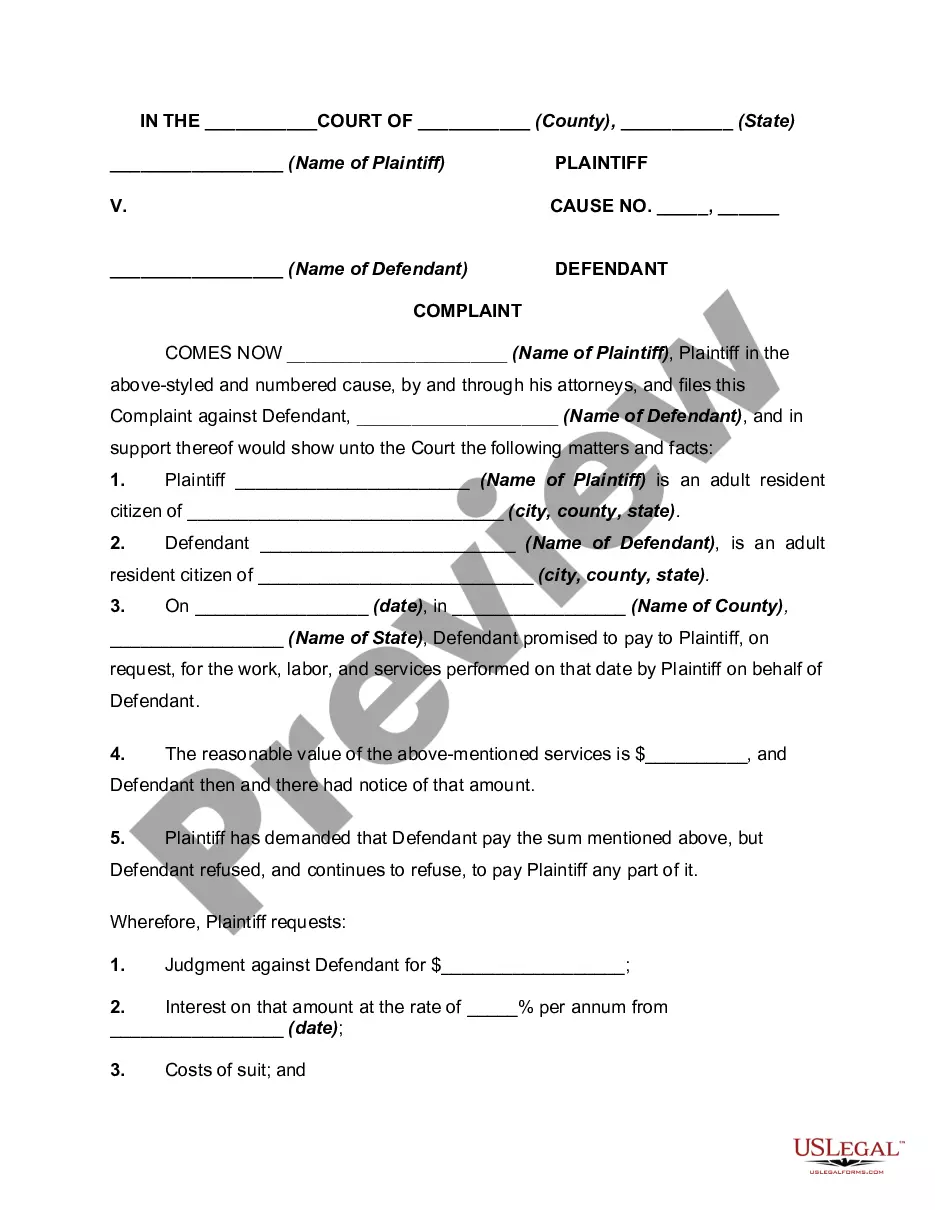

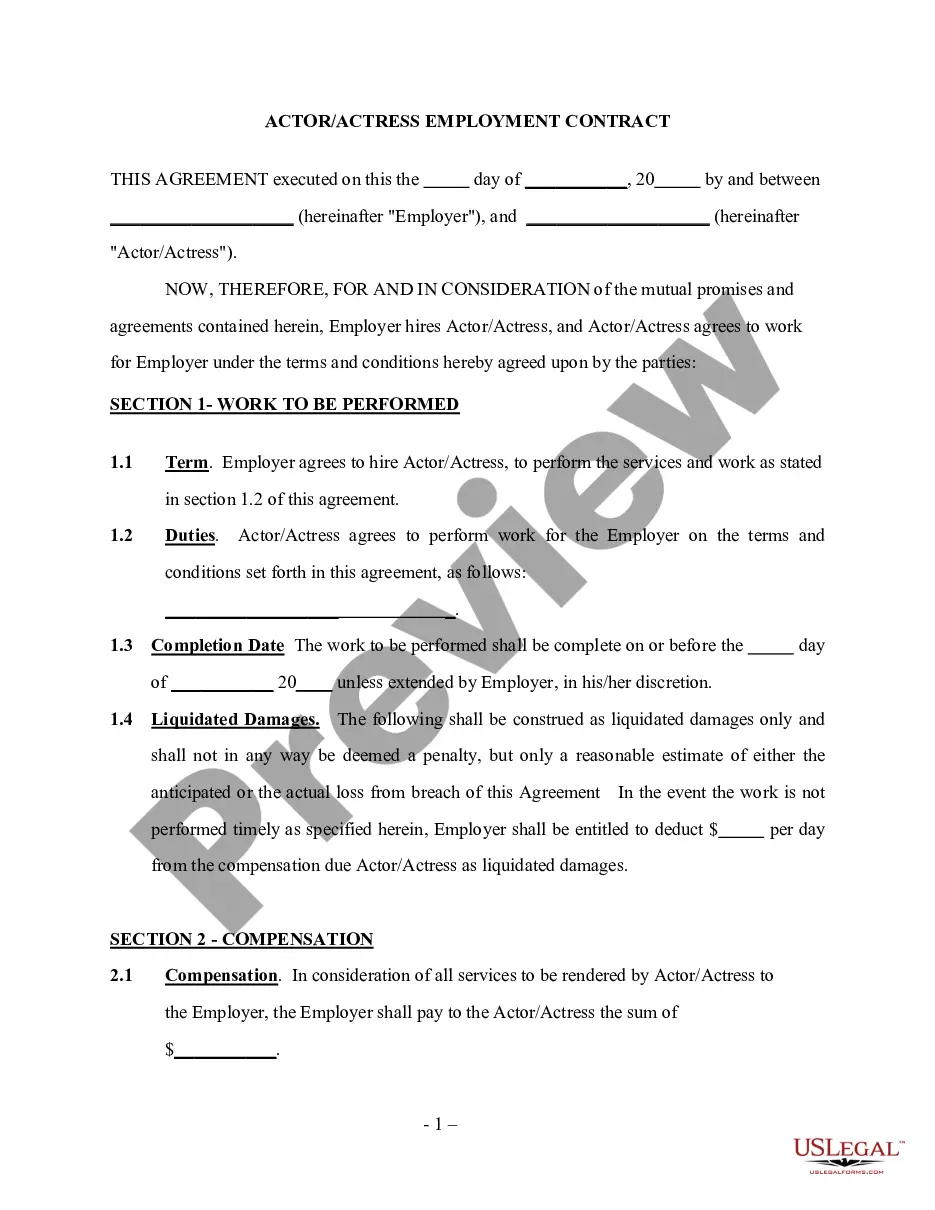

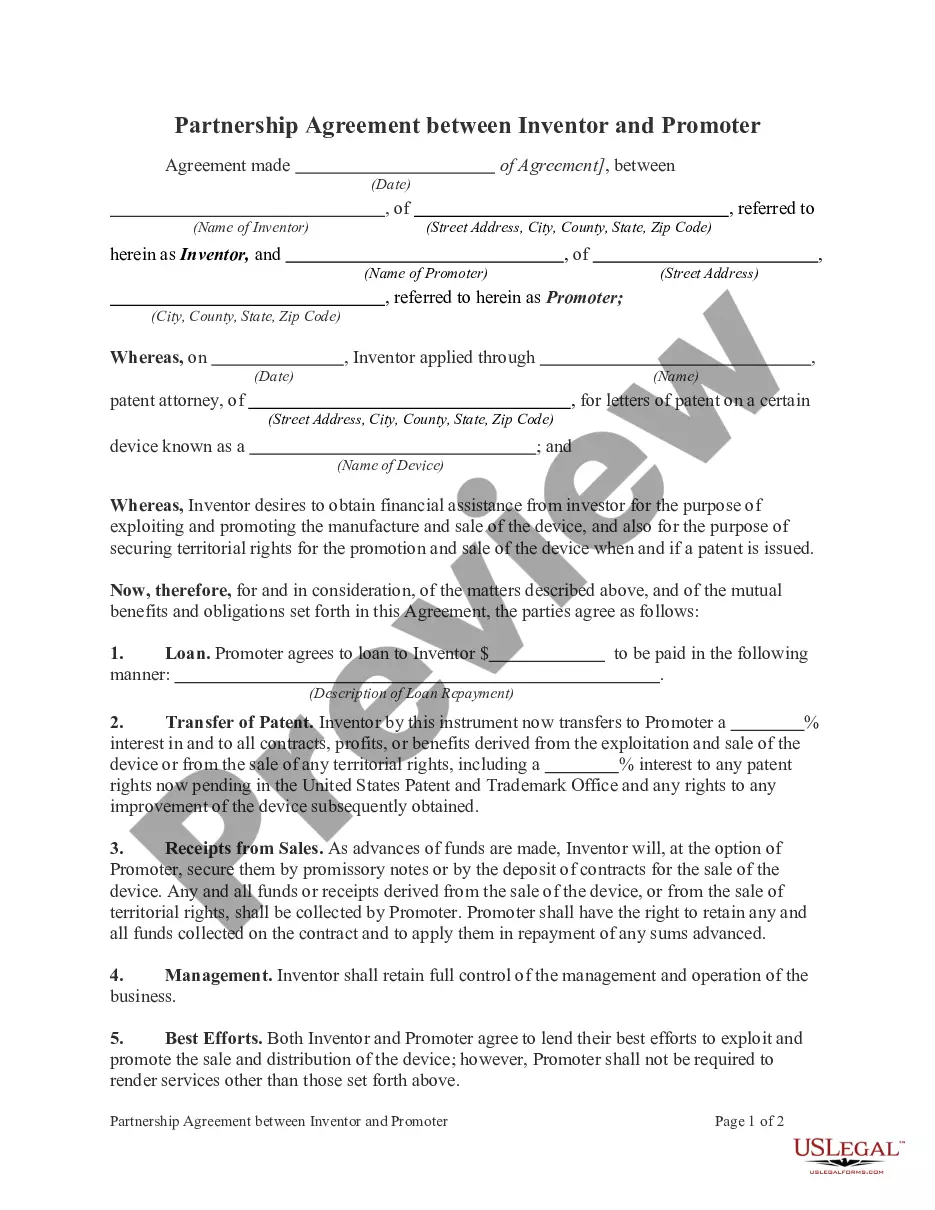

This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Property Form 2023 In North Carolina

Description

Form popularity

FAQ

Personal property owners are responsible for annually completing and submitting a personal property listing form to the Tax Office. Individual Personal Property includes, but is not limited to unlicensed motor vehicles, jet skis, campers, camper trailers, aircraft, manufactured homes, boat motors and gliders.

For Tax Year 2023, the North Carolina individual income tax rate is 4.75% (0.0475). Tax rates for previous years are as follows: For Tax Year 2022, the North Carolina individual income tax rate is 4.99% (0.0499). For Tax Years 2019, 2020, and 2021 the North Carolina individual income tax rate is 5.25% (0.0525).

Recent Trends in Tangible Personal Property Taxation State2006 Personal Property2017 Personal Property California 4.11% 5.20% Colorado 12.06% 6.90% Connecticut 6.09% 13.28% Florida 7.43% 7.00%29 more rows •

The three main elements of the property tax system in North Carolina are real property, personal property, and motor vehicles.

Calculating the Property Tax Rate Therefore, to calculate your county property taxes, take the assessed value of your property, divide by 100, and then multiply by 0.4831. For example, the owner of a $200,000 house will have an annual County tax bill of $966.20.

North Carolina's property tax rates are relatively low in comparison to those of other states. The average effective property tax rate in North Carolina is 0.70%, well under the national average of 0.99%.

