Personal Property On Financial Statement In Contra Costa

Description

Form popularity

FAQ

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings. These are considered to be real property.

• All businesses are required by law to file the Business Personal Property. • Tax Return (PT-50P) to the Tax Assessor's Office by April 1st of each year. • Personal property includes machinery, equipment, furniture, fixtures, inventory, supplies, and construction in progress.

Business personal property (BPP) insurance covers the equipment, furniture, fixtures and inventory that you own, use or rent inside your workspace. Basically, it covers almost everything except the building itself.

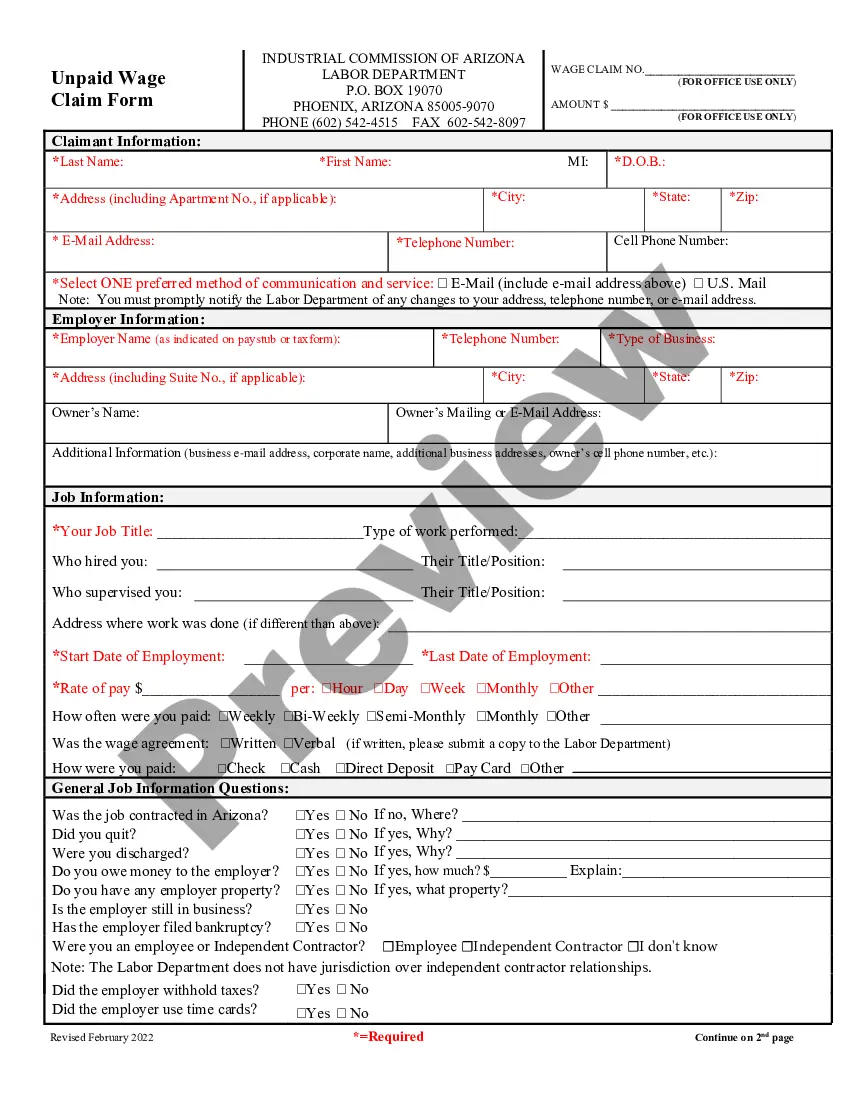

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

Personal property is a class of property that can include any asset other than real estate. The distinguishing factor between personal property and real estate, or real property, is that personal property is movable, meaning it isn't fixed permanently to one particular location.

The formula involves multiplying the assessed value by the Contra Costa County property tax rate, which includes the base rate of 1% plus any voter-approved local assessments and bonds. The actual property tax rate ends up being around 1.3% of a home's assessed value.

A personal property rendition is a report that lists all business assets (personal property) that are subject to personal property tax, which is typically all tangible personal property unless a specific exemption applies.

Recent Trends in Tangible Personal Property Taxation State2006 Personal Property2017 Personal Property California 4.11% 5.20% Colorado 12.06% 6.90% Connecticut 6.09% 13.28% Florida 7.43% 7.00%29 more rows •

Personal-use property is not purchased with the primary intent of making a profit, nor do you use it for business or rental purposes.