Chattel Mortgage Form With Promissory Note In Wayne

Description

Form popularity

FAQ

(“Lender”). (Rupees................................................………… only) together with interest from the date hereof, at ………… % per annum or such other rate the Lender may fix from time to time, compounding and payable with daily/monthly/quarterly rests, for value received.

A simple promissory note might be for a lump sum repayment on a certain date. For example, let's say you lend your friend $1,000 and he agrees to repay you by December 1st. The full amount is due on that date, and there is no payment schedule involved.

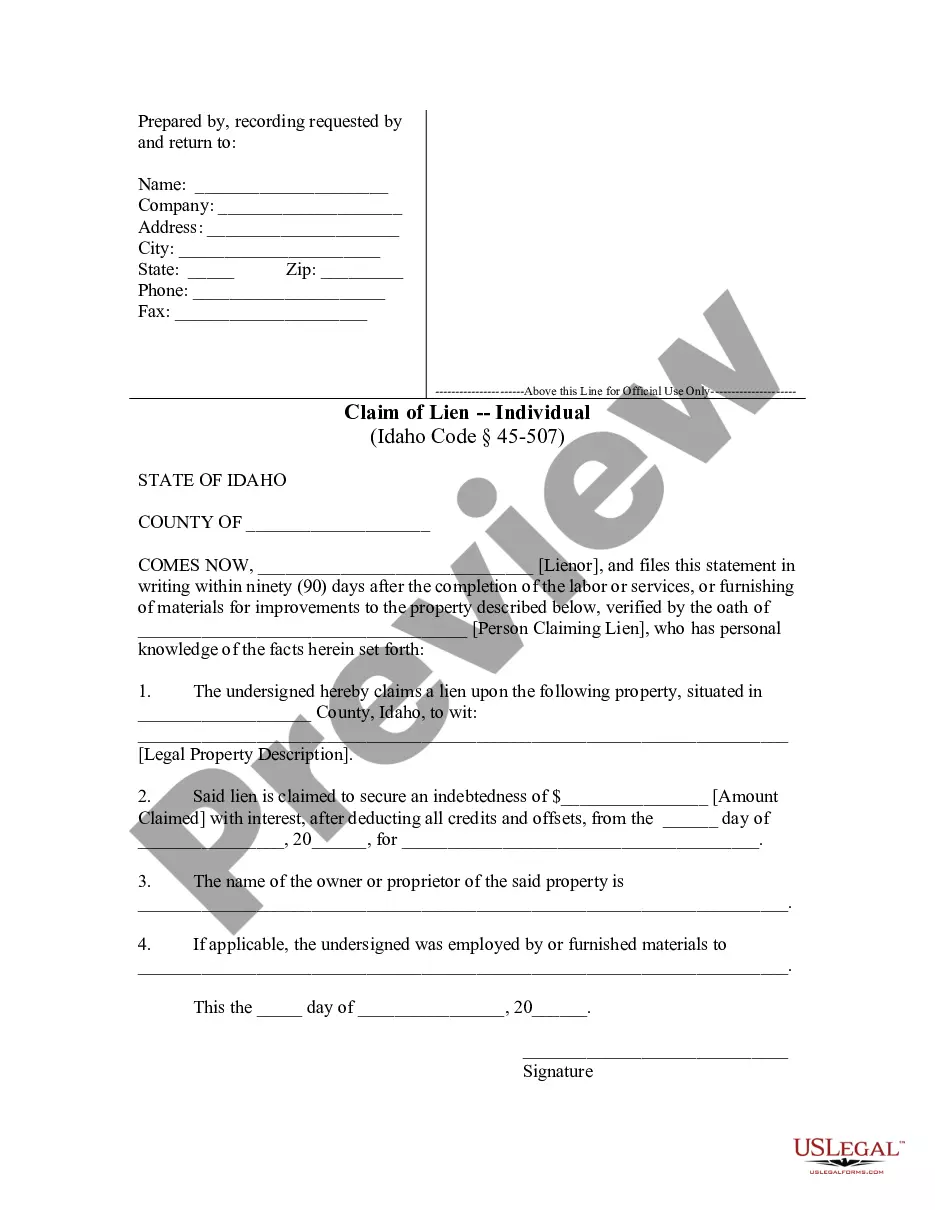

A chattel mortgage shall not be valid against any person except the mortgagor, his executors or administrators, unless the possession of the property is delivered to and retained by the mortgagee or unless the mortgage is recorded in the office of the register of deeds of the province in which the mortgagor resides at ...

The best chattel mortgage rates generally start from around 7.50% p.a. but can range up to 15% p.a. or higher for some borrowers. To get the best rate — i.e. the lowest rate — a borrower will want to present as little risk to the lender as possible.

LTO MEMORANDUM CIRCULAR NO. 17 of the said manual of operations provides that “In all dealings or transactions on motor vehicles, a chattel mortgage or release thereof shall first be registered with the office of the Register of Deeds before any registration transaction is effected.”

Competitive rates TermRate6 6 Month Convertible Mortgage Posted rate: 7.84% APR 3: 8.025% 1 Year Open Mortgage Posted rate: 8.00% APR 3: 8.098% 1 Year Fixed Closed Posted rate: 7.74% APR 3: 7.838% 2 Year Fixed Closed Posted rate: 7.34% APR 3: 7.390%6 more rows

Chattel is any tangible personal property that is movable. Examples of chattel are furniture, livestock, bedding, picture frames, and jewelry.

Advantages and Disadvantages Chattel loans offer quicker processing and flexibility. The downside is the higher interest rates and shorter terms which means higher monthly payments. Traditional mortgages provide for longer repayment periods and lower interest rates.

A promissory note isn't recorded in the county land records. The lender holds on to the note.