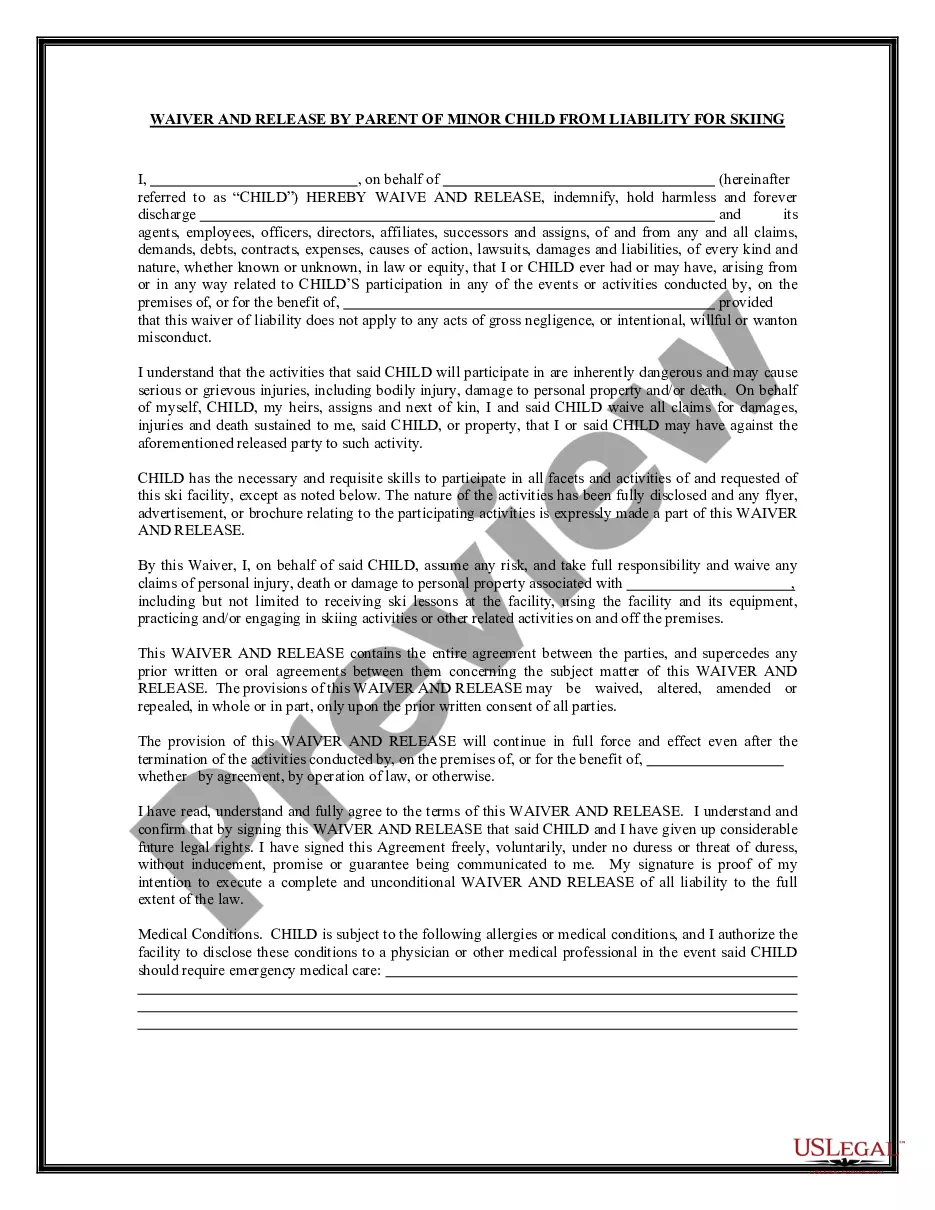

Some states allow the attachment of a Personal Property Memorandum, allowing the flexibility of easy updating without having to change the will or trust language. North Carolina, however, does not recognize the legality of the Personal Property Memorandum.

Personal property owners are responsible for annually completing and submitting a personal property listing form to the Tax Office. Individual Personal Property includes, but is not limited to unlicensed motor vehicles, jet skis, campers, camper trailers, aircraft, manufactured homes, boat motors and gliders.

As defined by North Carolina law, private property would be owned by a private individual and not a commercial or other business interest.

Applicants must file Form AV-9 (Application for Property Tax Relief) as well as Form NCDVA-9 (Certification of Veteran Disability) to qualify. This is a one time application and must be filed with the Tax Assessor's Office by June 1 of the year.