Personal Property Document With Tax In California

Description

Form popularity

FAQ

Where to Report Personal Property on Your Taxes. Claim the itemized deduction on Schedule A – State and local personal property taxes (Line 5c). Taxes you deduct elsewhere on your return — like for a home office or rental — don't qualify for this deduction.

Under Article XIII, Section I of the California Constitution, all property is taxable unless it is exempt. Each year Personal Property is reassessed as of lien date, January 1st.

Certain properties, or portions of properties, are exempt from taxation under the California Constitution. The most common types are homeowner, disabled veterans, welfare, charitable, and institutional exemptions.

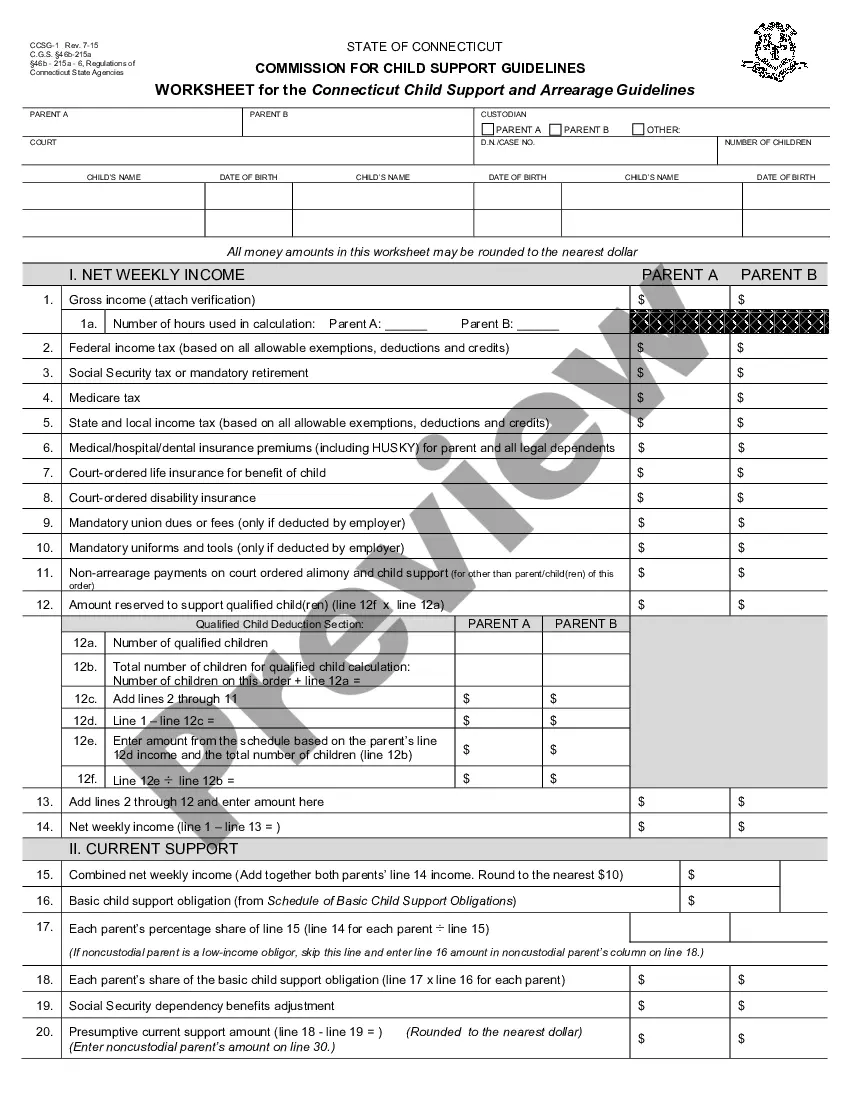

Recent Trends in Tangible Personal Property Taxation State2006 Personal Property2017 Personal Property California 4.11% 5.20% Colorado 12.06% 6.90% Connecticut 6.09% 13.28% Florida 7.43% 7.00%29 more rows •

If you sold a personal use asset for more than what you bought it for, then you would generally report that on the Stock or Investment Sale Information screen. You can report any selling expenses by reducing the amount you enter as "Sale Proceeds" by the amount of your selling expenses.

Proposition 13 thus gives rise to a lock-in effect for owner-occupiers that strengthens over time. It also affects the rental market, both directly because it applies to landlords and indirectly because it reduces the turnover of owner-occupied homes.

1. Senior Citizen Homeowners' Property Tax Exemption. The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

For transfers after February 16, 2021, the Parent-Child Exclusion allows parents to transfer a principal residence or a family farm to their children without full reassessment, if the child makes the home their principal residence after the transfer or continues to use the property as a farm.

Proposition 13 allows a transfer of primary resident between parent and child without reassessing the tax base of the home. To get the benefit, you filed the appropriate form with your county assessor's office after you prepared and filed the deed transferring the property from a parent to a child.