Real Property Clause In Will In Cuyahoga

Description

Form popularity

FAQ

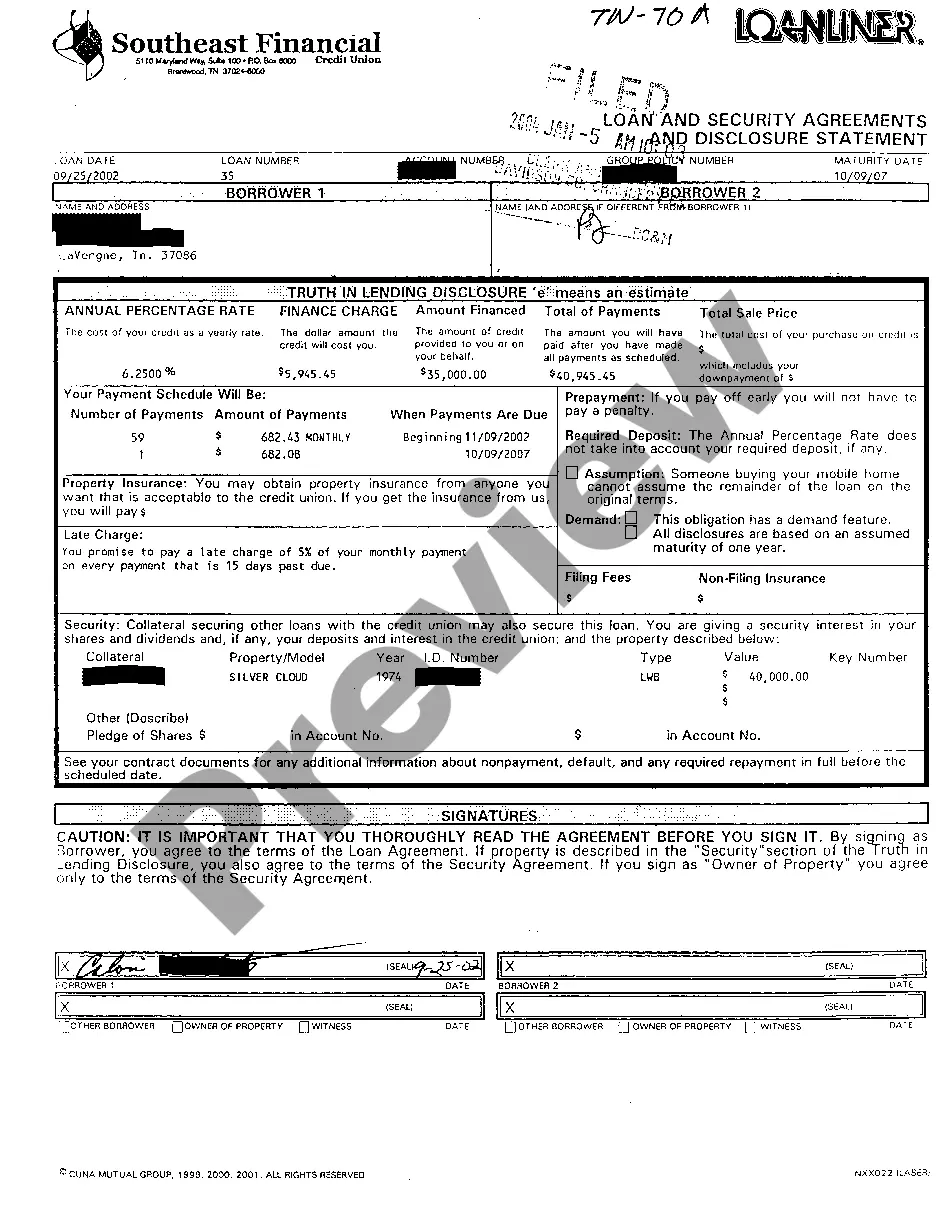

Non-Probate Property in Ohio Examples of common non-probate property include: Real estate held in joint or survivorship form. Assets and property with a transfer-on-death designation. Insurance proceeds with a named beneficiary.

Non-probate assets include assets held as joint tenants with rights of survivorship, assets with a beneficiary designation, and assets held in the name of a trust or with a trust named as the beneficiary.

How to create a Transfer on Death for your home Choose your recipients. You can choose one or more people to become owner of any home or land that you own. Find a copy of your deed. Complete the TOD for real estate form. Take the form to a notary. Submit the form at your County Recorder's Office.

First and foremost, there are a number of asset types that typically do not pass through probate. This includes life insurance policies, bank accounts, and investment or retirement accounts that require you to name a beneficiary.

