Asamblea Acta Forma In Florida

Description

Form popularity

FAQ

8 Steps to Start an Association Determine your goals. Determining your goals is an essential step to creating an association. Create a business plan. Recruit your board. Recruit your staff. File for tax-exempt status. Choose your software. Create an association website. Start recruiting members.

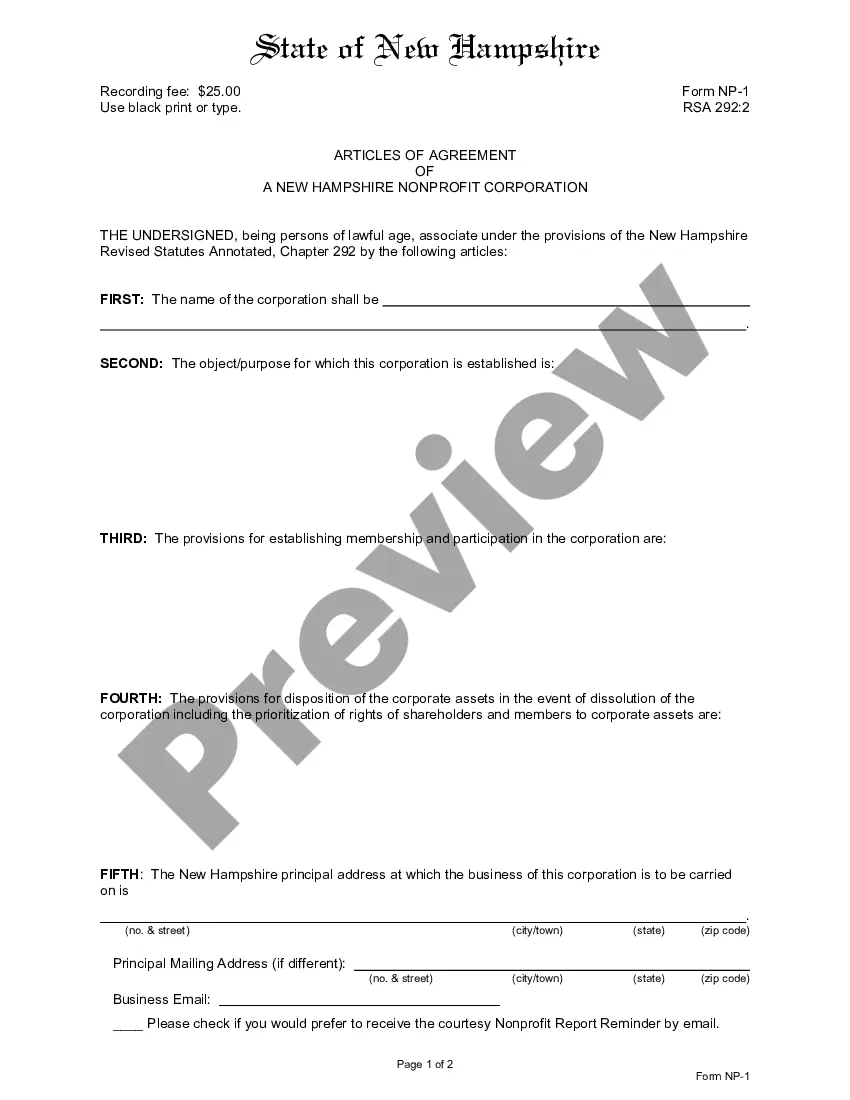

In order to form your professional association or professional corporation, you are required to file articles of incorporation. These articles will be filed with the Florida Division of Corporations and can be completed online or by mail.

9.030(b)(2)(A). A petition for writ of certiorari must be filed within thirty days of rendition of the order to be reviewed. Fla.

Let's get started! Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. Establish Initial Governing Documents and Policies.

CALIFORNIA. You can form a professional corporation, but professional LLCs are not allowed.

First, you need to file articles of incorporation with the Florida's Division of Corporations and Department of State. Next, you should check the website form, how to e-file, and then send articles of your incorporation. To make sure your article is just right: Your professional corporation's name.

Typically, after assessing the percentage of ownership to be transferred, an owner must seek approval from the corporate board of directors to proceed with the transaction. Then, the owner can sign the share transfer contract to close the deal.

While both the Florida LLC and Florida S-Corporation protect the owners' individual assets from business liabilities, only the LLC shields business ownership from creditors of the shareholders. An S-Corp offers similar liability protection but requires specific ownership and tax structure considerations.

Starting an S Corp may sound intimidating, but anyone can do it with a computer and the right information. Creating a business structure and filing an S Corporation tax election requires filing business registration forms with your resident state's secretary of state office and the Internal Revenue Service (IRS).

Now that you know what an S corp is and its requirements, follow these five steps to form your business as an S corp in Florida. Step 1: Choose a Business Name. Step 2: Articles of Incorporation. Step 3: Apply for a Business License. Step 4: Obtain EIN. Step 5: Complete and Submit IRS Form 2553.