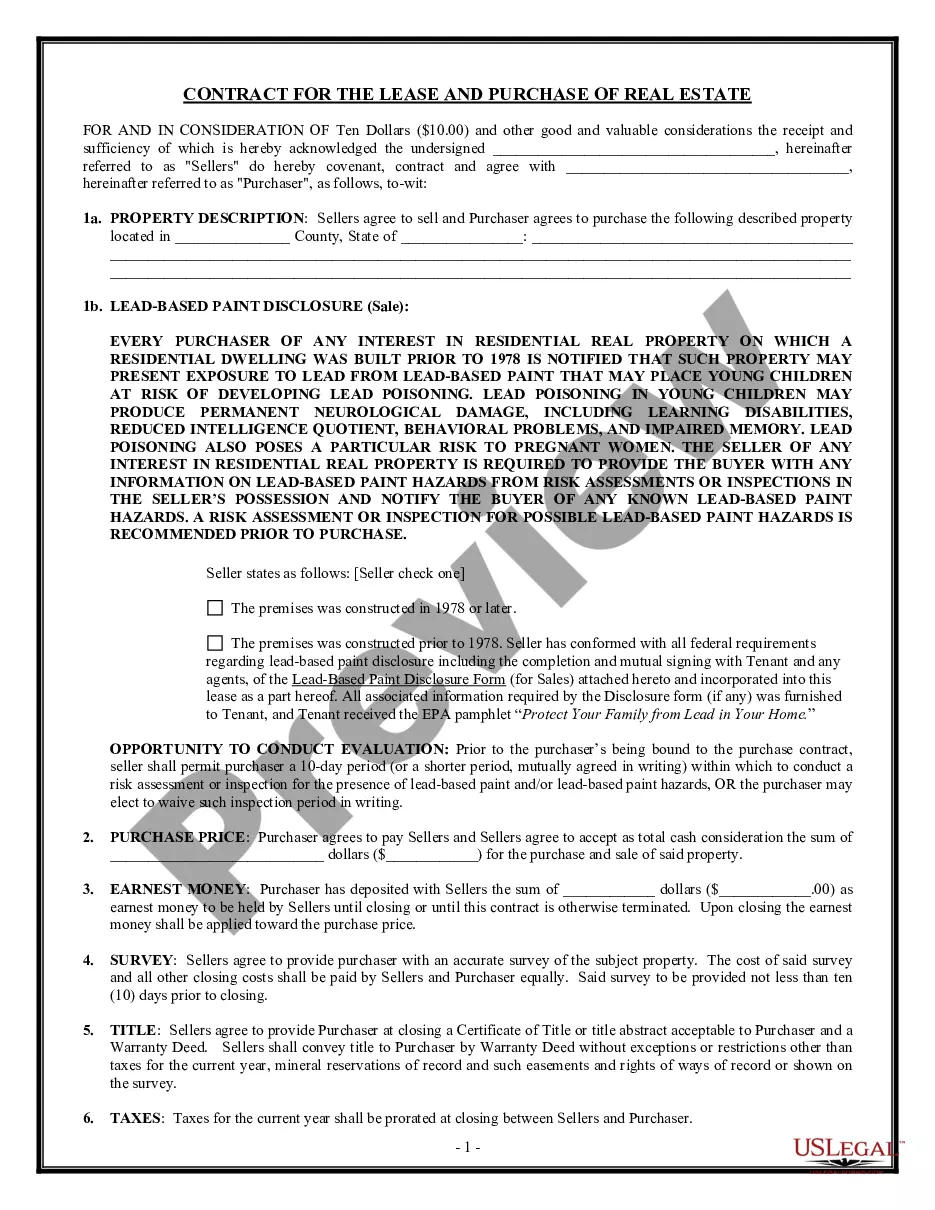

Probate property consists of all property titled in the decedent's name and not transferable on death. It is distributed ing to the terms of the decedent's will or, if the decedent died without a will (intestate), ing to Ohio law.

When an owner of real estate like a home, condo, or farmland dies, the property is often sold through the Ohio probate process. The ease or difficulty of selling the real estate in probate depends on whether the person who died (called the “decedent”) had a will (testate) or died without a will (intestate).

You normally need not get very specific, unless an object is particularly valuable. It is enough to list the location of the property: "all household furnishings and possessions in the apartment at 55 Drury Lane."

Final answer: Real property refers to land and anything permanently attached to it. A house is considered real property because it is a structure built on the land. Items like a wallet, air, and sunlight are not considered real property.

REAL PROPERTY Land and things attached to land; buildings, fences, walls, trees, growing crops, etc. SPOUSE ALLOWANCE The surviving spouse's right to request up to $2000 from the personal representative in addition to any provisions for his/her benefit contained in a Will or by intestate law.